The Union budget is right around the corner. While all of us are curious to know the changes that may happen in the FY24 budget & though there are plenty of tax expectations that the Budget can address, we give here our expectations, which have been placed forth keeping in mind the practical side of fiscal space that will be available. It is essential to note that this budget will lay the foundation for the 2024 general elections.

I. Expectations to mitigate hardship to retail taxpayers:

- Changes in tax slabs

As per income tax provisions, an individual pays tax based on slab rates as per their income. The highest tax for an individual earning Rs. 5 crores or more is 42.74%. Tax rates have stayed the same since 2017-2018 (Except for the New tax regime introduced in 2020-2021). Hence, the highest tax bracket is expected to be reduced to boost the economy’s consumption and provide more purchasing power in the hands of individuals.Rates for the highest brackets for individuals in neighbouring countries are Hong Kong – 17%, Singapore – 22%, and Malaysia – 30%. - Changes in limit for deductions

There are expectations around increasing the limit of various deductions for individual investors. For example, the current limit for tax saving under section 80C of the income tax is Rs. 1,50,000.If this limit of Rs. 150,000 is increased, individual taxpayers can save more. They will benefit from lower tax payments yearly and will increase income for everyone. We also expect some changes to standard deduction as well.

II. Even the Association of Mutual Funds in India (AMFI) has proposed specific tax-related changes to be made in the FY24 budget. We have listed down key tax recommendations only.

| Proposal | Rationale |

| For resident Indian | |

|

|

| For non-resident Indians (NRIs) | |

|

|

|

|

Click? here to Read the detailed recommendations by AMFI.

III. While there are several expectations from different sectors that the Budget can address, we give here our expectations, which have been placed forth keeping in mind the practical side of fiscal space that will be available.

Key themes to look forward to:

| Theme | Rationale |

| Capex | The last budget allocated a record-breaking Rs. 7.5 Tn for capital expenditure through the Gati shakti mission. It includes impetus to road, railways, airways, ports logistics development. |

| Government capital expenditure remains in line with expectations through FY23 YTD An analysis of spending by key ministries indicates that spending on railways is already over 100 of budgeted numbers in FY23 YTD. Yet, the ministry has requested for additional 20%-25% more funds for FY23. | |

| However, the investment demand remains subdued versus the all-time highs witnessed in FY 08. Capex revival has constantly been featured as a priority agenda item through the past couple of budgets. The same can be expected to continue with a renewed focus especially considering the need in India’s economic position. | |

| Production Linked Incentive Scheme (PLI) | To boost the domestic manufacturing sector, support exports, and attract investments in the manufacturing industry, the Government of India declared a Production linked incentive for five years with a total outlay of Rs 1.97 tn. The highest allocation has been earmarked for the auto sector, followed by mobile phones and the manufacturing of batteries. A separate Rs 0.76 Tn was explicitly announced for semiconductor manufacturing companies. |

| Credit Suisse estimates that PLI schemes can create $150 bn incremental revenue by the end of FY 27, contributing up to 1.7 per cent of GDP. | |

| The key objectives of PLI are to boost manufacturing in India, increase employment opportunities, and import substitution and export maximization. All of it will help in improving the current account situation of India. | |

| Considering the success of PLI, more such announcements are expected in new sectors along with the existing 13 sectors. There might be a specific focus towards the semiconductor industry. | |

| Rural | We have observed a divergent trend between rural and urban sentiments, with the gap widening consistently It is an indicator reflecting that the rural economy hasn’t recovered yet Inflationary pressure continues to weigh on demand sentiment in the rural segment of India. |

| A sum of Rs 278 billion has already been allocated towards the ministry of rural development on rural employment generation to support incremental expenditures in the segment. Most of this amount is to be spent on the Mahatma Gandhi National Rural Employment Guarantee Scheme (and Pradhan Mantri Awas Yojana Rural (PMAY R). | |

| We think the current allocation is insufficient to revive the rural economy given that it is the last budget before the upcoming general elections; we expect more populist announcements for the rural sector. Announcements may include a hike in MSP, agro-marketing support, a boost to rural infra, a focus on rural employment and aid through cheaper funding can help revive the rural economy. |

For an in-detail overview of the current fiscal math and investing opportunities, please read our detailed coverage of Budget Expectations.

Read more on Budget Expectations

Budget & Equity Markets:

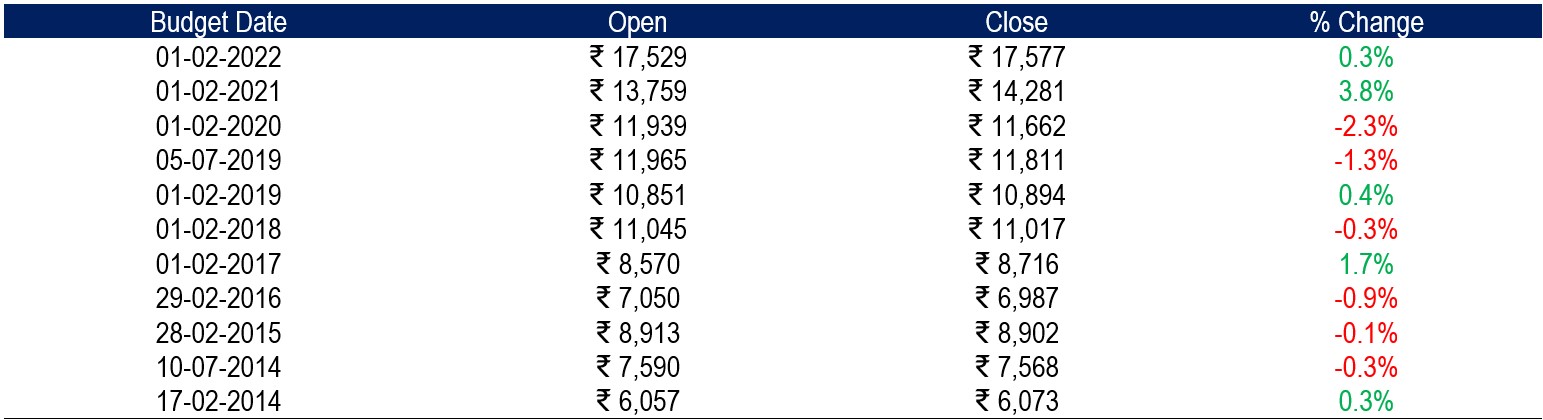

We didn’t find a strong correlation between budget day & the equity markets. We suggest that investors focus on long-term wealth creation, follow investment discipline, and invest per their risk appetite.

Here is how Nifty has performed on Budget Day

Source: Indiabudget.gov.in. NSE India