Hot Stuff this week: IPO frenzy in full swing

November saw a flurry of IPOs wherein at least nine companies across sectors have mobilized funds close to Rs. 10,350 crores. Some more IPOs expected by the end of the calendar year-end 2022.

Below is a list of IPOs that has got listed in November 2022:

Selection continued to be crucial as seven of nine IPOs launched in November were listed on premium. And four of them are listed at a premium of more than 10%. The key differentiator for these four IPOs was the QIB participation, which was 40 times more.

There are multiple reasons behind the stellar performance of IPOs; let’s have a look at a few of them below:

1. Indian equities stand tall & strong:

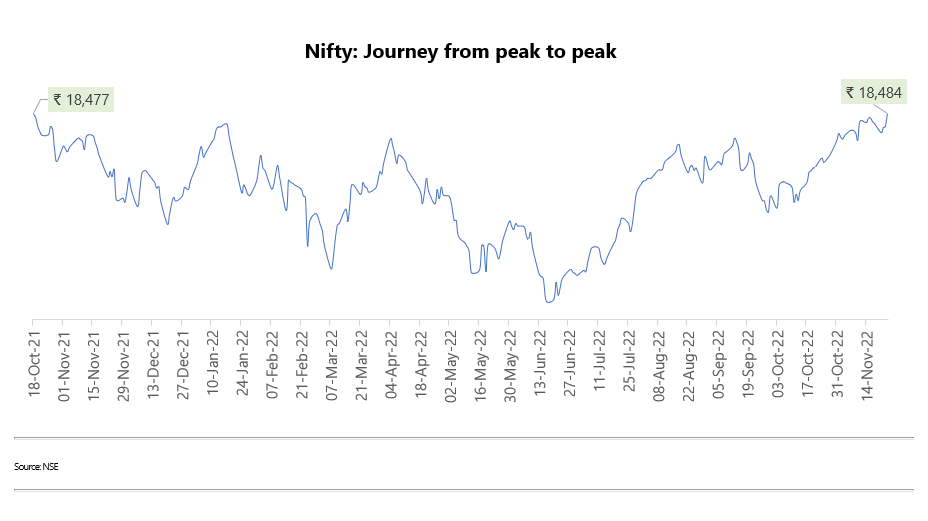

Indian markets have exhibited remarkable resilience & outperformed most of the AE pack in 2022. Strong macro fundamentals, proactive monetary & fiscal support and strong corporate balance sheets were a few key reasons behind the resilience of the Indian benchmark indices. We saw the same thing happening in H2CY2022. All the market cap indices showed remarkable strength and regained from a correction till June’22, especially the midcap & small cap categories. Even the critical benchmark indices, Nifty & Sensex, touched a new all-time high this month.

All of these have helped resume interest in the IPO market with some recovery in the performance of IPO stocks.

2. Comeback from FPIs:

FPIs have withdrawn Rs. 2 lakh crores from Jan to June 2022, mainly because of interest rate hikes undertaken by central banks globally. But we see a reversal in the trend from the last three months.

Even So far in November till date, they have pumped Rs. 27,400 crores into the Indian equity market. The first 15 days of November 2022 is the second-best stretch of FPI inflows. Massive participation from QIB & anchor segment shows the interest of FPIs towards IPOs. The favourable flow into IPOs primarily neutralises the outflows from secondary market equities.

3. Increasing retail participation & improving macro sentiment:

Average monthly Demat account openings have reached 3 million. It reflects retail investors’ confidence and enthusiasm towards Indian equity markets. The milestone SIP flow of Rs.13,000 crore in October’22 reflects the same.

Little dovish commentaries by US central bank, a fall in oil prices, a fall in the dollar index & India’s strong macro positioning vis other countries helped keep sentiments positive.

Key Takeaways:

IPO markets are a mix of hits and misses. Understanding the business and market sentiment at the time of listing is paramount to making the most of fresh listings. The definitive decision of holding/exiting the stock has the potential to print your portfolio returns.

General trend dictates that most investors exit immediately after listing, thus missing on follow-on gains. Studying IPO listing patterns since 2017, most IPO participants have missed out on 30% gains vis-à-vis qualified buyers. India’s already vibrant equity market will only get more lucrative from this point onwards.

