Gold demand had continued to rebound from 2020’ Covid-hit weaknesses, although remained well below pre-pandemic levels due to weak Indian demand growth. The demand for 1st of half of 2021 was 17% below the 2015-2019 average. However, gold will continue to play an significant role in investment kitty of Indians as it did in the days of Samudragupta, who was the son of Chandragupta around 375 CE who issued and used gold currency and conducted the Ashvameda sacrifice organized in war victories.

In 1991, the then government led by PV Narsimha Rao decided to pledge India’s gold reserve for a loan to tide over the financial crisis. Indians government mortgaged 67 tonnes of gold to raise $600 million to avoid defaulting on import payments. However, RBI was quick enough to buy back the pledged gold in December of that same year. The RBI learnt its lesson and has been buying gold since then with the present level of stock at 703.71 tonnes. There is a lesson here for retail investors that if central banks around the world trust gold as an important investment option, why shouldn’t you?

Impact of Macro’s On Gold

Apart from high liquidity, which is a prominent driver for gold demand, the low-interest rate regime makes it even more favourable to chase gold as an asset class instead of low yielding fixed income instruments. Since low-interest rates make bonds and other fixed-income investments less attractive, money flows into safer yielding instruments like bullions mainly gold.

Starting September 2007, the Fed steadily began reducing interest rates. During the 2008 financial crisis, slow growth and high unemployment forced the Fed to stimulate the economy through its policy of quantitative easing. Fed announced an expansion of the program from $600 billion to $1.25 trillion. Fed moved in the second round of QE and involved the purchase of $600 billion worth of short-term bonds. QE2 sparked a rally in gold prices but did little to spur sustainable economic growth.

Gold typically thrives during a period of uncertainty and the current rally started sometime in October 2018 as global growth started falling and was further triggered by uncertainty around US-China Trade War and Covid-19. Gold typically underperforms other asset classes during an economic expansion or a phase when central banks try to have control over inflation and increase interest rates to cut prices of skyrocketing commodities or assets.

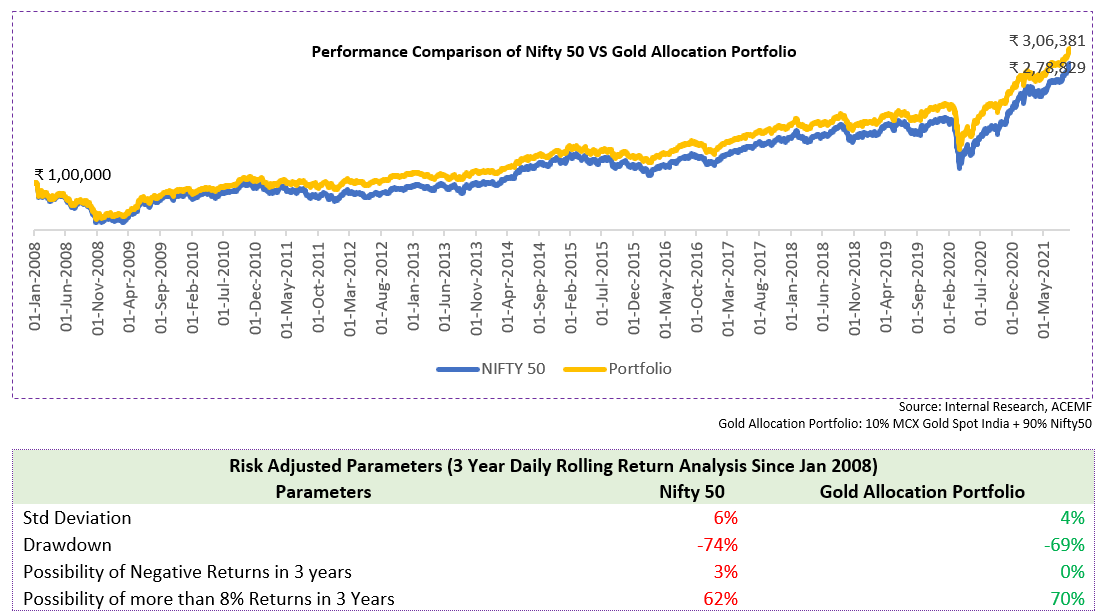

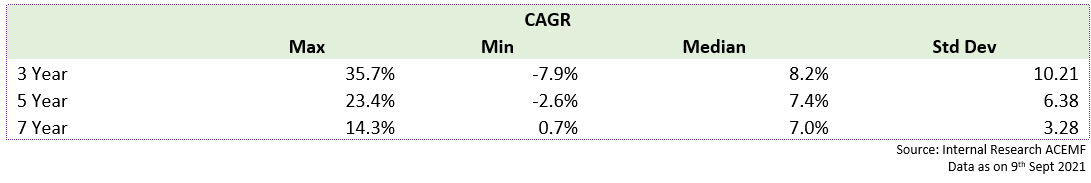

Covid-19 marred the markets with pessimism even as equities blazed past the 17,000-mark mile-stone. Community conservatism increased investor appetite for arresting downside risks, with subsequent preference for asset classes with similar qualities. In an almost rehearsed maneuver, Gold took to the limelight once again. The table below highlights how gold has enhanced returns of overall portfolio beating benchmark indices across time frames.

Gold’s ability to navigate volatility increases sharply with longer tenures as is visible from the table. The metal sees a ~68% reduction in its standard deviation when held between three and seven years!

What Should investor’s do?

In addressing actionable, it must be noted that a sole-Gold portfolio can have investors questioning their risk-return metrics across bull-&-bear markets. Quoting Warren Buffet’s thoughts on Gold, he says, “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head”.

As we are limited by our capacities in copying the investing legend’s techniques, it is advisable for you to have up to 10%-15% allocation of the precious metal in your portfolio.

Remember, uncertainty and speculation go hand-in-hand. And hey, there’s a reason we say, “Old Is Gold”! Hopefully with this note, we now know why.

Happy Investing!