Hot Stuff: Promoters & operators of Sadhna Broadcast Ltd and Sharpline Broadcast Limited have been accused of a pump and dump case.

Going by the definition, Investopedia explains: A pump and dump scam is the illegal act of an investor or group of investors promoting a stock they hold and selling once the stock price has risen following the surge in interest because of their endorsement.

So, what has exactly happened in case of Sadhna Broadcast Ltd and Sharpline Broadcast Limited?

A. Both these companies spread misleading information about the stock through YouTube channels.

Below are some of the relevant statements and recommendations made by the YouTube Channel that attracted retail investors to invest in these stocks:

- Sadhna Broadcast Ltd has 5G license. SBL is going to be taken over by Adani group. The margins of the company will increase after the deal.

- The company has a 5G license. SBL is going to be taken over by the Adani group. The margins of the company will increase after the deal.

- The company is moving from TV production to movie production.

- A giant American corporation has entered a contract for Rs. 1,100 crores to produce four devotional movies. The American investor will bring in the money, but the rights will remain with SBL.

- Big Mutual funds have already bought the stock.

- The promoter shareholding has been increasing.

- The technical indicators like Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) suggest that the company’s price is very bullish, and the target price is INR 76 in three months and INR 340 in one year.

- The company is debt free; the fundamentals of the company are strong, and the net profit of the company has increased substantially.

B. Promoters bought the shares before the misleading information got disclosed in the public and sold it when retail investors started investing it in the same stocks.

