We have heard time and again how India is suffering under the burden of huge NPAs. The economy is under a lot of pressure due to the increasing NPAs in the banking sector that erodes the funds from the country and hampers its progress. The NPAs by the end of 2019 stood at a whopping Rs.1.86 trillion and have only worsened due to various factors, the covid pandemic being one of them.

So what are these NPAs and why is it so significant to keep them in check? The answers to these questions and repeated details of the NPAs are discussed below.

What is the meaning of non-performing assets?

NPAs is the abbreviation used for Non-performing Assets of a bank. These assets are the loans or advances that are in arrears or have been defaulted on more than one occasion. While loans in arrears are the loans where the interest or the principal payment is delayed or missed, loans in default are the loans where the possibility for the borrower to meet the loan obligations is no longer feasible.

RBI has specified the time period that signifies the classification of the loans or advances under NPAs. As per this classification, if any payment (whether interest or principal amount or both) remains overdue for a period of 90 days or more on a loan or advance it will be deemed to be classified as an NPA. These loans and advances can be in the nature of a term loan, overdraft/cash-credit, discounted bills, etc. as per the guidelines of RBI.

How are NPAs classified?

The guidelines of RBI have classified the NPAs into three broad categories. Depending on the period of default. These categories and the basis of their classification are tabled below,

| Categories of NPAs | Basis of classification |

| Substandard Assets | A loan or advance that has remained outstanding or NPA for a period of less than or equal to 12 months |

| Doubtful Assets | A loan or advance that has remained outstanding or NPA for a period of more than 12 months and are already classified as substandard assets. |

| Loss Assets | These are overdue and doubtful assets that have little to no recovery value. The bank or its auditor or the RBI has been forced to recognize them as loss assets as the asset is considered to be uncollectible, however, there may be some salvage value or recovery value to it. |

What are the possible reasons for rising NPAs?

Recently, the Minister of State for Finance, Mr. Bhagwat Karad, said that the “occurrence of non-performing assets (NPAs) is normal, although an undesirable, corollary to the business of banking”. It is virtually impossible for every loan or advances extended to be repaid and NPAs are a normal course of business.

However, the degree of NPAs has to be regulated closely as when these NPAs increase beyond measure, it snowballs into an economic crisis for the country as a whole. Some of the possible reasons for an increase in the NPAs are mentioned below.

- Lack of due diligence on part of the lenders while issuing loans

- Loss of businesses and employment opportunities on account of the lockdowns due to the Covid pandemic

- Impact of the general slowdown of the economy even in the pre-pandemic period

- A slowdown in a particular sector or industry can lead to losses for a business which in turn impact their loan repaying capacity.

- Misappropriation of funds by the management can lead to wilful defaulting.

- Issues like lack of government support, an increase in the timeline of capital-sensitive projects, and any changes in the economic or monetary policies can cripple a business or a sector leading to loss of revenues and eventually damaging its repaying capacity (for example infrastructure sector)

- Extreme competition in a particular sector can be fractal for companies with weak fundamentals and their loans can eventually turn into NPAs for lenders (for example telecom sector)

- An increase in the imports in a sector can lead to a slow death of the local manufacturing industry eventually turning their loans into NPAs (for example, the mobile phone industry in the country that is now captured by Chinese phones.

- Taking excessive loans in a time of economic boom at lower interest rates which later have to be serviced at higher rates in a time of recession can also lead to a rise in the NPAs.

What is the impact of NPAs?

The impact of rising NPAs is seen on the micro level as well as the macroeconomic level on the nation as a whole. Some of the immediate and long-term impacts of the rise in the NPAs are highlighted below.

- The direct impact of the NPAs is in the banking sector as they do not have enough lending capacity to fund new projects.

- Banks have to charge a higher interest margin to their customers to meet their profit margins.

- Loss of employment opportunities due to closure of businesses that cannot repay their loans.

- The bad health of the banking sector directly impacts the earning potential of its shareholders and in PSU banks it directly means less revenue for the government. It will translate into less available resources for infrastructure and social-political causes.

- The rising cases of NPAs increase the burden on the judiciary system of the country.

- NPAs will result in lower credit scores for the borrower and damage their brand value or goodwill.

