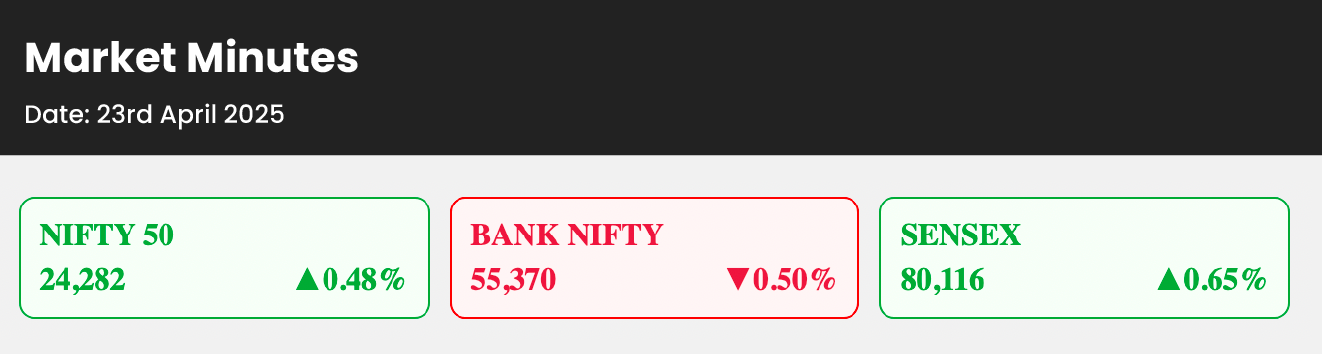

Market Snapshot

- Indian benchmark indices closed higher for the seventh straight session on April 23, amid a volatile trading day.

- Gains were led by strong performance in Information Technology, Pharma, and Auto sectors.

- U.S. markets rebounded on Tuesday, recovering from the previous session’s selloff, as investor focus shifted to corporate earnings.

- The U.S. dollar strengthened after Treasury Secretary Scott Bessent indicated in a closed-door meeting that U.S.-China trade tensions may de-escalate.

- European markets were trading higher, while Asian markets ended positively.

- Market sentiment was supported by President Trump’s assurance that he has no intention of firing the Federal Reserve Chair and his suggestion of potentially lower tariffs for China.

Sectoral Trends

| Sector Name | % Change | Sector Name | % Change |

| NIFTY IT | 4.3 | NIFTY REALTY | 1.3 |

| NIFTY AUTO | 2.4 | NIFTY METAL | 0.8 |

| NIFTY PHARMA | 1.4 | NIFTY FMCG | 0.5 |

| NIFTY HEALTHCARE INDEX | 1.3 | NIFTY OIL & GAS | 0.1 |

Top News

- Lupin Ltd. gained 2.5% after launching Tolvaptan tablets in the U.S., a key addition to its generics portfolio, targeting the treatment of autosomal dominant polycystic kidney disease (ADPKD).

- Havells India reported strong Q4 earnings with a 16% YoY profit rise, but its stock declined due to cautious management commentary on cooling product demand amid a delayed summer.

- IT stocks surged, with the Nifty IT index up over 4%, following U.S. President Trump’s comments on significantly reducing China tariffs, easing trade war concerns and recession fears.

Top Gainers and Losers

| Top Gainers | % Change | Top Losers | % Change |

| HCLTECH | 7.7 | HDFCBANK | -2.1 |

| TECHM | 4.8 | KOTAKBANK | -2.1 |

| TATAMOTORS | 4.4 | GRASIM | -2.0 |

Trade Ideas Update

- Our trade ideas success rate has 74% over the past month, even with increased volatility in the benchmark index. Follow Trade Ideas for timely stock insights.

Please visit www.fisdom.com for a standard disclaimer