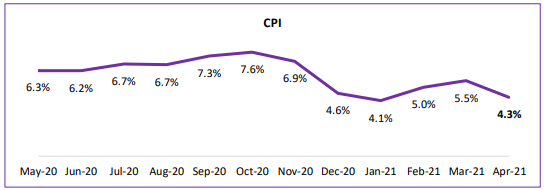

What is the latest reading?

India’s kicks off the new financial year with tepid inflation numbers post an upwardsfacing scale in the 1st quarter of CY21. It recorded 4.29% in April, vs 5.52% (4-month high) levels seen in prior month. Inflation figures mark a comeback to 4% territory after an aggressive pattern in shaky economic climate over the past two months. The figures came out surprisingly favorable amidst intensification of the viral virus.

CPI falls in RBI’s target range of 4 (+/-2) % for fifth consecutive month, with RBI extending target range till March 2026. Any further loosening can undermine the central bank’s ability to set effective monetary policy. Reducing inflation & expanding IIP expanding can misguide investors about health of economy due to base effect at play.

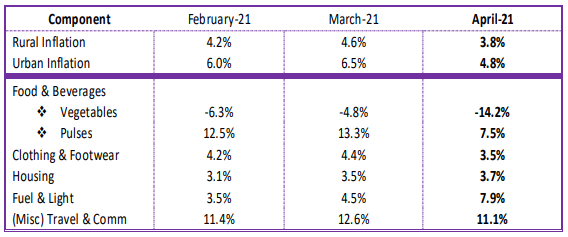

Element Inflations

Investor Takeaway

A key reason for flat-line inflation figures is the realization of the high base-effect. The base play can misguide real inflation figures in H1CY2021, courtesy of extraordinary inflation seen in comparison figures.

Other reasons for soft inflation print can be credited to continuous fall witnessed in vegetable prices as reflected by food basket easing to 2.02% in current month, down from 4.87% in month prior. The forecast of normal monsoon can further keep food prices in check with supply-side disruption due to localized lockdowns acting as key risks.

Cost pressure of increase in inputs such as oil and pulses can escalate tensions in this segment. Declining crude oil inventories in U.S., tighter supplies from OPEC, and rising govt. taxes are primary drivers of increasing oil prices.

Unaddressed issues in elements such as supply-side disruptions, and higher labor charges can add stress to inflation trajectory in coming times.

Core-inflation charts a similar trajectory as demand-side factors continue to battle the covid brunt. It is a result of gushing commodity prices, higher import duties, rising input prices and feverish demand. Same is confirmed by visible uptrend in goods rather than services (housing, education) which continue to be benign.

In last bi-monthly monetary policy meeting, the central bank kept its key interest rates unchanged while maintaining its accommodative stance. Continuing to focus on growth via polices and packages, RBI is to use an arsenal of unique liquidity and similar supportive strategies to maintain current pace of expedited growth.

Broad-based domestic and global economic recovery should improve aggregate demand, posing an upside risk to inflation. Favorable base effect, appreciating rupee and any risk of new covid-strain led slowdown, will be a tailwind for CPI inflation.

It is likely for RBI to remain on pause in next meet and consider rate-cuts in near future after efficacy in transmission of prior rate-cuts.

Click here If you want to read the complete CPI Inflation press release