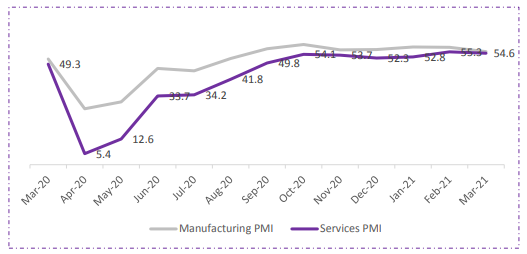

What is the latest Services PMI reading?

Service Sector in India pointed to further increase in new businesses and output at Indian services firms, the latest reading was consistent with a slower but still marked pace of expansion. Services PMI fell from 55.3 in February to 54.6 in March.

A reading above 50 denotes expansion and below 50 denotes contraction.

The latest reading was indicative of a growth for sixth consecutive month. However despite remaining in expansionary phase, the rate of expansion softened due Covid curbs and low footfall.

Service providers reported a sharp increase in input costs, the second fastest since Feb 2013. Companies that noted high output linked the upturn to the elections and successful marketing campaigns which led to demand.

New orders grew in March continuing the current sequence of expansion to six months.

Firms had an optimistic outlook for the year ahead business activity, but overall the confidence was unchanged from Feb.

External demand for Indian Services continued to worsen, with new orders from abroad decreasing for thirteen straight month.

Transportation and storage sector posted a strong performance during the month, which recorded sharp increase in sales and business activity. Services related to consumers, insurance remained in a expansionary mode, while information & communication and real estate and business services posted declines in new work and business activity.

The rate of input cost inflation across private sector was only lower by few basis points from Feb’s 88 month high indicating another sharp increase in firms expenses.

Going ahead companies expect business activity to increase over the course of 12 months on account of rising business enquiries and hopes of higher vaccination rollout.

Kye risks will continue to be unforeseen events resulting from the virus and inflationary upticks. Passing input cost burdens to client via price hikes can see demand strength under pressure.

Click here If you want to read the complete Services PMI HIS Markit press release