Investing is an act of faith.

Might some unforeseeable economic shock such as now can trigger another recession so severe that it would destroy our faith in the promise of investing? Excessive confidence in smooth seas can blind us to the risk of storms. There is little certainty in investing. As long term investor, however, we cannot afford to let the short term events frighten us away from the markets. For without risk there is no return. Another word for “risk” is “chance”. Here’s a dialogue by Chance, The Gardener that stuck.

As uncanny as it may seem, the word “chance” struck a chord that reminded me of ‘Chance, The Gardener’. For the ones who have never had the fortune to read this gem of book, ‘Being There’ by Jerzy Kosinski or watch the movie based on it, the plot revolves around a rather simple man – Chance, the gardener whose knowledge about the world is defined by what he has watched on TV and everything he has observed while tending to his garden. By twists of fate, he reaches a situation where he has high-ranking state officials seeking advise from him and interpret his simple words as a metaphor about the economy.

Back to the scene that stuck with me for long – When asked about the stressed state of economy, he said – “In a garden, growth has its season. There are spring and summer, but there is also fall and winter. And then spring and summer again. As long as the roots are strong, all is well and all will be well”.

Well, when you look at markets, economies (and also gardens), you would appreciate the simple yet profound truthfulness of the statement.

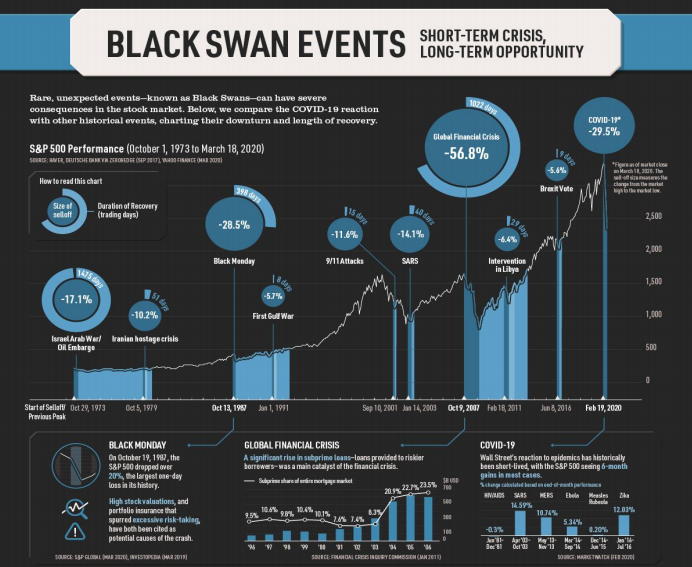

In an attempt to draw a parallel, I started rummaging through the internet ocean and found a beautiful illustration (Courtesy: Visual Capitalist) that clearly reflects that as long as the world economy is healthy, financial crises may come and go, but the economy will only bounce back stronger – offering a much larger opportunity each time.

Perhaps, the fact that the global economy has gone through a longer period in economic crises than uninterrupted growth. However, like Chance put it right, economies and markets only continued to push upwards with periods of crises seeming like nothing more than simple seasonality in hindsight.

I remember reading about at least ten black swan events where the S&P 500 declined by a quantum of anywhere between -5% to -60% only in the past fifty years. Events include the Oil Embargo ’73, Iranian Hostage Crises ’79, Black Monday ’87, Gulf War ’91, 9/11 Attacks ’01, SARS ’03, Sub-Prime Crisis ’08, Intervention in Libya ’11, Brexit ’16, and Pandemic’19. However, it is interesting to note that $100 invested in 1973 in S&P 500 is worth almost $3,000 today – which seems pretty healthy considering the number of financial crises we just recounted.

As an investor, you may choose to focus on the periods where people lost money and redeem with a higher probability of converting notional losses into real losses, or ride the tide only to emerge victorious as the world pushes ahead towards progress.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3fJjPrh||target:%20_blank|” button_position=”button-center”]