Introduction to Purchasing Managers’ Index (PMI)

PMI, as an index, tracks and reflects changes in manufacturing volumes derived from a fivehundred company survey. Different elements are attributed distinct weights and the resultant index is accepted to be indicative of current business activity and projected confidence levels.

Key elements covered by the index include new orders, output, employment, suppliers’ delivery time, and inventory build-up, in descending weights ranging between (30-10) %.

The index is considered important as an economic indicator helping compare a country’s activity competitiveness vis-à-vis peers.

Update: Manufacturing PMI Reading – April 2021

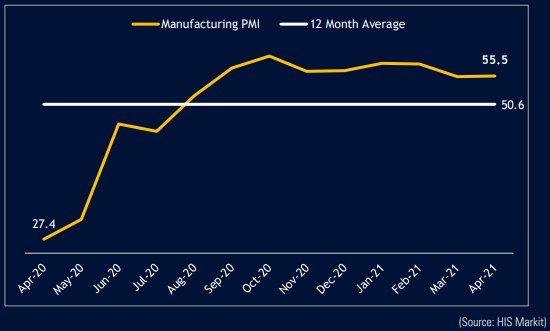

India Manufacturing PMI recorded 55.5 in April after declining to a seven-month low of 55.4 in the month prior. Remaining flat-to-positive, the index remained above its long-run average of 53.6. The manufacturing sector remained surprisingly favorable amidst intensification of the viral virus.

A reading above 50 denotes expansion and below 50 denotes contraction.

Analyst Commentary

The manufacturing index in its current avatar strikes a delicate balance between dampening domestic demand and exponential exports.

Within borders, output and sales increased at the slowest rates since August 2020 as covidinduced restrictions shook the supply chain systems. A key contributor to this was the steep increase in input costs, with steel playing culprit due to new-found demand across major economies in USA and China. Chemicals, transportation, and energy price-rise further added pressure to the element reading. Such intensity elevated input inflation at its quickest since July

2014, with rate of increase following suit by recording highest figures over seven-&-half years.

Vaccination drives trickled positivity over the coming year as business confidence levels, and demand forecasts held strong. The same reflected in actions as businesses rushed to pile-up inventories in spite of cost challenge. In fact, stock pile-up rose for the eighth consecutive month.

The rate of fall in manufacturing sector recorded the weakest intensity over the prior thirteen months of consecutive shedding. This marked a major positive for the index.

Outside borders, exports marked an eighth consecutive increase as peer countries oiled economic gears to trump economic shocks observed due to Covid-19. The same was reflected in data released by national commerce faction, highlighting India’s record 197% April export growth to $30.21 billion.

Key risks are visible in the possible imbalance between rising global prices and domestic case counts. Abruptions in push-&-pull inflations can disrupt stabilizing demand footprints, if costs are levied onto consumers instead of being consumed in the production chain.

Going ahead, the widening of vaccination programs will be instrumental in printing manufacturing sector’s next leg of growth. The numbers today highlight the nascent and fragile stage of recovery that the Indian economy is in. We continue to keep an eye on efficient implementation of public policies which can be expected to bolster the economy at large.

Click Here to read HIS Markit’s original press release on ‘IHS Markit India Manufacturing PMI’ for the month April, 2021