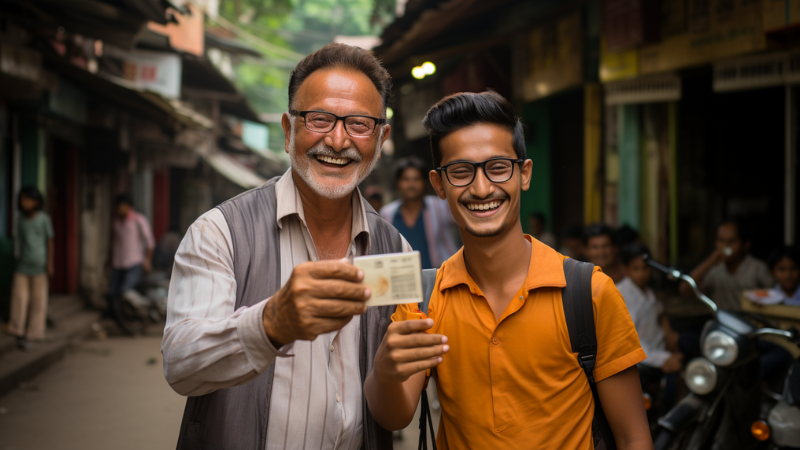

If you have an Aadhaar card, you may have come across aggressive campaigning from the government, urging individuals to link Aadhar with PAN. The deadline for linking Aadhaar-PAN is fast approaching on June 30, 2023. Every tax assessee must therefore ensure that they link their Aadhaar card to the PAN card online.

Read More – How to Link Aadhaar with PAN Card Online & Offline?

Here, we will discuss the consequences of not linking Aadhaar to PAN and also highlight the benefits of doing so.

What are PAN and Aadhaar?

PAN or Permanent Account Number is a unique tax identification number that is issued to individual taxpayers by the country’s Income Tax Department. It is an essential document for filing income tax returns and also for carrying out other activities such as opening a bank account, investing in a property, purchasing jewelry, borrowing a loan, opening a Demat account, etc.

Aadhaar card was introduced by the UIDAI a few years ago in an attempt to give a unique identity card/number to every Indian citizen. Since it involves biometrics, it is considered a more secured personal identification document.

What happens if you do not link your Aadhaar and PAN?

If you fail to do pan card Aadhar card link within the due date, you may have to face the below-mentioned consequences:

- PAN becomes inoperative

If an individual does not link PAN to Aadhaar within the due date, his/her PAN will become inoperative. Once PAN becomes inoperative, it will not be possible to furnish, intimate, or quote the PAN number anywhere. This may further result in:

- Higher tax rate applied for income tax purposes

- Higher TDS collection

- Inability to file income tax returns, which can further attract interest, penalty and even prosecution as a result of not furnishing details of income generated

- Penalty for not quoting PAN during certain financial transactions

- PAN-Aadhaar interchangeability is not allowed

If Aadhaar is linked to an individual’s PAN, the Income-tax act allows the interchangeability of both. This means a person can quote either Aadhaar or PAN where needed. However, if these are not linked, the interchangeability of these numbers will not be permitted.

Additionally, since PAN will become inoperative in the case of non-linking to Aadhaar, an individual will not be able to quote Aadhaar in lieu of PAN or vice versa.

- Penalty under Section 234H

- In case an individual fails to link Aadhaar to PAN by the due date, he/she will be held liable for charges of up to Rs. 1,000 for while requesting for linking of PAN with Aadhaar.

- A penalty of Rs. 10,000 will be applicable for non-filing of returns of income.

What are the benefits of linking Aadhaar and PAN?

How does it benefit the government?

The economy sees constant churning of black money due to missing audit trails. With the PAN-Aadhaar linking, it is easier for the government to retain audit trails of transactions. Since the Aadhaar card is essential for most transactions these days, linking it to PAN allows the IT department to see a complete activity trail and easily identify revenue leakages.

Since Aadhaar card has covered a larger population as compared to PAN cards, the linking will ensure that more people get covered under the tax net and the government can discourage tax evasion.

Individuals who may have multiple Aadhaar or PAN cards for tax evasion purposes will be discouraged by the process of Aadhaar-PAN linking.

How does it benefit the taxpayer?

Honest taxpayers across the country who had been paying their taxes diligently while others got away without tax burden can expect a fair tax treatment with Aadhaar-PAN linking. With this, the IT department will be able to spread its tax net wider and, in turn, pass on the benefits to honest taxpayers by lowering tax rates.

Aadhaar-PAN linking will also benefit the process of IT returns filing as it will eliminate the complicated activities of sending ITR receipts to the IT department. With Aadhaar e-verification, e-signatures will also not be required for IT returns.

After linking Aadhaar and PAN, taxpayers will also be able to get a snapshot view of all their IT transactions using their login details on the IT website.

How to link Aadhaar to PAN?

Follow these steps for your aadhar pan card link:

- Check that your Aadhaar and PAN details match and are up-to-date

- Visit the e-filing portal of the Income Tax Department of India (https://incometaxindiaefiling.gov.in/)

- Login using your PAN or register if you don’t have an account

- Go to “Profile Settings” and click on “Link Aadhaar”

- Enter your Aadhaar number and your name as it appears on your Aadhaar card

- Verify the details with an OTP sent to your registered mobile number

- If details match, the linking process is completed successfully.

Aadhaar-PAN linking can also be done via SMS, by sending an SMS to 567678 or 56161 in the format UIDPAN<SPACE>12-digit Aadhaar number<SPACE>10-digit PAN number.

Who is exempted from Aadhaar and PAN Linkage?

Following individuals are exempt from linking Aadhaar-PAN linkage:

- Residents of the states of Assam, Jammu and Kashmir, and Meghalaya;

- non-residents as per the I-T Act, 1961;

- persons aged 80 and above at any time during the previous year; and

- those who are not citizens of India.

Latest Govt deadline for Aadhaar PAN Linking

The deadline for Aadhaar and PAN linking is 30 June 2023 as per an announcement by the Government of India.

Conclusion

The Income-tax Act has made it mandatory for individuals who have PAN and are eligible for Aadhaar number to provide the Aadhaar number to the Income-tax Department. Failure to do so will result in the PAN card of the individual turning inoperative post the due date. The last date for linking PAN with Aadhaar is 30-06-2023. The above-mentioned consequences will be applicable in case one misses this deadline.

FAQs

Yes, you can still link your PAN and Aadhaar even if you miss the due date of June 30, 2023. However, your PAN card will become inoperative if you miss the due date. It can be made operational only after linking it with the Aadhaar number. The penalty for linking PAN-Aadhaar after the due date is Rs 1,000.

One can easily link PAN with Aadhaar using the Income Tax department’s website. After registering on the website, one can login using PAN number and password. There, one can follow the steps to link PAN with Aadhaar.

Residents of the states of Assam, Jammu and Kashmir and Meghalaya, also non-residents and individuals over 80 years of age, are exempted from linking PAN and Aadhaar.

Linking PAN with Aadhaar does not require submission of any documentary proof. It is a very simple process which can be done by entering the PAN and Aadhaar numbers on the IT website using a relevant link.

If your name on the Aadhaar Card is different from the name on the PAN card, you must initiate a name change process for either of the documents before linking them.