Here’s what Anand Dalmia (Co-founder & Chief Business Officer of Fisdom) said on “which are the three golden rules that beginners must follow” during his interview with the economic times:

- Evaluate the business:

Some popular factors applicable to most companies include market share, substitutability of the product/service, and vulnerability to changes in political, regulatory, technological, and any other applicable environment.

- Evaluate the financials

Some broadly analysed financial metrics include revenue growth, profit margins, expenses, and applicable ratios.

- Valuation of the offer

The most popular valuation metrics are Price/Earnings and Price/Sales. Now, the subject of valuation is as much an art as a science.

Read the full interview here:

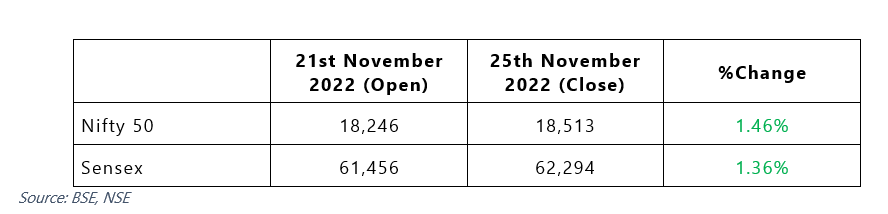

Market This Week

- Markets ended on a positive note.

- Indian benchmark indices hit record high in the week gone by amid positive global sentiments led by US Fed meeting minutes stating slowdown in pace of rate hike goring forward.

- Foreign investors buying, falling US dollar, F&O expiry and stable crude oil prices were some other reasons for investors enthusiasm.

- During the week Nifty Bank also hit an all-time high. Some other sectors which were in demand were Nifty Media, PSU bank, Oil and Gas and IT. Each index closed with a gain of more than 2.5 percent.

- Investors however ignored the fact that tight Covid-19 restriction in China could impact global growth forecast.

Going ahead in next week market participants will be looking at Fed chairman speech and macroeconomic data points that will influence market trajectory.

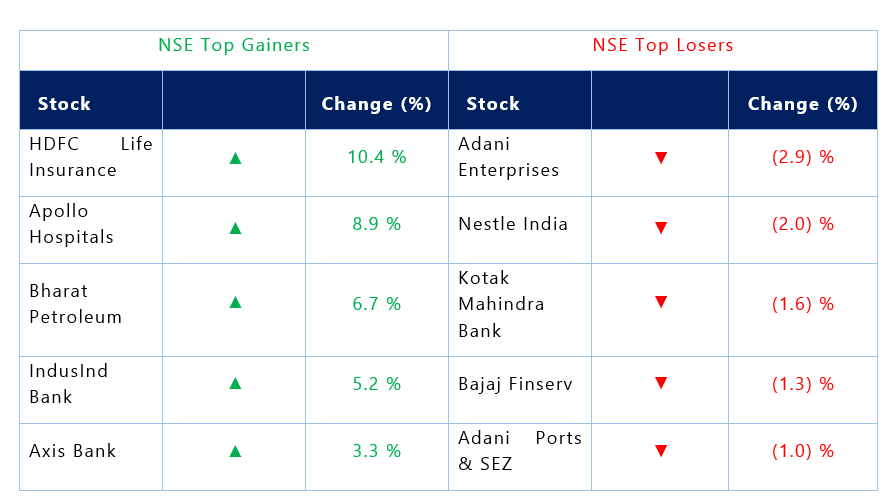

Stocks that made the news this week:

- HDFC Life Insurance remained top gainer for the week as IRDAI approved merger with Exide Life following the announcement of deal in Sep’21. In addition to this IRDAI has permitted banks to tie up with 9 life insurance, general insurance, and health insurance companies instead of a present limit of 3.

- Axis Bank remained among the top gainers as analysts appeared were cheerful of the long-term vision presented by the bank on analyst day meet this week. A key takeaway from the meeting was the Bank’s emphasis on focusing less on growth and more on holding customers with outmost satisfaction in services provided.

- Punjab National Bank hit 52-week high as the bank received approval from Ministry of Finance and DIPAM to divest entire stake in UTI Asset Management Company. The objective behind the stake sale is to book profits on investments.

- PB Fintech gained more than 10 percent during the week as hedge fund Ward Ferry Asian Smaller Companies Fund picked by 1.5 percent stake in the firm. Earlier same fund had bought 50 lakh equity shares and the total shareholding has now reached at 2.6 percent up from 1.32 percent.