Technical Overview – Nifty 50

The Nifty50 followed its previous day’s movement witnessed a gap-up opening and continued to trade in a bullish terrain throughout the day. The Index continued to sustain above its 9 & 21 EMA is one of the positive signals for the Index.

INDIA VIX witnessed a sharp fall of more than 17% as soon as the market opened and drifted more than 20% in a day and formed a tall red candle for the day. WHAT IS HAPPENING TO THE INDIA VIX NOW? It is currently trading very close to its all-time lows. Such sharp falls in India VIX were last seen once the General election results were announced. In 2014 & 2019, it dropped by ~34% & 30% on the day of results. Today’s drop is the biggest fall after these two falls.

The Nifty50 has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. The immediate support for the Index is placed at 22,200 levels and resistance is capped at 22,500 levels. If the Index witnessed a breakdown below 22,200 levels, then the gate is open till 21,900 marks. Similarly, a close above 22,500 will trigger more upside till 22,700 levels.

Technical Overview – Bank Nifty

The Bank Nifty index on 23rd April witnessed a marginal gap-up opening and the index traded in a mildly bullish terrain for the majority of the day. The Banking Index on the daily chart has formed a bullish piercing candle stick pattern suggesting support at the 47,000 mark.

The Bank Nifty has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. The Momentum oscillator RSI (14) has taken support near the upward-rising trend line at 50 levels but still is in a bearish crossover mode.

The immediate support for the Banking Index is placed at 47,500 levels and resistance is capped at 48,500 levels. If the Index witnessed a breakdown below 47,500 levels, then the gate is open till 47,000 mark. Similarly, a close above 48,500 will trigger more upside till 48,900 levels.

Indian markets:

- On Tuesday, April 23, amid positive global cues, Indian stock market benchmarks the Sensex and the Nifty 50 ended in the green for the third consecutive session.

- However, the Indian market squandered most of the day’s gains in last-hour selling but managed to close with modest gains, marking the third consecutive session of upward movement.

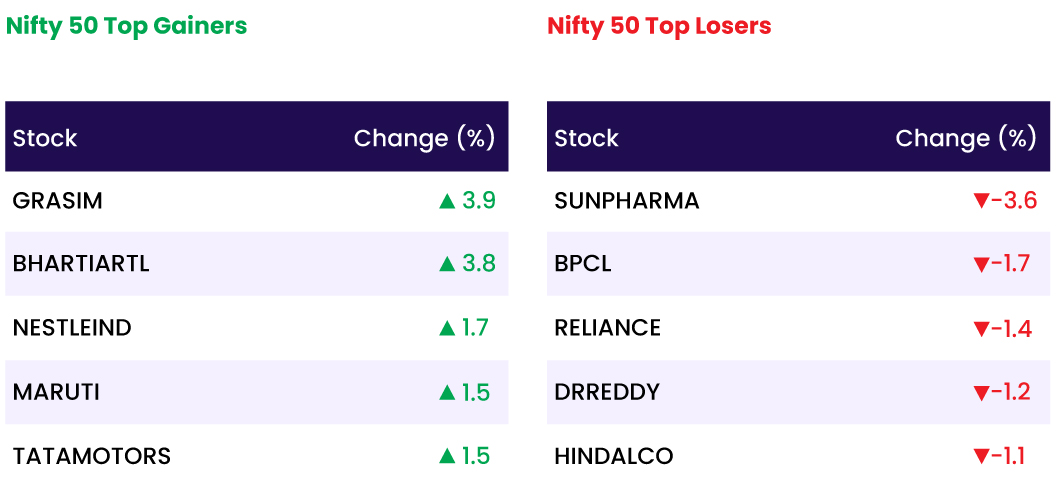

- In terms of sector performance, healthcare, metal, oil & gas, and energy saw declines ranging from 0.3 to 0.8 percent, while FMCG, power, IT, realty, and auto sectors witnessed gains ranging from 0.4 to 2 percent.

- Additionally, the BSE midcap index saw a 0.5 percent rise, while the smallcap index recorded a 1 percent increase.

Global Markets:

- Asia-Pacific markets mostly extended gains from Monday, driven by a rebound in tech shares on Wall Street, while investors analyzed flash business activity figures from Australia, Japan, and India.

- According to S&P Global data, Australia’s composite purchasing managers index surged to a two-year high, reaching 53.6 compared to March’s 53.3.

- Japan and India also experienced accelerated rates of expansion in their business activities in April.

- Hong Kong’s Hang Seng index led gains in Asia, climbing nearly 2%, while mainland China’s CSI 300 slipped 0.7%, marking a third consecutive day of losses.

- Japan’s Nikkei 225 closed 0.3%, while the Topix edged up 0.14%.

- The S&P/ASX 200 advanced 0.45% following the PMI release.

- South Korea’s Kospi dipped 0.24%, and the small cap Kosdaq lost 0.04%.

Stocks in Spotlight

- The Tejas Network stock surged 20 percent, hitting the upper circuit, following the company’s robust Q4 earnings report. It recorded a consolidated net profit of Rs 146.78 crore, a significant turnaround from the Rs 11.47 crore loss reported a year earlier.

- Vodafone Idea shares witnessed an 11 percent rally after the conclusion of the company’s follow-on public offer (FPO), which garnered a subscription of 6.36 times. Investors bid for 8,011.8 crore equity shares, surpassing the offering of 1,260 crore shares in the Rs 18,000-crore FPO.

- Hatsun Agro’s stock surged over 8 percent as the Chennai-based company’s net profit doubled to Rs 52 crore in the January-March quarter. This impressive performance was attributed to strong sales, retail expansion, increased milk procurement, and notable margin expansion.

- KP Energy witnessed a 5 percent surge in its shares, hitting the upper circuit, subsequent to its acquisition of a wind power project. The company is poised to develop a 9MW segment of a wind-solar hybrid power project in Gujarat.

News from the IPO world🌐

- Awfis Space Solutions receives SEBI nod for IPO launch

- RCRS Innovations files draft papers with NSE Emerge to raise funds via IPO

- Solar cell maker Premier Energies files IPO papers to raise more than Rs 1,500 crore

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 2.6 |

| NIFTY FMCG | 0.8 |

| NIFTY CONSUMER DURABLES | 0.7 |

| NIFTY MEDIA | 0.5 |

| NIFTY IT | 0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2338 |

| Decline | 1475 |

| Unchanged | 121 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,240 | 0.7 % | 1.4 % |

| 10 Year Gsec India | 7.2 | (0.4) % | 0.8 % |

| WTI Crude (USD/bbl) | 83 | (3.1) % | 17.5 % |

| Gold (INR/10g) | 71,143 | (1.1) % | 5.1 % |

| USD/INR | 83.42 | (0.2) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer