Technical Overview – Nifty 50

The index ended the day nearly unchanged. Neither side exhibits any significant volatility. The rising trend line in a 75-minute timeframe provided support for the index.

On a 75-minute timeframe, the momentum indicator RSI (14) has built a base near the 56 mark and is exhibiting hidden positive divergence. The MACD is consistently rising and above its polarity, indicating that the upward trend should continue.

Diffusion Indicator: % of stocks >= RSI 50 mark in the benchmark index has a negative divergence to the price and has fallen below 80%.

Based on benchmark index OI data, a base formation may take place at the 24,200 level, where put writing is almost 55 lakhs. At 24,400, or almost 40 lakhs, call writing, resistance might arise. The PCR value of the benchmark index is 0.95.

The support and resistance levels for the next sessions are at 24,250 and 24,150 and 24,400 and 24,500, respectively.

Technical Overview – Bank Nifty

The banking index opened downside with a gap but still managed to close near 10DEMA. The banking index underperformed the benchmark index for the day, and moved in a consolidation since last week, 52,250 – 52,800 zone.

The momentum indicator RSI (14) shows a hidden positive divergence over a 125-minute timeframe and a negative divergence over a daily timeframe. The index is above the major DEMA and found support at the 10-DEMA, suggesting general bullishness. The MACD is consistently rising and above its polarity, indicating that the upward trend should continue.

The resistance and support levels for the upcoming sessions are 52,750, 53,000 for resistance, and 52,250, 52,000 for support.

Indian markets:

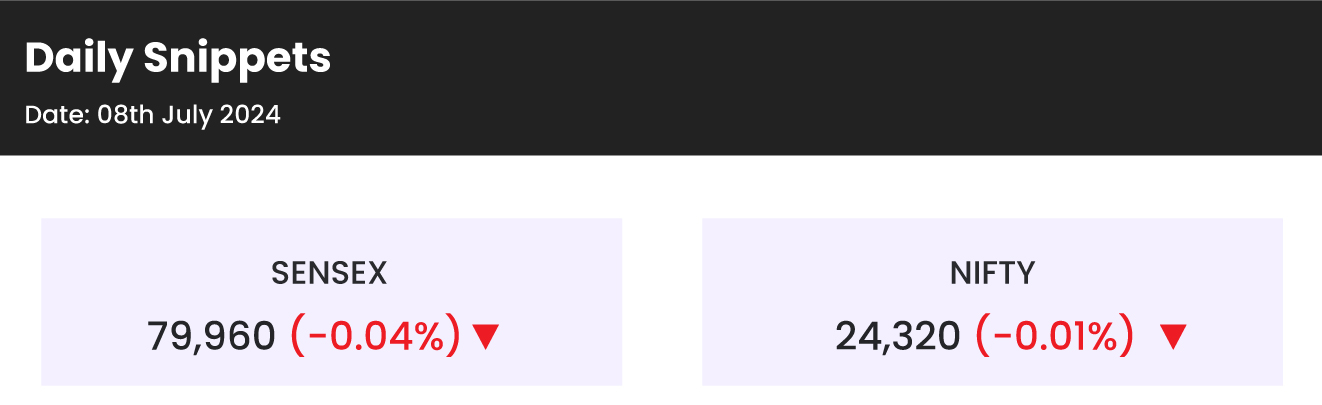

- Indian markets closed flat on July 8, stepping back from last week’s record highs.

- Now, markets are focused on upcoming June quarter earnings reports, with the IT sector poised to kick off its Q1FY25 earnings season on July 11, starting with Tata Consultancy Services (TCS), the country’s largest software exporter.

