Portfolio Outline

Historically, an incumbent party win tends to offer investors a sense of continuity and stability. The markets may respond positively, anticipating policies in line with the prevailing economic trajectory.

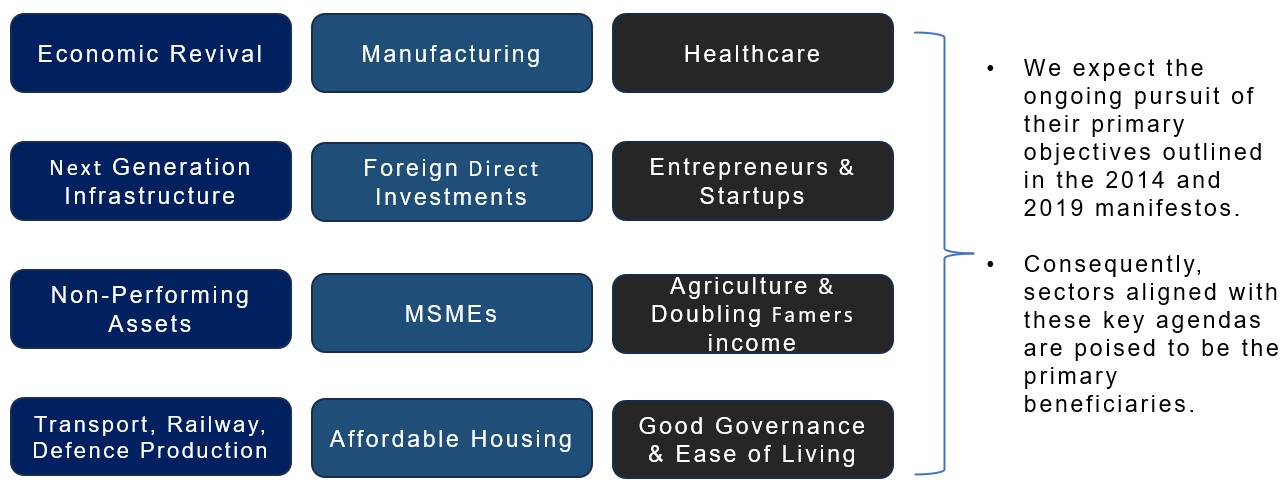

Our assessment suggests a high likelihood of a comfortable majority for the BJP-led government, consistent with opinion polls from India Today-CVOTER and India TV-CNX, pointing towards a favourable outcome for the BJP. Given our assumption that the BJP is likely to secure power, we anticipate a continuation of their key broad agendas outlined in the Manifestos of 2014 and 2019.

Key Priorities of the Current BJP Led Government (Since 2014 -2023)

Sectoral Winners (2014-2023)

| BSE Indices | Returns (%) | Index Growth Since May 2014 | |

| May 2014 – 22 Dec 2023 | |||

| 1 | Consumer Durables | 23.3 | 7.5x |

| 2 | Industrials | 18.4 | 5.1x |

| 3 | Capital Goods | 16.8 | 4.5x |

| 4 | Consumer Discretionary Goods& Services | 16.5 | 4.4x |

| 5 | RealtyIndex | 16.4 | 4.3x |

| 6 | Information Technology | 15.8 | 4.1x |

| 7 | Energy | 15.5 | 4.0x |

| 8 | BasicMaterial | 15.1 | 3.9x |

| 9 | BANKEX | 14.3 | 3.6x |

| 10 | Utilities | 13.5 | 3.4x |

| 11 | Power | 13.4 | 3.4x |

| 12 | Auto | 12.2 | 3.0x |

| 13 | Fast Moving Consumer Goods | 11.8 | 2.9x |

| 14 | HealthCare | 11.5 | 2.9x |

| 15 | Oil & Gas | 9.3 | 2.3x |

| 16 | Telecom | 5.9 | 1.8x |

| 17 | Nifty 50 | 12.7 | 3.2x |

| 18 | Sensex | 12.7 | 3.2x |

Source: ACE MF, Fisdom Research

Stock Picks

| Stock Name | Sector | 1st Target | 2nd Target | Support | |

| 1 | Tata Consumer Products Ltd. | FMCG | 1,100 | 1,150 | 850-825 |

| 2 | State Bank of India Ltd. | Banking & Finance | 725 | 750 | 550-525 |

| 3 | Tata Steel Ltd. | Metals & Mining | 155 | 170 | 115-110 |

| 4 | PNB Housing Finance Ltd. | Housing Finance | 1,000 | 1,150 | 575-550 |

| 5 | Tata Power Ltd. | Utilities | 380 | 410 | 280-260 |

| 6 | Ambuja Cements Ltd. | Cement & Construction | 600 | 650 | 400-380 |

| 7 | IRCTC Ltd. | Consumer Services | 1,000 | 1,100 | 700-675 |

| 8 | Can Fin Homes Ltd | Finance – Housing | 870 | 900 | 650-630 |

| 9 | Larsen & Toubro Ltd. | Engineering & Construction | 3,900 | 4,050 | 2,850-2,800 |

| 10 | L&T Finance Holdings Ltd. | Finance – NBFC | 180 | 200 | 115-110 |

| 11 | Adani Ports Ltd. | Transport Infrastructure | 1,150 | 1,200 | 825-800 |

1. Tata Consumer Products Ltd.

Navigating success through robust financials, sales expansion, and subsidiary amalgamation for synergies

- TATA CONSUMER surged from 700 to 1000, delivering a 30% return in 12 months. After consolidating for 24 months, it broke out from a bullish rectangle pattern on the monthly chart, indicating a continuation pattern.

