What makes gold poised to shine in the future?

✓ Record Demand and Value

• Gold demand surged by 5% year-on-year in Q3 2024, reaching a record high of 1,313 tons and surpassing $100 billion in value,

reflecting strong investor interest.

✓ Central Bank Support

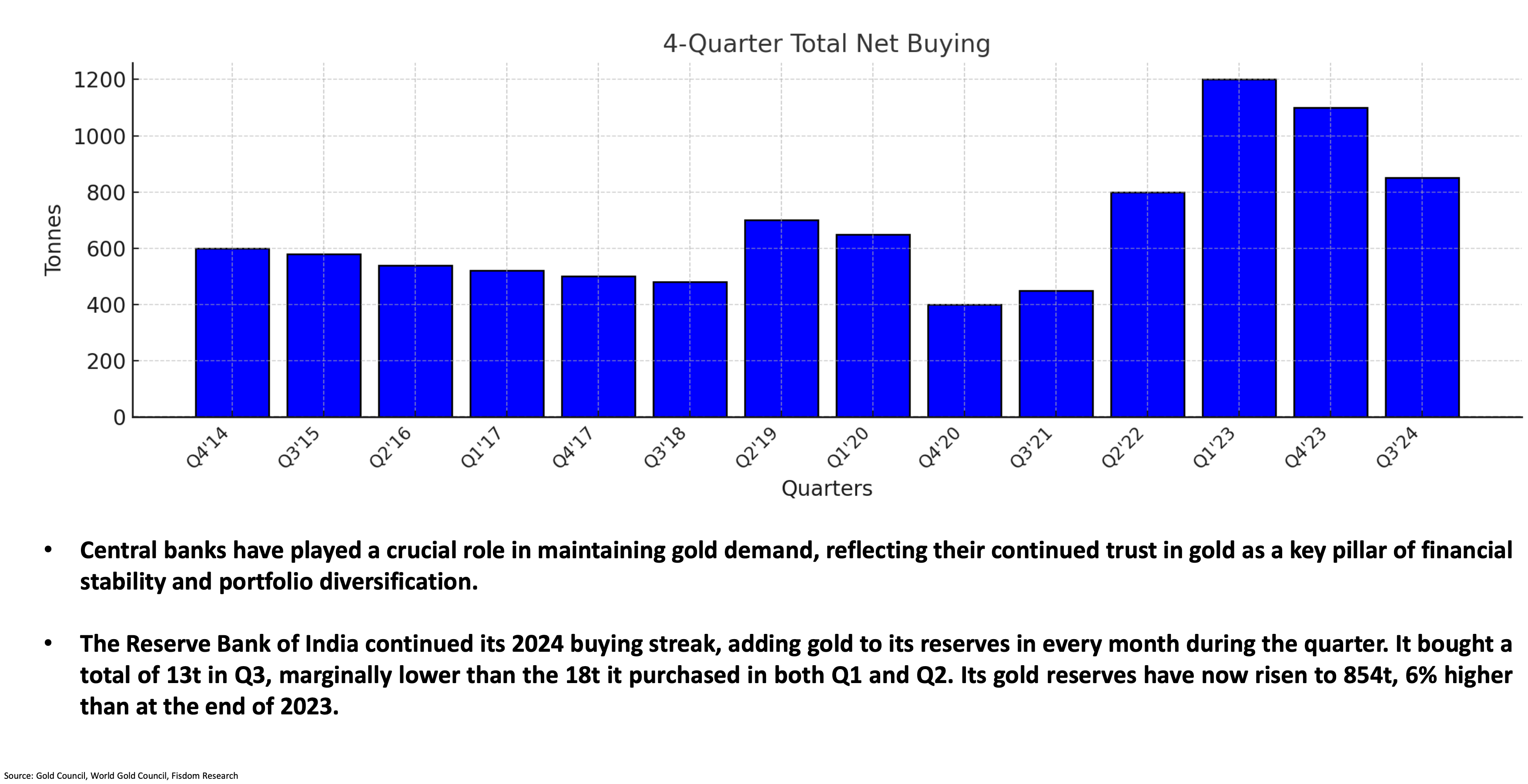

• Despite a slowdown in Q3 purchases, central bank buying in 2024 remains consistent with previous years, reinforcing gold’s role in

financial stability and diversification.

✓ Macroeconomic Uncertainty

• The combination of geopolitical risks, including Middle East tensions, and US election policy uncertainties, creates a favorable

environment for gold as a safe-haven asset.

• Moreover, global fiscal deficits surged in the post-COVID era. Although they are gradually declining, they remain at elevated levels,

continuing to support gold prices.

✓ Rate Cut Expectations

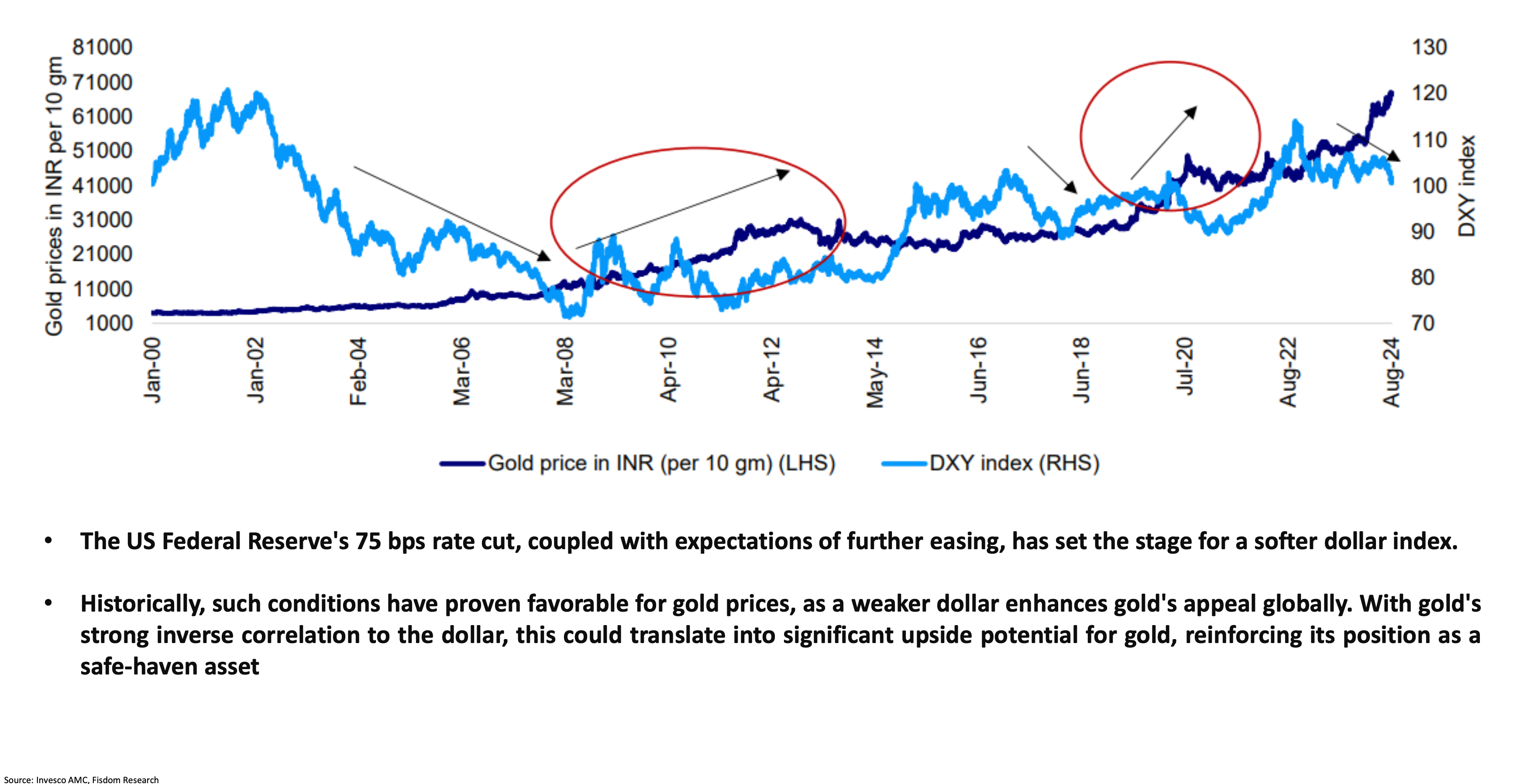

• Fed has already cut the rates by 75bps. We are expecting Fed to cut the rates further which may boost gold’s appeal, as lower interest

rates generally make non-yielding assets like gold more attractive.

• A weakening US Dollar (USD) driven by rate cuts is expected to provide strong support for gold prices.

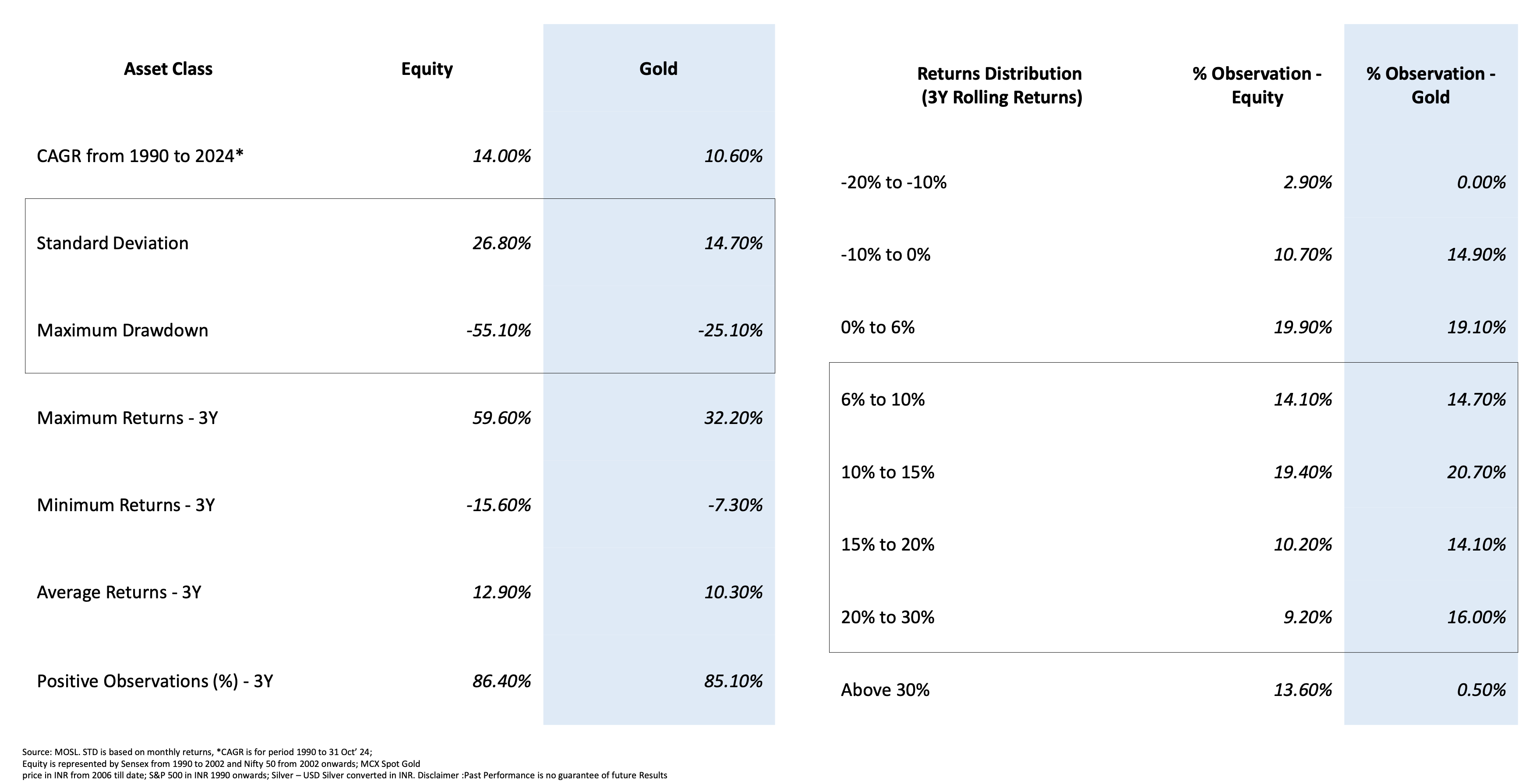

1. Historically, gold as an asset class has delivered strong risk adjusted performance over long term

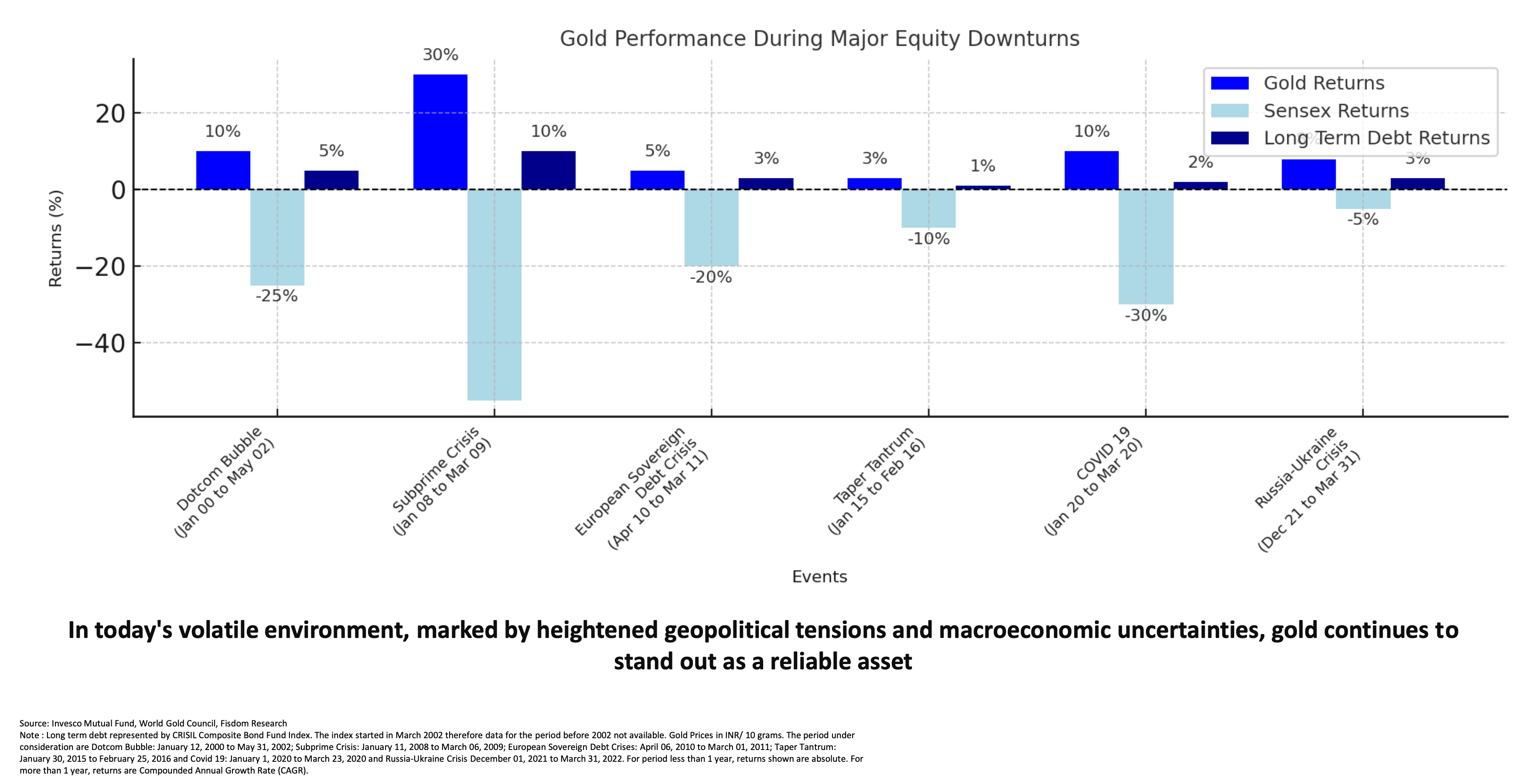

2. Provides cushion during macro & geopolitical events

3. Gold has low correlation with other asset classes

4. Central bank demand remains robust as they continue their consistent purchasing streak

5. Lower interest rates and a weaker dollar index serve as key factors supporting gold prices