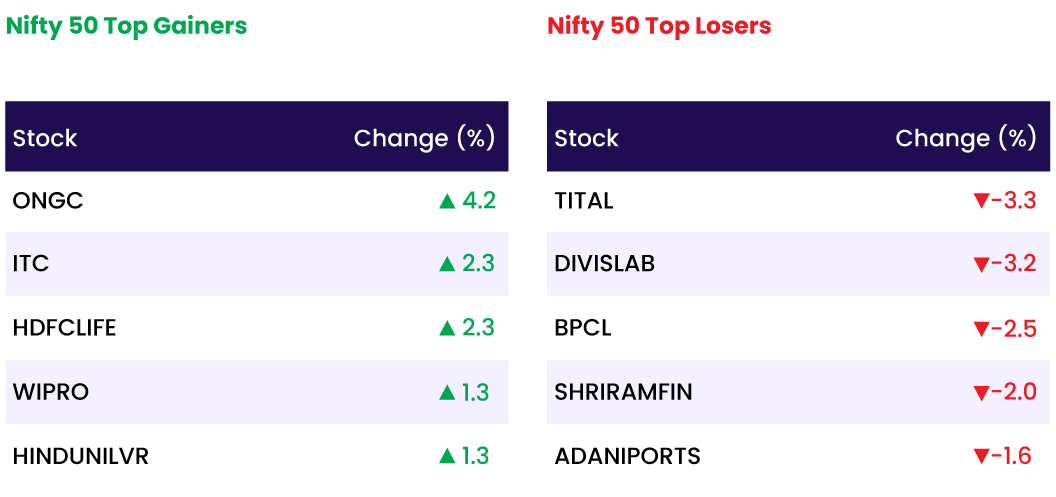

- In sectoral performance, Nifty FMCG emerged as the top gainer, rising 1.6 percent, followed by Nifty Oil & Gas which gained 0.8 percent.

- On the downside, Nifty PSU Bank was the biggest loser, falling 1.6 percent, followed by Nifty Consumer Durables and Nifty Metal which dropped 1.3 percent and 1 percent, respectively.

- Nifty Auto, Realty, and Nifty Bank each declined by 0.5 percent.

Global Markets:

- Asia-Pacific markets were mostly lower on Monday as investors awaited key economic data from the U.S. and China later this week, while election results in France overnight signaled a hung parliament.

- Japan’s Nikkei 225 fell 0.32%, while the broad-based Topix was 0.57% lower, amid news of Japan’s real wages falling for a 26th straight month.

- South Korea’s Kospi fell 0.16%, while the small-cap Kosdaq climbed 1.39%.

- Hong Kong’s Hang Seng index fell 1.68% in its final hour of trade, and the mainland Chinese CSI300 slid 0.85% marking its lowest level since February and a fifth day of losses.

- Australia’s S&P/ASX 200 finished 0.76%, marking a second straight day of losses.

- On Friday in the U.S. the S&P 500 and the Nasdaq Composite rose to new highs, with both indexes posting record closes as the latest jobs report reignited hopes for rate cuts from the Federal Reserve.

Stocks in Spotlight

- Titan’s shares fell nearly 4% as JPMorgan downgraded the stock from ‘overweight’ to ‘neutral.’ This downgrade followed Titan’s release of its June quarter business update, which may have prompted concerns or a more cautious outlook from the investment bank, influencing the stock’s decline.

- Adani Wilmar’s shares experienced a notable increase of over 4% following the company’s release of its business updates for the first quarter of the fiscal year 2025 (Q1FY25). These updates likely provided positive insights into the company’s performance, potentially including metrics such as revenue growth, profit margins, and operational improvements. Investors often react favorably to strong quarterly performance indicators, which can drive share prices higher.

- Dabur’s shares rose over 4% following the release of a positive business update for the April-June quarter. The company expects mid to high single-digit growth in consolidated revenue for the first quarter of the fiscal year 2025 (Q1FY25). This optimistic outlook likely boosted investor confidence, contributing to the rise in share price.

- Marico’s shares surged over 6% after the company released a healthy business update for the April-June quarter. The positive update highlighted continued growth in demand trends, which likely reassured investors about the company’s performance and future prospects, driving the share price higher.

News from the IPO world🌐

- SAR Televenture announces Rs 450 crore rights issue, FPO

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | 1.6 |

| NIFTY OIL & GAS | 0.9 |

| NIFTY IT | 0.1 |

| NIFTY MIDSMALL HEALTHCARE | 0.1 |

| NIFTY FINANCIAL SERVICES | -0.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1798 |

| Decline | 2261 |

| Unchanged | 110 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,376 | 0.2 % | 4.4 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 1.3 % |

| WTI Crude (USD/bbl) | 83 | 0.4 % | 18.2 % |

| Gold (INR/10g) | 72,788 | (0.3) % | 7.3 % |

| USD/INR | 83.51 | 0.0 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer