Technical Overview – Nifty 50

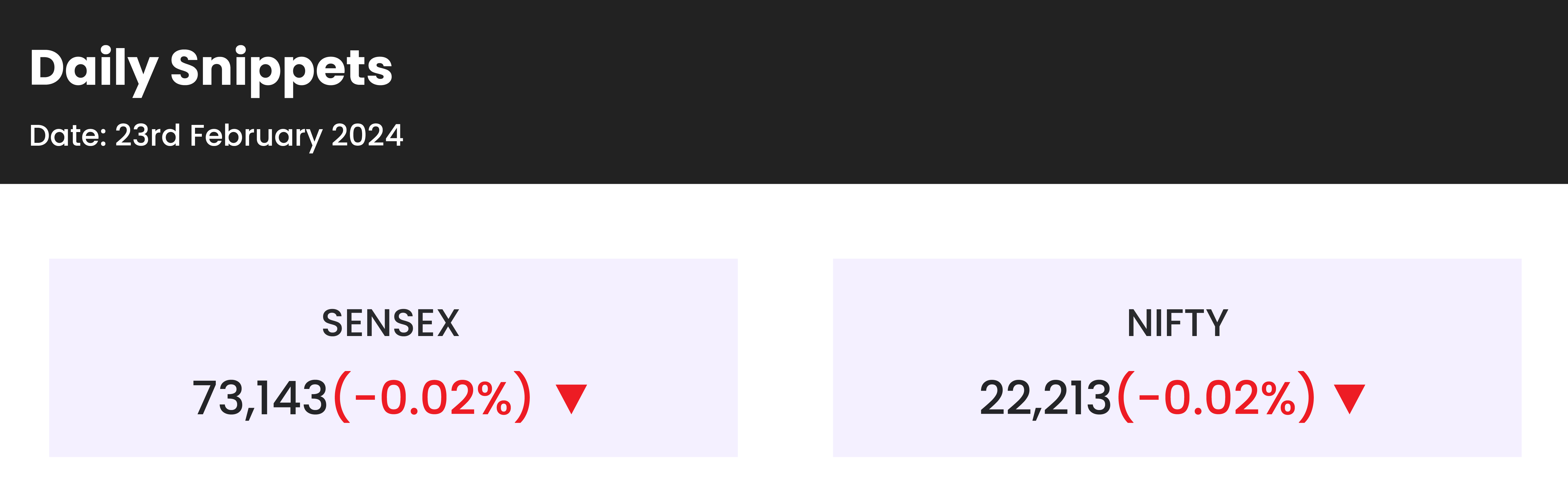

The Benchmark Index on 23rd February traded within the pre-defined range after a V shape reversal rally in the previous trading sessions. The Nifty on the daily chart has given a consolidation breakout and the prices closed above the upper band of the range after facing an above-average volatility.

On the weekly time frame, the Nifty has given almost 1 percent returns and has closed marginally above the bullish flag pattern.

