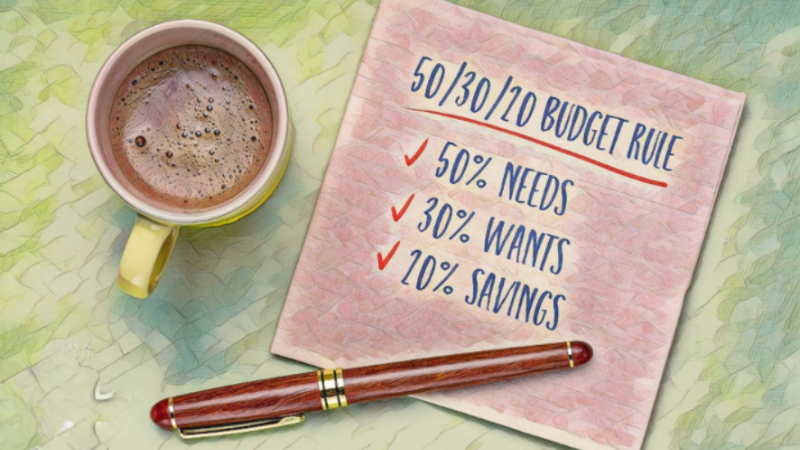

If you are a keen investor, you would have scoured a lot of reading material to navigate the tricky path of budgeting, saving and investing. One of the popular rules that you would have come across is the 50/30/20 rule. This is an age-old rule but holds true even today. Check out this blog to know the meaning of this rule and how to apply it successfully.

Read More: Financial Planning – All you need to know

What is the 50/30/20 rule of financing?

The 50/30/20 rule of financing is a popular budgeting guideline that helps individuals allocate their income into three main categories: Needs, Wants, and Savings. While this rule is widely recognized in the context of personal finance, it can also be useful for investors who want to manage their finances effectively. Here is a simple explanation of the rule.

50% for Needs

This portion of your income, ideally 50%, should be allocated to your essential expenses or needs. These are the expenses that are necessary for maintaining your basic standard of living. Some examples of the expenses that can be included in this list are,

- Rent or mortgage payments

- Utilities (electricity, water, gas)

- Groceries

- Transportation (fuel, public transport)

- Health insurance premiums

- Education expenses for children

- Minimum debt payments (like EMIs on loans)

This portion of budgeting ensures that you cover your essential needs which is crucial for financial stability.

30% for Wants

About 30% of your income can be dedicated to discretionary spendings or wants. These are non-essential expenses that improve your quality of life but are not necessary for survival. Some examples of the expenses that can be included in this list are,

- Dining out and entertainment

- Shopping for non-essential items

- Hobbies and leisure activities

- Travel and vacations

- Subscription services (streaming, gym, etc.)

This portion allows you to enjoy your income and indulge in the things that bring you happiness and satisfaction.

20% for Savings and Investments

The remaining 20% should be allocated to savings and investments. This is where you build your financial security and work towards achieving your long-term goals, including investing in the stock market, mutual funds, or other investment vehicles. Some examples of the expenses that can be included in this list are,

- Systematic Investment Plans (SIPs) in mutual funds

- Fixed deposits or recurring deposits

- National Pension System (NPS)

- Individual Retirement Accounts like SCSS, NSC, or similar retirement plans

- Emergency fund savings

Allocating a significant portion of your income to savings and investments helps you grow your wealth over time and achieve financial goals like retirement, buying a home, or funding your children’s education.

Understanding the rule using an example

The above rule of 50/30/20 can be explained further with a simple example.

Suppose your monthly income is Rs. 50,000.

Allocation of 50% for Needs – Allocate 50% of your income for your essential needs. In this case, it would be Rs. 25,000 (50% of Rs. 50,000). You can use this money for things like rent or mortgage, groceries, utility bills, transportation, and health insurance. These are the necessities for maintaining your standard of living.

Allocation of 30% for Wants – This is the next portion of your income that you can reserve for discretionary spending or wants. That would be Rs. 15,000 (50% of Rs. 50,000). This money can be spent on dining out, shopping, hobbies, and entertainment – things that make life enjoyable but aren’t vital for survival.

Allocation of 20% for Savings and Investments – This is a crucial practice for long-term financial stability and creating a successful investment portfolio where you set aside 20% of your income for savings and investments. In this scenario, it’s Rs. 10,000 (20% of Rs. 50,000). You can consider investing in mutual funds, fixed deposits, or saving for retirement and emergencies.

Steps to apply the 50/30/20 rule

The 50/30/20 rule may look quite simple and easy to implement in our daily lives, however, it can be tricky and may not yield results if not implemented properly.

#Step 1 – Know your income

The starting point for this crucial exercise is knowing your total income. Here it is important that you know your take home salary figures well.Pool all your resources that yield you income in a month which includes your active and passive income sources.

#Step 2 – Keep a track of your unavoidable expenses

Now that you know what you can spend, the next step is to account for all your unavoidable expenses. It is imperative to understand the difference between non-essential and essential expenses at this stage for this rule to be implemented effectively. Your OTT subscriptions may seem important but they actually are not. So prioritise accurately and allocate 50% of your budget towards necessities. Make sure you include important items like insurance premiums and debt EMIs under this bucket.

#Step 3 – Identify your wants

Following this, identify your wants and allocate the balance 30% of your budget towards them. You can segment and prioritise here too for options like routine dining out, shopping, etc. or bigger desires like travelling the world. Finally, the most important step is to keep updating the plan and keep adjusting as and when needed.

#Step 4 – Determine your financial goals

After this exercise, determine your financial goals. This includes your short-term and long-term goals and segmenting 20% of your budget towards different investments.

Conclusion

The 50/30/20 rule is not new and has been followed by millions across the globe. It is often cited to be the fundamental principles of budgeting and living a healthy financial life. The key to successfully implementing this budgeting rule is identifying expenses that fit each category correctly and allocating the resources to meet them. While there may be initial errors, through experience, one can master this rule and achieve much-needed financial stability in the long term.