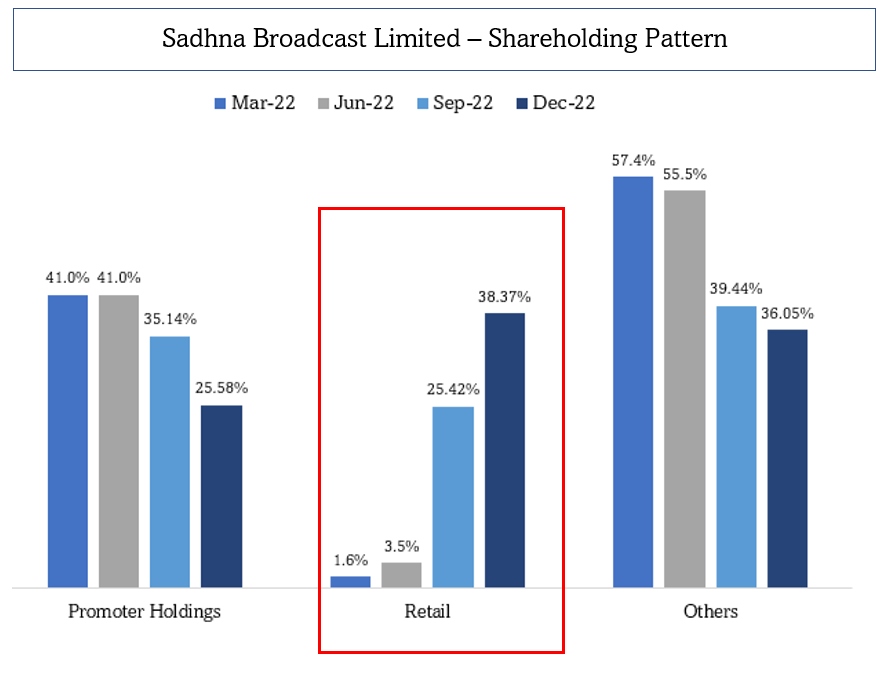

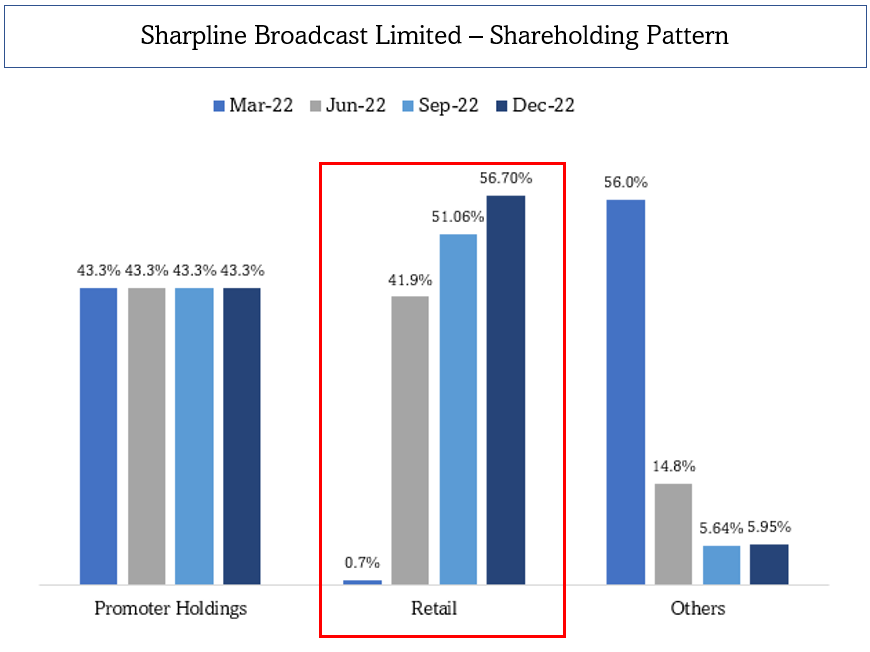

Source: Tickertape, Fisdom research

Source: Tickertape, Fisdom research

- The volume in shares appears to have been contributed by many retail investors, likely influenced by the misleading YouTube videos.

- During the same period, certain promoter shareholders, key management personnel of Sadhna and Sharpline, and non-promoter shareholders who held more than 1% of the shareholding in Sadhna and Sharpline offloaded their holdings significantly at inflated prices and booked profits.

C. Promoters made money; retail investors lost money.

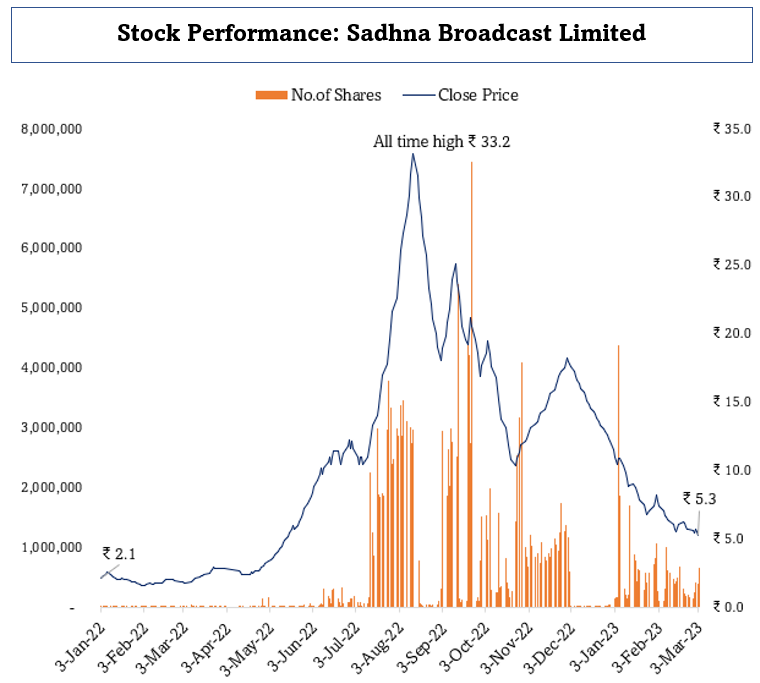

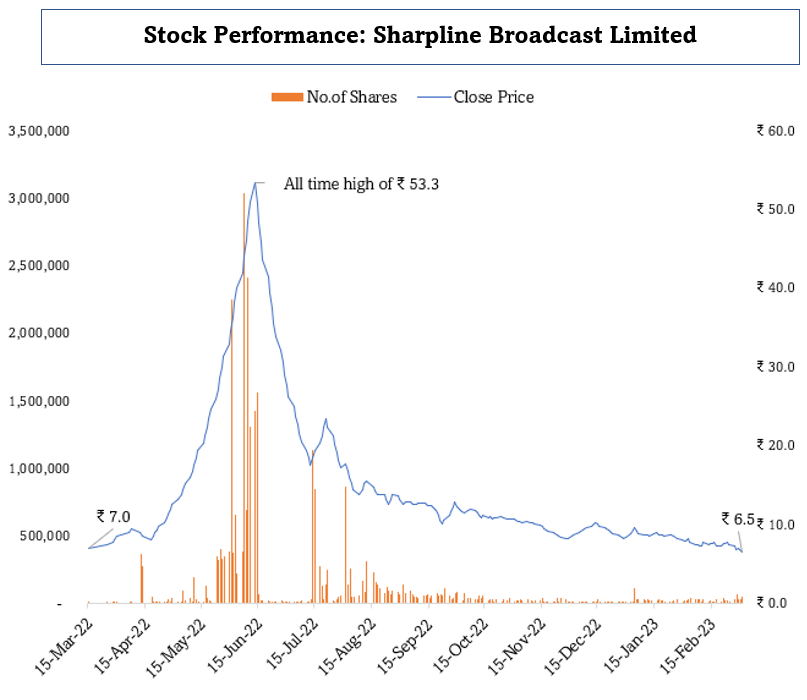

Source: BSE India, Fisdom research. Sadhna Broadcast Limited share price adjusted for stock split

Source: BSE India, Fisdom research. Sadhna Broadcast Limited share price adjusted for stock split

| Date | Sadhna Broadcast Limited |

| 01 Jan’22 | Rs. 2.1 per share |

| 12 Aug’22 | Rs. 33.2 per share |

| 03 Mar’23 | Rs. 5.3 per share |

| Date | Sharpline Broadcast Limited |

| 15 Mar’22 | Rs. 7.0 per share |

| 13 June’22 | Rs. 53.3 per share |

| 03 Mar’23 | Rs. 6.5 per share |

SEBI has sent the notices to everyone who was involved in these manipulation case. Refer to the detailed SEBI interim ex parte order here

Key learnings for investors:

- Don’t rely on the advice shared on Youtube or any other social media platform.

Instead, one should always consult or seek advice from the SEBI registered investment advisor & who are complied with the SEBI regulation. Fisdom is one of them. - If you don’t understand anything or need more clarity, ask for it before investing. It is a job of an advisor to help you with the necessary information.

- It is ok to use social media platforms to get the information, but final investment decisions should be made after doing research on the same. If you are not well equipped with the information, please consult your advisor always. Just to share an example from the current instance:

|

We at Fisdom are more than glad to help you with all the assistance that you may require. Please write to us at research@fisdom.com for any investment-related queries.

Markets this week

| 27th February 2023 (Open) | 03rd March 2023 (Close) | %Change | |

| Nifty 50 | 17,429 | 17,594 | 1.0% |

| Sensex | 59,331 | 59,809 | 0.8% |

Source: BSE and NSE

- Markets witnessed volatility and ended on a positive note.

- Mixed cues from global peers, better macro-economic data and reports of foreign investment in Adani stocks were the key positive triggers during the week.

- On the sectoral front, Nifty PSU Bank gained 9 percent, Metal index 6.6 percent, Realty 6 percent and Media index up 5.2 percent. On the other hand, Pharma index shed 1 percent.

- Foreign institutional investors (FIIs) continued the selling in this week, as they sold equities worth Rs 6,010.44 crore, however, domestic institutional investors (DIIs) bought equities worth Rs 6,010.44 crore.

- Going forward, Indian equities are likely to take cues from global trends as investors weigh comments around the Federal Reserve policy and interest rate trajectory.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Adani Enterprises | ▲ +42.86% | Cipla | ▼ -8.75% |

| Adani Ports and SEZ | ▲ +22.50% | Infosys | ▼ -4.60% |

| SBI | ▲ +7.71% | UPL | ▼ -3.83% |

| IndusInd Bank | ▲ +4.38% | Bajaj Auto | ▼ -3.06% |

| ICICI Bank | ▲ +3.44% | Tech Mahindra | ▼ -3.03% |

Source: BSE

Stocks that made the news this week:

?All Adani group companies saw a sharp spike in share prices after an investment of Rs 15,446 crore by GQG Partners lifted sentiments. Adani Enterprises was the top index gainer, surging over 16 percent. Apart from GQG Partners’ investment, Adani Green Energy shares were also in focus as the company’s operating renewable portfolio reached 8,024 MW. This is the largest in India.

?Morgan Stanley gave an Outperform rating to GAIL India with a target price of Rs 124. Morgan Stanley’s optimistic stance stems from the Petroleum and Natural Gas Regulatory Board’s proposal to increase tariffs for the unified pipeline by 41 percent. If approved, the price hike is expected to result in a 25 percent increase in transmission revenue.

?Automotive components maker Divgi TorqTransfer Systems closed its IPO on March 3, with bids received for 2.08 crore equity shares against the offer size of 38.41 lakh. IPO, was subscribed 5.44 times, generated a lot of interest among qualified institutional buyers who bought 7.83 times their quota of shares. The company is going to utilise the proceeds from the fresh issue to buy equipment and for general corporate purposes.