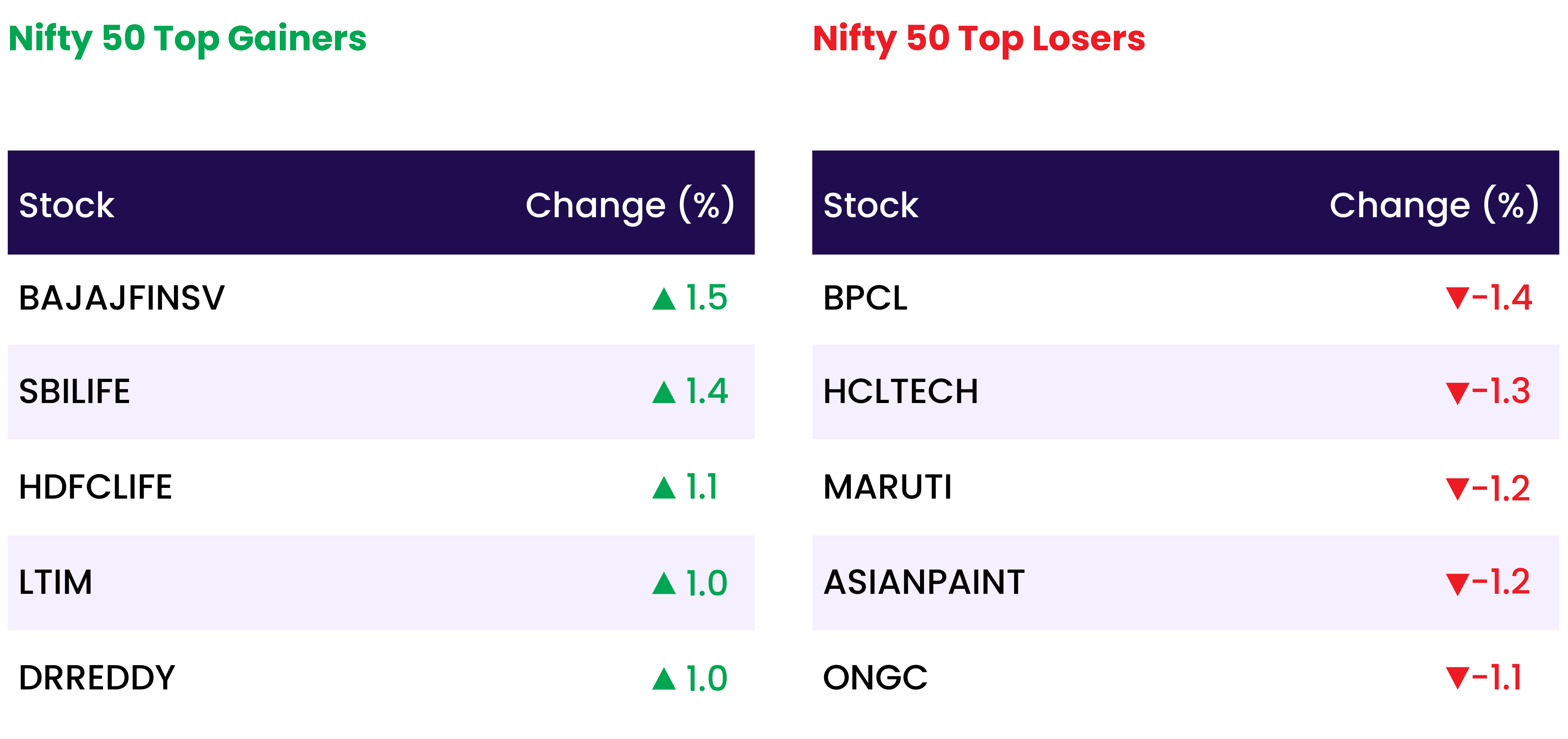

15 Nifty50 Companies Reaching All-Time High Prices This Week Nifty50 has achieved all-time high levels almost nearing 22,300 today Several constituent stocks within the Nifty50 have also reached their all-time high prices, reflecting the overall bullish sentiment in the market.

The India VIX drifted 1.50 percent in the week but has sustained above 14 which will keep a volatility factor alive. The immediate support for the Nifty is placed at 22,000 and the immediate resistance is capped below 22,400 – 22,500 levels.

Technical Overview – Bank Nifty

The Bank Nifty Index on 23rd February traded within the pre-defined range after a V shape reversal rally in the previous trading sessions. The Banking Index on the daily chart has given a triangle pattern breakout and the prices closed above the upper band of the range after facing an above-average volatility.

The Banking index rose with a gain of more than 1% and formed a bullish candle. The prices on the weekly time frame are trading above their 21 and 50 EMA and it is taking support near the lower band of the rising wedge pattern and moving higher.

Technically speaking, Bank Nifty’s technical picture on the daily chart shifts to bullish from neutral amidst bullish breakout technical conditions on the daily charts. Immediate support for now is near 46,500 levels while resistance is near 47,500 levels.

Indian markets:

- Indian equity benchmarks remained flat on February 23 despite early highs, with banking stocks under pressure and investors exercising caution ahead of GDP data release and other key economic indicators.

- Investors refrained from taking long positions in anticipation of GDP data, fiscal deficit numbers for January, and the release of eight infrastructure industries data on February 29.

- Banking stocks experienced weakness following a downgrade by global brokerage firm Goldman Sachs, signaling the end of a period marked by robust growth and profitability in the financial sector.

- Goldman Sachs pointed to escalating headwinds in the Indian financial services sector, including mounting pressure on the cost of funds, increasing consumer leverage, and structural funding issues.

Global Markets:

- The Stoxx 600 index rose by 0.1% in early trading, with most sectors showing gains.

- Automotive stocks saw a 0.7% increase in early trading, while telecom stocks experienced a 1.1% decline.

- The benchmark index closed the session 0.82% higher at 495.1 on Thursday, surpassing its previous record close of 494.35 on Jan. 5, 2022, according to LSEG data.

- Standard Chartered reported an 18% rise in pre-tax profits, leading to a 7.8% increase in its shares. Conversely, Allianz shares fell by 2.4% after its property division’s fourth-quarter operating profits fell short of expectations.

- February saw a decline in U.K. consumer confidence, as indicated by new survey data from GfK, reflecting continued concerns over higher inflation impacting economic prospects.

- U.S. stock futures showed little change on Friday, following the S&P 500 and Nasdaq Composite’s strongest performance since early 2023.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Vodafone Idea surged by 7.67 percent, continuing its upward momentum for the second consecutive session, following a 6 percent increase in the previous session. The surge comes in the wake of the company’s announcement that its board will convene on February 27 to deliberate on proposals for fundraising.

- Sona Blw Precision Forgings saw a 5.88 percent increase in its stock after being recognized as the inaugural automotive component manufacturer to achieve certification under the Auto Production Linked Incentive (PLI) scheme.

- Olectra Greentech experienced a 2.76 percent decline as investors took profits, following the stock’s previous session gains driven by securing a Rs 4,000 crore contract from Brihanmumbai Electricity Supply and Transport Undertaking (BEST) for the provision, operation, and maintenance of 2,400 electric buses.

News from the IPO world🌐

- IPO bound Ola Electric slashes prices of e-scooters by up to Rs. 25000

- EV charger maker Exicom Tele systems IPO to open on Feb 27th

- Platinum Industries sets Rs. 162-171 price band for IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 1.9 |

| NIFTY AUTO | 1.6 |

| NIFTY METAL | 1.2 |

| NIFTY MEDIA | 1.0 |

| NIFTY FMCG | 1.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2005 |

| Decline | 1833 |

| Unchanged | 98 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,069 | 1.2 % | 2.9 % |

| 10 Year Gsec India | 7.1 | 0.1 % | (1.7) % |

| WTI Crude (USD/bbl) | 78.6 | 0.9 % | 9.1 % |

| Gold (INR/10g) | 61,658 | (0.1) % | (1.3) % |

| USD/INR | 82.8 | (0.1) % | (0.5) % |

Please visit www.fisdom.com for a standard disclaimer