Retirement is a phase where usually the income tub reduces to droplets. Build a reservoir to stay financially hydrated.

Picturing yourself with sparse hairs, in a rocking chair, newspaper in hand and toddlers at feet is a task next to impossible, when your career ball has just got rolling. But as much as you hate to think about finances for your grey days (or golden days, if you prefer) you should remember that the only way there is, is to walk through it.

If you are adequately prepared financially, there are more chances of your retirement being jolly and stress free. However the best thing is if you start now, your retirement finances will be neatly done, without having to sacrifice your present little joys!

What is a Retirement Fund?

A retirement fund is a way to save money for your future so that you can have enough to live on when you retire. In India, retirement funds can be set up by individuals, employers, or even the government.

As someone who lives in India, it’s important to start thinking about retirement early so that you can have a comfortable life after you stop working. One way to do this is to set up a retirement fund.

Retirement funds can come in different forms, such as mutual funds or pension plans, but the basic idea is the same. You contribute money into the fund over time, and the fund invests your money to grow over time. When you retire, you can withdraw money from the fund to live on.

It’s important to choose a retirement fund that matches your goals and risk tolerance. Some funds may invest in riskier assets, such as stocks, while others may invest in safer assets, such as bonds. It’s a good idea to do your research and talk to a financial advisor to make sure you choose the right retirement fund for you.

How to get started with a retirement fund

If you are a 25-something you have 3 cool decades to stack up resources. In case your knowledge of personal finance products begin and ends with FDs and RDs, no worry, we will help you identify the right products. But even before you begin you must resolve to use these funds only after your pack up and not dig into them to buy the next trendy smartphone, bike or anything else.

The first step towards your goal is the most challenging one- save enough. The next question logically is how much is enough? If you observe in your Ideal Single Lifestage Report, you should manage savings of about 40%. This is assuming you are debt-free. More on savings is covered in Do Not Spend All Your Salary.

What should be the mode of investing for retirement?

Since retirement is such a long term goal, your retirement funds should go in growth assets. Of the growth assets, equity mutual funds are an excellent tool for retirement planning. If you invest in a good diversified equity mutual fund, your money will grow along with the markets, well beyond inflation’s reach. This is something that cannot be achieved with income assets like FD, bonds etc.

So pick up one of the best long term funds and start a monthly SIP in it. For instance if you plan to save and invest Rs 10,000 every month, about Rs 6,000 can go to one of the large cap equity funds.

Don’t succumb to the temptation of withdrawing funds at market fluctuation, just keep to your SIP, as long as the fund you have chosen continues to be among the best ones. Only move them to less risky products systematically by the time your approach retirement (read on this after 2 decades). And remember to pump up your investments as and when income rises. When retirement dawns on you, there will be enough funds at your disposal.

Tips to boost your retirement savings

Here are some simple tips to boost your retirement savings:

- Start early: The earlier you start saving, the better it is. You can benefit from the power of compounding, which can help grow your money over time.

- Set a savings goal: Decide how much you want to save for retirement and work towards achieving that goal. It’s important to set realistic goals based on your income and expenses.

- Contribute to a retirement fund: Look for retirement funds that suit your needs and start contributing to them regularly. You can consider investing in mutual funds, National Pension System (NPS), or Unit Linked Insurance Plans (ULIPs).

- Take advantage of tax benefits: Retirement funds offer tax benefits in India, so make use of them. You can claim a deduction of up to Rs. 1.5 lakh under Section 80C of the Income Tax Act.

- Avoid early withdrawals: Avoid withdrawing money from your retirement fund before you retire. Not only will you lose out on the power of compounding, but you may also have to pay penalties and taxes.

- Keep increasing your contributions: As your income increases, try to increase your contributions towards your retirement fund. This can help you reach your savings goal faster.

- Consider diversifying your investments: Diversification can help reduce your risk and increase your returns. Consider investing in a mix of assets such as equity, debt, and gold.

Remember, saving for retirement is an important part of your financial planning. By following these tips, you can boost your retirement savings and secure your financial future.

Calculating the amount needed for retirement

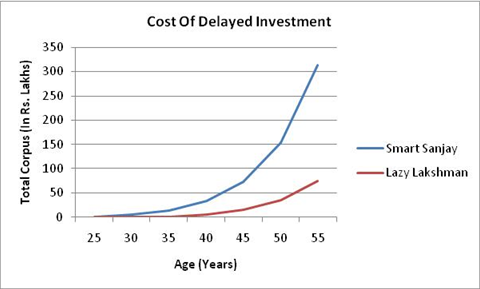

If you’re still not motivated to start retirement investment from now, here is a classic illustration of why those who start earlier turn out to be smart.

Take the case of 2 buddies Lazy Lakshman and Smart Sanjay who start off career at age 25 yrs. Lazy Lakshman is the squandering type and never took investments serious in the early days. Smart Sanjay had his share of fun but was more disciplined from the start, so he invests Rs 6,000 every month in a good long term mutual fund for 30 years. Assuming 15% returns from the fund, at the end of 30 years he’d have a nice Rs 3 crores corpus to live on.

Suppose on turning 35 yrs, Lazy Lakshman starts investing a similar Rs.6,000 per month at a 15% assumed rate. By the end of 20 years- at the age same as Smart Sanjay, Lazy Lakshman will have a corpus close to only Rs.74 Lakhs, which is a clear loss of 75% or almost Rs.2 crores plus!

Now, what if Lazy Lakshman also aims at creating a corpus of Rs 3 crore in 20 years for his retirement? Guess how much would he have to invest, assuming the same return rate? Hold your breath- Rs 25,000 every month! Okay let’s assume he got disciplined at about 30 yrs and wishes to create the same corpus in 25 years. In this case his job would be done with an investment of Rs 12,000 a month.

Being the person that he is, do you think Smart Sanjay would not have increased with investment amount with time? Assume he added 10% to his investments every year. Not only would he have a king sized corpus for retirement, he would also be in a position to meet all his other financial goals- buying home, kids’ education, marriage, etc without taking loans!

Do the numbers look astounding? Credit it to the power of compounding. Albert Einstein called it the ‘Eighth Wonder’. He also observed that ‘he who understands it, earns it; he who does not, pays it’.

So go, make use of the power of compounding through SIP and without pinching your pockets create a decent retirement corpus.

Click Here to know the best way to invest and build wealth for your retirement.