“Don’t save what is left after spending, spend what is left after saving”. These are the wise words of Mr. Warren Buffet and should also be your guru mantra to have sufficient savings every month from your salary. We all know a friend who always complains of not having enough money even if they are earning a decent income every month. The prime reason for such cases is often inefficient money management while a lack of importance of savings in some. Are you too among those who want to save from your salary more efficiently? Then you have come to the right place. Read on to know some tips and techniques to save money from your salary and create a healthy discipline for your secure financial future.

Calculate: Check out your monthly take home salary with our calculator

Why is saving important?

Saving is incredibly important for any person no matter whether they are in urban or rural areas or any age group they belong to. It’s like a financial safety net that helps you weather unexpected storms and pursue your dreams. Whether it’s for your child’s education, buying a home, or securing your retirement, saving is the key to achieving these goals. Plus, it offers peace of mind and financial stability, empowering you to face life’s challenges head-on. Furthermore, saving ensures a comfortable retirement, allowing you to maintain your lifestyle and enjoy your golden years.

Top 10 techniques to save money from salary

Now that we have seen the importance of saving, let us now focus on the tips and techniques that can help in saving money from the salary.

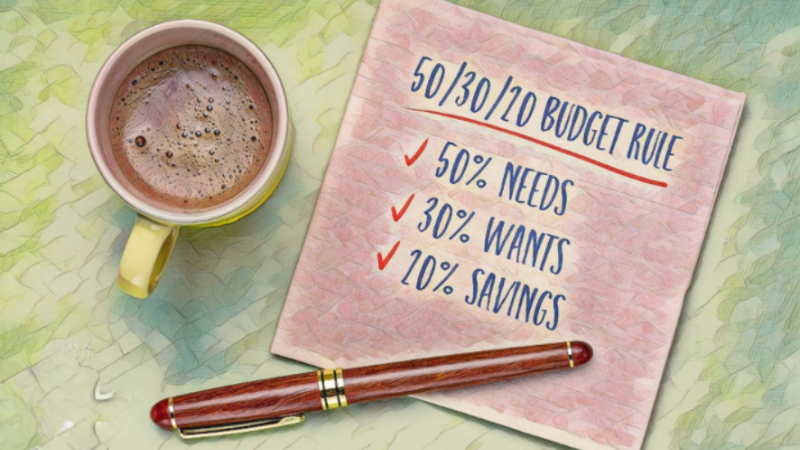

Technique to save money from salary #1 Creating a budget

Developing a budget is like creating a financial roadmap for your life. It involves meticulously listing your monthly income and expenses. By doing this, you gain a clear understanding of where your money is being spent, making it easier to allocate a portion of your salary toward savings. Budgeting also helps you identify areas where you can cut unnecessary expenses and redirect those funds into your savings account.

Technique to save money from salary #2 Automate your investments

Automating your investments is like putting your finances on autopilot. You can arrange with your bank to transfer a predetermined amount of your salary directly into your savings or investments like mutual fund sips, investment into direct equity or anyother investment as per your risk appetite each month. This hands-off approach ensures that you save before the temptation to spend arises. It’s a reliable method to make savings a consistent habit.

Technique to save money from salary #3 Avoid unnecessary expenses

Cutting down on frivolous spending is a crucial step in saving money effectively. This may involve reducing dining out, curbing impulse purchases, online shopping, or reconsidering subscription services. By being mindful of your expenses and eliminating unnecessary ones, you free up more of your salary for saving, helping you reach your financial goals faster.

Technique to save money from salary #4 Optimise the use of utilities to reduce bills

Optimizing utility usage is not only environmentally friendly but also cost-effective. Simple actions like using energy-efficient appliances, turning off lights when not needed, and exploring options for public transport or carpooling can substantially reduce your monthly bills. The money saved on utilities can be redirected towards your savings.

Technique to save money from salary #5 Practice the 24-hr rule

If you are an impulsive spender, start waiting for a 24-hr period before making impulsive non-essential purchases. Many a times you will find that you may find that you no more are interested in the purchase. This can be a great technique to save some money.

Technique to save money from salary #6 Optimise the use of cashback sites and promotional offers

In today’s digital age, many online platforms offer cashback rewards and promotional discounts. When making purchases, whether online or in physical stores, consider leveraging these opportunities. It’s a smart way to get more value from your spending and increase your savings over time.

Technique to save money from salary #7 Track your expenses and prioritise them

Keeping a detailed record of your expenses allows you to analyze your spending patterns. By categorizing and prioritizing expenses, you can ensure that essential costs like rent, groceries, utilities, education and medical expenses are covered first. Once these are accounted for, you can allocate the remaining funds toward savings, ensuring a balanced financial strategy.

Technique to save money from salary #8 Create your emergency fund and a sinking fund

An emergency fund acts as a financial safety net. It’s a dedicated account where you save money to cover unexpected and urgent expenses like medical bills or home repairs. On the other hand, a sinking fund helps you prepare for planned expenses, such as vacations or home improvements. Both funds prevent you from dipping into your regular savings and provide peace of mind.

Technique to save money from salary #9 Reduce your debt

High-interest debt can be a significant drain on your finances. By actively working to pay off loans and credit card balances with high-interest rates, you can reduce the burden of debt EMIs and free up more of your salary for saving. This discipline can also save you from falling into a debt trap which puts a deep strain on your finances. Prepaying your loan can be an another option you can think of.

Technique to save money from salary #10 Create passive income avenues

Building passive income streams is like planting financial seeds that grow over time. This could involve creating streams of income like dividends from investing in stocks, mutual funds, or rentals from investing in real estate,etc. These investments have the potential to generate additional income beyond your salary, boosting your savings and helping you achieve your financial aspirations more quickly.

Conclusion

Salary is the backbone of the financial freedom of the salaried class. However, there are many who are not able to have sufficient savings per month and also tend to live paycheck to paycheck. This issue can be resolved through careful planning and understanding your individual needs. And eventually, you will achieve your goals of effective financial planning.