Technical Overview – Nifty 50

A smart turnaround by the Nifty50 after witnessing a massive gap down opening on 19th April. The Index recorded a day low at 21,777.90 and posted that it continues to trade higher throughout the trading session.

The Benchmark index retested the breakdown levels on the daily chart of a rising channel pattern. The Index on the daily chart has formed a bullish piercing candle stick pattern suggesting support at the 21,800 mark.

The Nifty50 has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. 2024 is Expected to Unleash More Volatility in Equities than 2023. In contrast, in 2023, there were only 14 instances of daily falls exceeding 1%. Therefore, compared to last year, 2024 is expected to have brought more volatility to the equity market.

The immediate support for the Index is placed at 21,800 levels and resistance is capped at 22,300 levels. If the Index witnessed a breakdown below 21,800 levels, then the gate is open till 21,500 mark. Similarly, a close above 22,300 will trigger more upside till 22,500 levels.

Technical Overview – Bank Nifty

A smart turnaround by the Bank Nifty after witnessing a massive gap down opening on 19th April. The Index recorded a day low at 46,579 and posted that it continues to trade higher throughout the trading session.

The Banking Index on the daily chart has formed a bullish piercing candle stick pattern suggesting support at the 46,500 mark. The Bank Nifty has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA.

The Momentum oscillator RSI (14) has taken support near the upward-rising trend line at 50 levels but still is in a bearish crossover mode.

The immediate support for theBanking Index is placed at 46,500 levels and resistance is capped at 48,000 levels. If the Index witnessed a breakdown below 46,500 levels, then the gate is open till 46,000 mark. Similarly, a close above 48,000 will trigger more upside till 48,500 levels.

Indian markets:

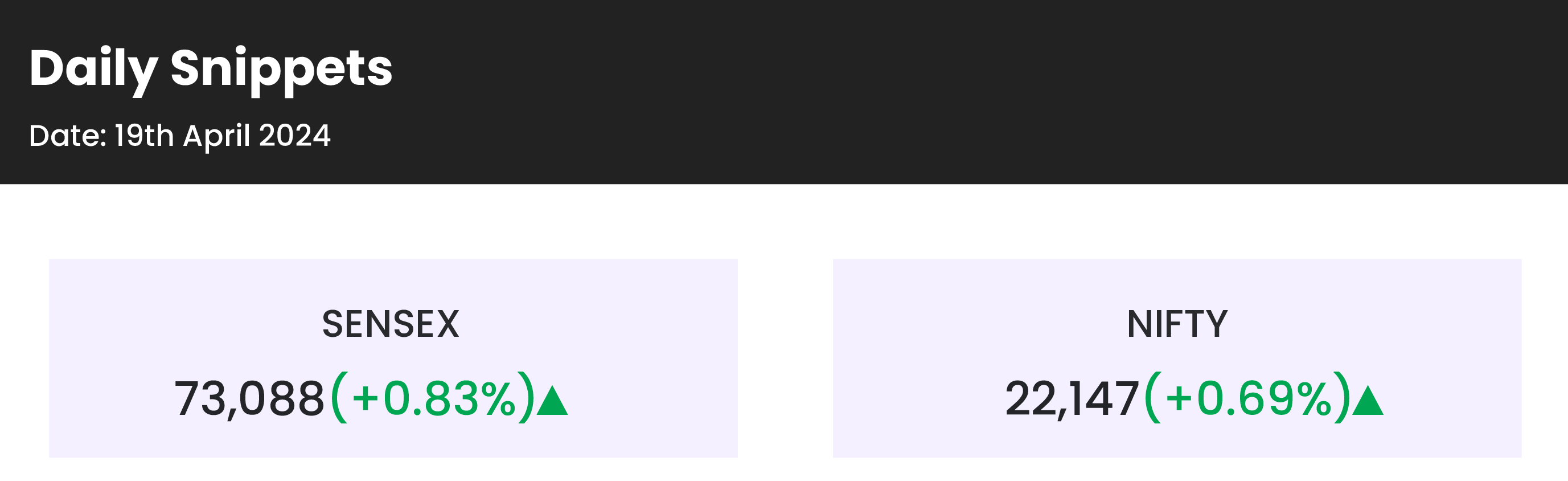

- Domestic equity benchmark indices, the Sensex and the Nifty 50, rebounding into positive territory after four consecutive days of losses, amid escalating tensions in the Middle East.

- Initially trailing behind their Asian counterparts, the domestic benchmarks swiftly regained momentum throughout the trading day.

