In a recent flurry of market activity, shares of several Tata Group companies experienced a significant uptick in their prices, marking a notable rally for the conglomerate’s stocks. Notably, Tata Chemicals, Rallis India, Tata Power Company, Nelco, Tata Teleservices (Maharashtra), and Tata Investment Corporation all witnessed substantial gains ranging from 5% to 13% on the Bombay Stock Exchange (BSE). This surge in share prices was accompanied by heavy trading volumes, indicating strong investor interest in Tata Group companies.

Leading the charge, Tata Chemicals saw an impressive surge of 14% intraday, reaching a 52-week high of Rs 1,349 on the National Stock Exchange (NSE). The stock eventually settled at Rs 1,311.60 per share, representing a notable gain of 11.30% for the day. This surge comes in the wake of a report by equity research firm Spark Capital, which highlighted Tata Chemicals’ substantial holding of 2.5% in Tata Sons, potentially amounting to a staggering Rs 19,850 crore, equivalent to 80% of its market capitalization. This revelation fueled investor optimism and contributed to Tata Chemicals’ remarkable rally over the past six trading sessions, during which its stock price surged by more than 40%.

The positive momentum extended across various other Tata Group entities, including Tata Motors, Tata Power, Tata Steel, Rallis India, Nelco, and Tata Investment Corporation, which all experienced robust buying activity on Thursday. Notably, among the 17 active listed Tata stocks, only Titan witnessed a marginal decline of 0.6%, reflecting the overall bullish sentiment surrounding Tata Group companies.

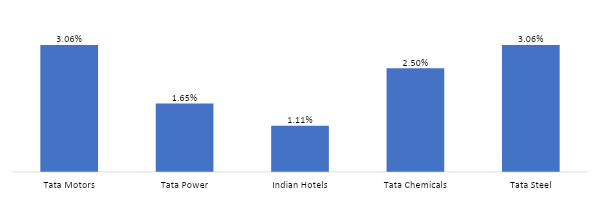

Market analysts speculate that Tata Sons, the holding company of the Tata Group, is poised to raise approximately Rs 55,000 crore through an initial public offering (IPO). Many Tata Group companies hold significant stakes in Tata Sons, contributing to the market’s anticipation of the potential value unlocking upon Tata Sons’ listing. For instance, Tata Motors, Tata Power, Indian Hotels, Tata Chemicals, and Tata Steel collectively hold substantial stakes in Tata Sons, which could translate into significant value for these companies upon listing.

According to Spark Capital, Tata Sons could command a valuation of Rs 7.8 lakh crore upon listing, considering the current market capitalization of Tata Group firms. This valuation projection accounts for a 60% holding company discount and estimates Rs 1 lakh crore as the value of optionalities. The anticipated value unlocking stemming from Tata Sons’ listing has fueled investor optimism and contributed to the recent rally in Tata Group stocks.

For instance, Tata Chemicals’ stake in Tata Sons is estimated to be worth close to its own market capitalization of Rs 33,414 crore, underscoring the substantial value potential for Tata Group companies. Furthermore, as Tata Sons is classified as an upper-layer non-banking financial company (NBFC), it is expected to list next year in compliance with Reserve Bank of India regulations, further adding to the market’s excitement.

In conclusion, the recent surge in Tata Group stocks reflects investor optimism surrounding the potential IPO of Tata Sons and the consequent value unlocking for Tata Group companies. As market participants eagerly await further developments, the rally in Tata Group stocks underscores the high expectations and positive sentiment surrounding one of India’s most prominent business conglomerates.

Market this week

| 04th Mar 2024 (Open) | 07th Mar 2024 (Close) | %Change | |

| Nifty 50 | ₹ 22,404 | ₹ 22,494 | 0.4% |

| Sensex | ₹ 73,903 | ₹ 74,119 | 0.3% |

Source: BSE and NSE

- The Indian market extended its rally for the fourth consecutive week, ending on March 7, reaching fresh record highs, buoyed by positive global cues.

- Sector-wise, the Nifty PSU Bank index surged by 3%, followed by the Nifty Pharma index, which rose by 1.5%. Additionally, the Nifty Energy index and Nifty Bank added 1.4% and 1%, respectively. However, the Nifty Media sector experienced a decline of 3.2%, while the Nifty Information Technology index and Nifty Realty index saw losses of 1.3% and 1%, respectively.

- Foreign institutional investors (FIIs) offloaded equities worth Rs 10,081.08 crore, whereas domestic institutional investors (DIIs) bought equities worth Rs 10,129.17 crore during the week.

Weekly Leaderboard

| NSE Top Gainers | NSE Top Losers | ||||

| Stock | Change (%) | Stock | Change (%) | ||

| Bajaj Auto | ▲ | 10.42 % | UltraTech | ▼ | (4.29) % |

| Bharti Airtel | ▲ | 6.06 % | LTIMindtree | ▼ | (3.25) % |

| TATA Motors | ▲ | 5.16 % | Adani Enterprises | ▼ | (3.20) % |

| HDFC Life Insurance | ▲ | 5.01 % | M&M | ▼ | (3.19) % |

| TATA Consumer | ▲ | 4.50 % | Bajaj Finance | ▼ | (2.48) % |

Source: BSE

Stocks that made the news this week:

- Macrotech Developers, formerly known as Lodha Developers, successfully raised Rs 3,281 crore through a qualified institutional placement (QIP) aimed at institutional investors. The funds will be utilized for various purposes including debt repayment, land acquisition, and covering other expenses. The QIP, which commenced on March 4, concluded on March 7. Invesco Developing Markets Fund secured the largest allotment of shares, accounting for 21.4% of the total issue size. Following closely behind were GQG Partners with 11.2% and Stitching Depositary APG Emerging Markets Equity Pool with 9%.

- SpiceJet experienced a 4% surge following the announcement of the resolution of a Rs 413-crore dispute. The airline operator, SpiceJet, reached a settlement with Echelon Ireland Madison One, resulting in significant savings of $48 million or Rs 398 crore. As part of the agreement, SpiceJet will acquire two airframes, which will bolster its fleet and operational capabilities. This settlement marks the third major resolution for the carrier, following its recent fundraising endeavors, resulting in a total savings of Rs 685 crore for the airline.

- Suzlon’s shares surged by 5% as the renewable energy solutions provider secured an order from Juniper Green Energy for a wind power project. Suzlon will undertake the development of a 72.45 MW wind power project, involving the installation of 23 wind turbine generators (WTGs) with a Hybrid Lattice Tubular (HLT) tower. These WTGs will have a rated capacity of 3.15 MW each and will be installed at the client’s site in the Dwarka district of Gujarat.