- The RSI (14) shows an inverted head and shoulder pattern breakout, moving above 60 with a potential bullish crossover. Prices are above the 21, 50, and 100-month EMAs, and various indicators signal a bullish trend.

- Strong support is at 850 – 825 levels, with potential targets at 1,100 and 1,150, driven by the breakout and expected upward momentum.

Fundamental Rationale:

- The company’s total income marked a noteworthy surge of 12.71% to Rs 3823.61 crore, propelled by an 11.02% rise in revenue from operations to Rs 3733.78 crore and a three-fold jump in other income to Rs 89.83 crore during Q2FY24. It is largely fueled by robust international business growth.

- The company has achieved significant milestones in its Sales and distribution expansion, extending its total reach to 3.8 million outlets as of September ’23. Simultaneously, they have enhanced throughput in larger towns through targeted initiatives. Additionally, they are fortifying their distribution networks in rural and semi-urban areas. Their strong growth momentum persists in alternative channels such as modern trade and e-commerce, crucial components of their growth and innovation agenda.

- The company has unveiled plans for the amalgamation of its wholly-owned subsidiaries—NourishCo, Tata Consumer Soulfull, and Tata SmartFoodz—into the parent entity. This strategic move is expected to yield synergies, particularly in the backend operations, and presents opportunities for direct and indirect tax synergies.

- We believe that the perspective that the company is undergoing a transformative journey towards establishing itself as a leading FMCG entity. The expansion of its distribution network and a digital emphasis throughout the supply chain are poised to propel the company into the next phase of growth.

2. State Bank of India Ltd.

Strong profits, improved asset quality, and digital transformation drive a positive outlook

- SBIN has recently experienced a breakout on the monthly chart, accompanied by substantial volumes, forming an ascending triangle pattern. This suggests a potential continuation of the previous uptrend.

- The RSI (14) exhibits a bullish range shift on the monthly chart, and the MACD consistently remains above its polarity line. Prices are currently trading above the 21 and 50-period EMAs, providing support.

- Key support levels are identified at 550 – 525, and there’s an anticipation of potential upside targets around 725 and 750 based on the breakout.

Fundamental Rationale:

- SBI has unveiled its Q2 consolidated net profit, witnessing a robust 9.09% increase to Rs 16,383.18 crore, aligning with market expectations. The bank’s total income surged by 25.68% to Rs 1,44,256.12 crore for Q2FY24, reflecting its steady financial performance.

- Key financial indicators showcase a positive trajectory, with interest income growing by 26.95% to Rs 1,01,379 crore and net interest income increasing by 12.27% to Rs 39,500 crore in Q2FY24.

- SBI’s asset quality demonstrated improvement, evident in the decline of gross non-performing assets (GNPA) to 2.55% and net non-performing assets (NNPA) ratio to 0.64% in Q2FY24. Furthermore, the Capital Adequacy Ratio (CAR) strengthened by 77 bps year on year, reaching 14.28%.

- Anticipated growth in profits, supported by a strong loan portfolio with a focus on digital transformation, is set to boost the bank’s overall financial health. Efforts to minimize loan defaults and improve the quality of assets demonstrate a commitment to financial strength. In light of this positive outlook, we recommend buying the stock, expressing our confidence in its future potential.

3. Tata Steel Ltd.

Navigating challenges, embracing sustainability & positioning for long-term growth in India’s steel sector

- TATA STEEL recently experienced a breakout on the monthly chart, accompanied by a notable increase in trading volumes. The breakout is characterized by a symmetrical triangle pattern, and the stock’s prices have successfully maintained their position above the upper boundary of this pattern. This indicates a likely extension of the previous upward trend after a brief consolidation phase.

- Various indicators and oscillators for the stock are aligning, suggesting an attractive “buy-on-dips” opportunity. These metrics consistently register above the polarity levels, reinforcing the prevailing bullish sentiment.

- Key support levels are identified at 115 – 110, and potential upside targets are around 155 and 170 based on the breakout.

Fundamental Rationale:

- Tata Steel’s Q2FY24 results reflect a challenging period marked by a net loss of Rs 6,511.16 crore due to European operations’ weakness.

- However, key factors for investment consideration include the strategic focus on sustainability, commitment to Net Zero by 2045, and investment plans in the UK for a state-of-the-art scrap-based EAF.

- Additionally, ongoing initiatives for responsible growth, cost optimization, and the Kalinganagar expansion indicate a long-term commitment to operational efficiency. It’s important to note that the stock may attract attention for its potential turnaround and focus on sustainability in the steel industry.

- Overall, the company stands as a linchpin in India’s thriving steel sector, poised to leverage the sector’s ongoing growth in CY23 and beyond. Its adept financial performance, strategic capex timing, and skilful debt management position the company for continued success

- It’s savvy backward integration approach proves invaluable in navigating challenges posed by persistent raw material price fluctuations. In essence, Tata Steel’s solid strategy and performance make it a compelling investment choice for both seasoned analysts and everyday investors.