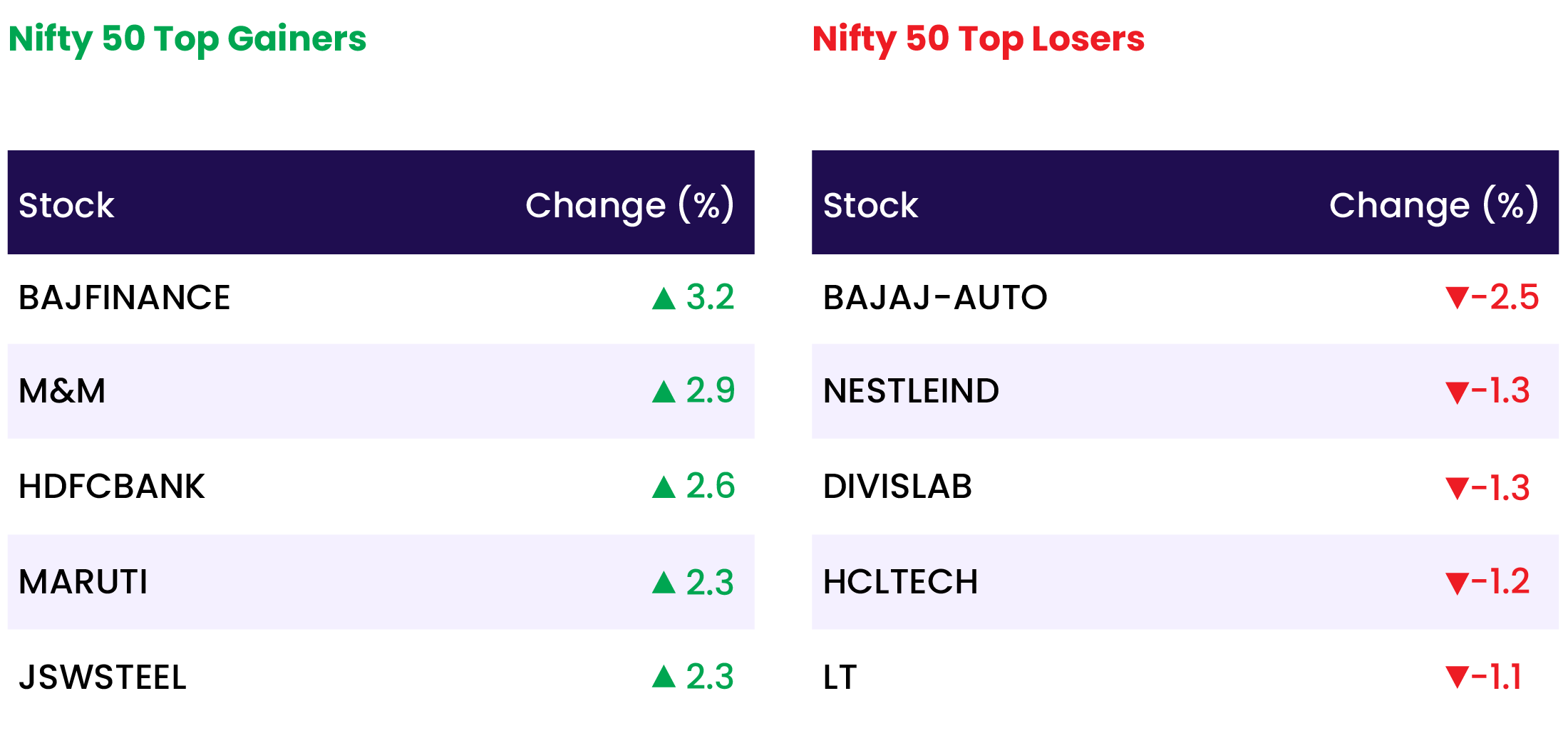

- Notable sectoral movements included a 1% rise in both bank and metal indices, while the FMCG index climbed by 0.5%. Conversely, healthcare, IT, power, and realty sectors experienced declines ranging from 0.3% to 0.6%.

- Meanwhile, the BSE midcap index dipped by 0.4%, while the smallcap index remained unchanged.

Global Markets:

- Asian stocks faced a downturn after reports from NBC News, citing a source familiar with the situation, indicated that Israel conducted a limited strike in Iran. This development triggered a sell-off in stocks and other risk assets, driving investors towards safe-haven assets.

- Japan’s Nikkei 225 declined by 2.66%, although it managed to recover some of its earlier losses, while the broader Topix index fell by 1.91%. Over the week, the Nikkei recorded a loss of 3.65%.

- South Korea’s Kospi index retreated by 1.63%, accompanied by a 1.61% decline in the small-cap Kosdaq.

- Australia’s S&P/ASX 200 index dropped by 0.98%, marking its sixth decline in seven trading sessions.

- Hong Kong’s Hang Seng index slipped by 0.95%, mirroring the downtrend, while China’s mainland CSI 300 index fell by 0.79%.

Stocks in Spotlight

- Tata Communications witnessed a sharp decline of over 5% for the eighth consecutive session, with brokerages citing limited upside potential following disappointing earnings in the March quarter. The company’s net profit saw a decline of 1.5% to Rs 321.2 crore, despite a 24.6% increase in revenue to Rs 5,691.7 crore. However, the EBITDA margin dropped to 18.6% from 22.6% compared to the previous year.

- Despite Bajaj Auto’s Q4 results surpassing street expectations, its stock experienced a 2% decline. The fall was attributed to the company’s share price exceeding brokerages’ target prices and being perceived as overvalued. Brokerages issued ‘sell’ calls, setting target prices below the current value, indicating that positive factors were already factored into the stock’s price.

- ITC shares saw a modest increase of over 1% following the announcement of ITC Infotech’s acquisition of a 100% stake in Pune-based IT company, Blazeclan Technologies Private Limited, for Rs 485 crore. This strategic acquisition aims to enhance ITC Infotech’s capabilities in serving customers within multi-cloud and hybrid cloud environments, with a focus on leveraging the partner ecosystem to drive future growth.

News from the IPO world🌐

- Nephro Care India files DRHP to raise funds via IPO

- JNK India has fixed a price band of Rs 395-415 per share

- Vodafone Idea FPO subscribed 26% on Day 1

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FINANCIAL SERVICES | 1.3 |

| NIFTY PRIVATE BANK | 1.1 |

| NIFTY BANK | 1.1 |

| NIFTY METAL | 1.0 |

| NIFTY CONSUMER DURABLES | 0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1717 |

| Decline | 2073 |

| Unchanged | 113 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 37,775 | 0.1 % | 0.2 % |

| 10 Year Gsec India | 7.2 | 0.7 % | 1.6 % |

| WTI Crude (USD/bbl) | 83 | (3.1) % | 17.5 % |

| Gold (INR/10g) | 72,860 | (0.2) % | 7.8 % |

| USD/INR | 83.63 | 0.1 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer