What is open market operation (OMO)?

Open market operation is the sale and purchase of government securities and T-bills by Reserve Bank of India. The objective of OMO is to regulate the money supply in the economy and minimise the impact on the interest rate and inflation

When does RBI come up with open market operations?

When RBI wants to inject the liquidity in the system or increase the money supply, it purchases the government securities from the market and sells government securities when it wants to suck out the liquidity from the market.

OMO Announcement – August 2020

What is the latest Open Market Operation (OMO) announcement?

RBI has decided to conduct simultaneous purchase and sale of government securities under OMO for an aggregate amount of INR.20,000 Crores in two tranches of INR.10,000 crores each.

The auctions will be conducted on August 27,2020 and September 03,2020.

Details of OMOs are as follows:

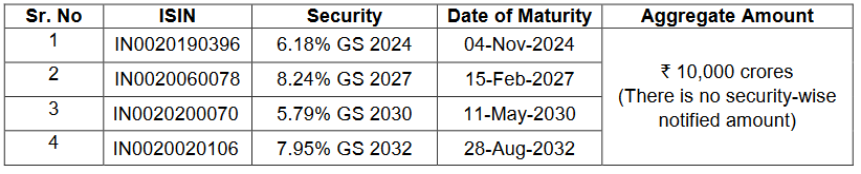

1. The RBI will purchase following securities through Open Market Operation:

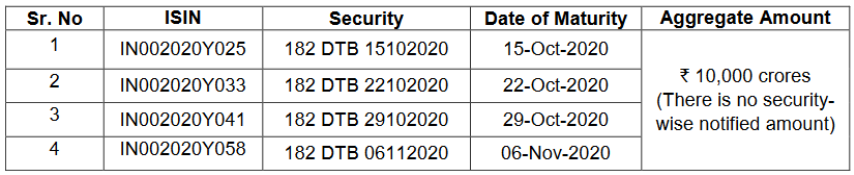

2. The RBI will simultaneously sell following securities through Open Market Operation:

Let us understand the reason:

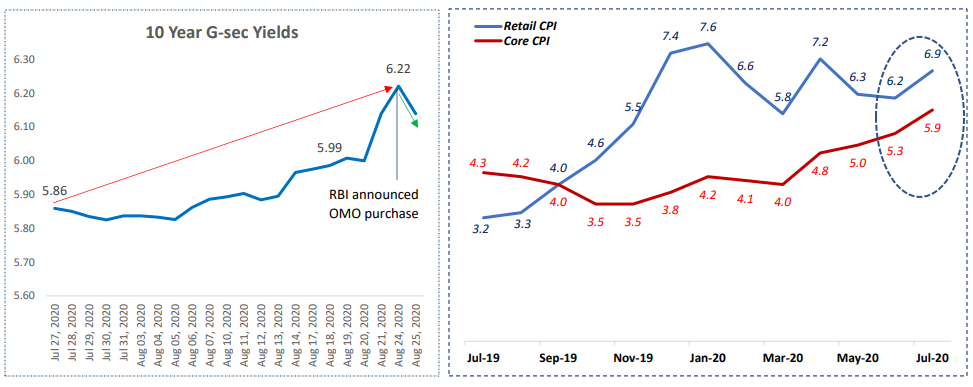

1. Long term G-sec yields hardened by ~20-25 bps in last week

MPC has signal led its concern in its stance by resolving to ensure that inflation remains within the target going forward. MPC also believes that the available space for policy space should now be used prudent. With no further rate cuts hope till next MPC meet in October 2020, traders turned bearish on G-sec and resulted in lowering demand for sovereign papers at time when both central and state governments are borrowing large sums.

This move by RBI will help ease the pressure on long term yields.

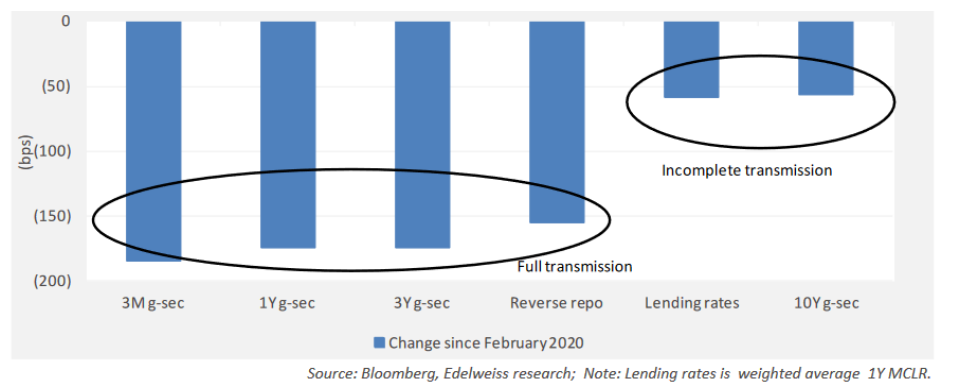

2. Short end rates have fallen, but long -end sticky

The spread between the 10Y and 3-month G-sec has widened to more than 250bps to a ten-year high and hence RBI’s move of buying long term paper will reduce the spread henceforth.

Investor Takeaway

A benign global monetary cycle, weak growth and rising inflation may not give the RBI more room to cut rates in near term. We expect RBI to come up with such bold measures henceforth to manage liquidity and evolving market conditions. It will take measures as appropriate to ensure the orderly functioning of financial markets.

Click here If you want to read the complete RBI press release.