Example of NPA

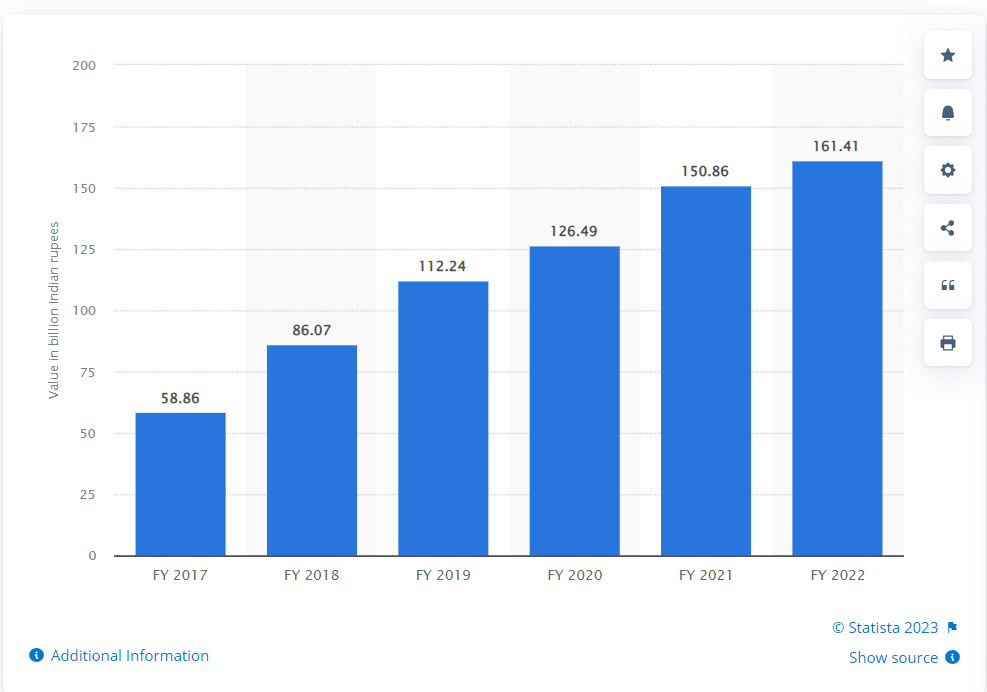

Let’s take a look at the gross non-performing asset value of HDFC Bank from financial year 2017 to 2022 –

Conclusion

The rising NPAs are one of the most severe blots for an economy as it damages the potential of the country to get on a fast track for development. The government has recently announced that it has been able to collectively get back or receiver bad loans with Rs. 8.6 lakh crores over 8 financial years. While this is a huge achievement for the country, there is still a long way to go. To tackle this problem the government has to take many measures that prima facie include the disbursal of loans and advances in a more efficient manner and at the same time increase forensic audits of the borrowers to identify hidden NPAs. The need of the hour is to tighten the lending norms as well as develop skills and techniques to identify potential defaulters thereby taking immediate remedial measures.

FAQs

Some of the measures taken by the Government or RBI to curb the NPAs and the losses arising from them are by developing various Acts and legislations from time to time. These include

-Lok Adalats -2001

-Comprehensive Settlement – 2001

-SARFAESI Act – 2002

-Asset Reconstruction Companies (ARC)

-Corporate Debt Restructuring – 2005

-Debt recovery Tribunal – 2013

-5:25 Rule – 2014

-Joint Lenders Forum – 2014

-Mission Indradhanush – 2015

-Strategic Debt Restructuring – 2015

-Asset Quality Review – 2015

-Insolvency and Bankruptcy Code – 2016

The NPA situation in India is the worst when compared to other emerging markets in BRICS like China, Brazil, Russia, and South Africa.

Gross NPA refers to the total amount of NPAs without deducting any provisions while the Net NPA amount refers to the actual NPA amount after the provisions are reduced from the gross NPA amount.

There recently have been many cases of bank mergers as a measure to reduce the overall NPAs and the burden on the individual banks. However, this is a mere restructuring of the accounts and not solving the underlying issue of NPAs. Hence, this cannot be treated as a permanent solution to tackle the increasing NPA issue in the country.

The 4Cs that banks need to look out for before extending any loans or advances are,

Character of the borrower and the intention of repaying the loan

-Collateral provided has to be adequate and loan disbursed should be keeping in mind the loan to value ratio

-Capacity of the borrower to repay the loans by evaluating the current and future revenue projections.

-Conditions of the industry and other factors like the market and environment as well as the relative position of the borrower in the industry.