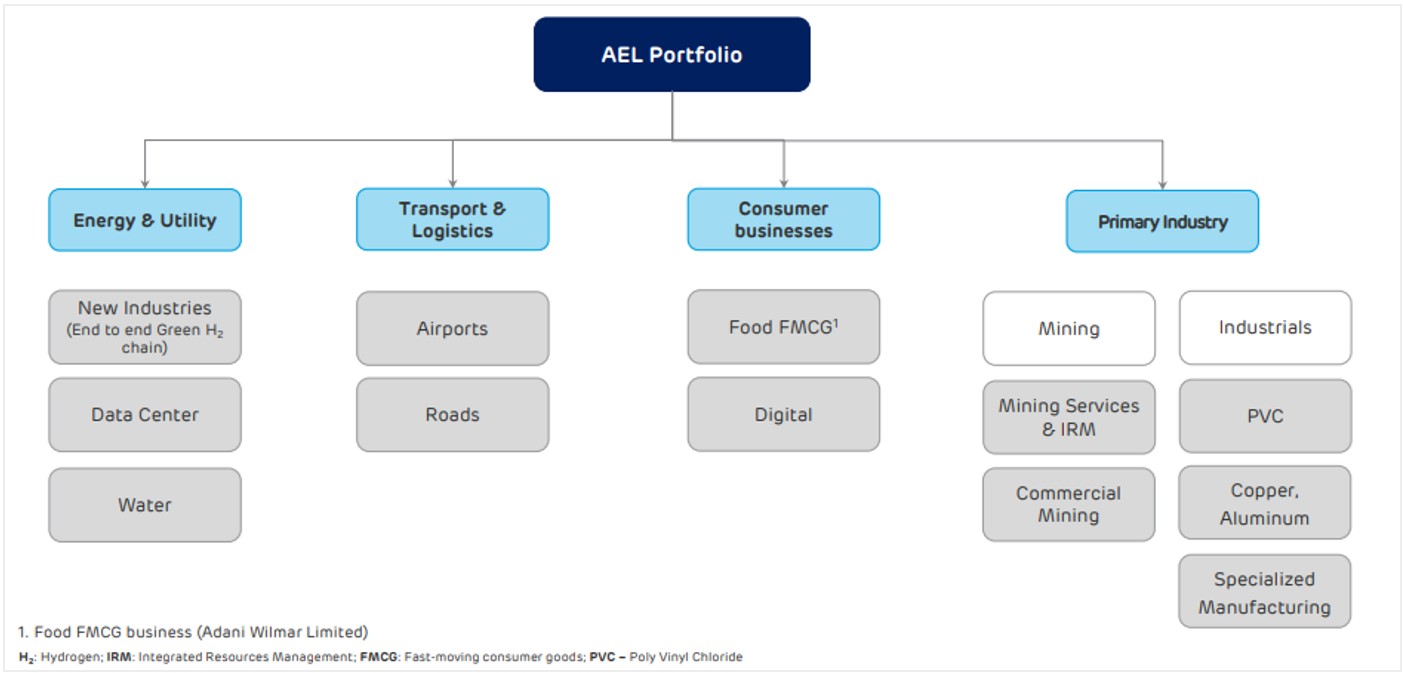

Adani Enterprises Limited (AEL) is the flagship company of the Adani Group, one of India’s most prominent business organizations. Over the years, Adani Enterprises has focused on building stellar infrastructural assets that contribute to nation-building.

How diversified is Adani Enterprises Limited?

Source: AEL Business Presentation for Nov’22

- Energy & Utility: The company is setting up a green hydrogen ecosystem to incubate, build and develop an end-to-end integrated ecosystem to manufacture green hydrogen. They develop data centres to maintain and drive India’s internet-derived data in India & also develop infrastructure projects that improve water treatment and use efficiency.

- Transport & Logistics: They manage significant airports in India as part of their airport business. We currently develop, operate and manage seven operational airports across the cities of Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, Thiruvananthapuram, and one greenfield airport in Navi Mumbai.

- Consumer Business: They manufacture, market, and brand food FMCG products. Additionally, they are developing a super-app, “AdaniOne”, as part of their digital business to complement Adani group’s consumer-serving businesses.

- Primary Industry: They offer mining services involving contract mining, development, production-related services, and other related services to customers, primarily in the coal and iron ore industries. To cater to the high demand for coal in India, the company offers integrated resource management services for coal which involves access to coal from diverse global pockets and provides just-in-time delivery to Indian customers.

They have also recently acquired commercial mines to conduct commercial mining activities. Under industrials, they intend to manufacture petrochemicals, copper and similar metals and manufacture strategic military and defense products that enhance India’s self-reliance.

Why is AEL raising the money?

|

Particulars |

Amount (Rs. In crore) |

Proposed Deployment of the net proceeds |

|

Funding capital expenditure requirements of some of their subsidiaries in relation to:

|

10,869 |

Rs.3,335 crores in fiscal 2023 Rs.7,535crores in fiscal 2024 & 2025 |

|

Repayment, in whole or part, of certain borrowings of the Company and three of their Subsidiaries, namely, Adani Airport Holding Limited, Adani Road Transport Limited, and Mundra Solar Limited |

4,165 |

Rs. 4165 crores in fiscal 2023 |

|

General Corporate Purpose |

– |

– |

|

Total |

20,000 |

– |

What are key opportunities going ahead?

- Green Hydrogen: While India does have opportunity in various industries for carbon capture but has a significant competitive edge in green hydrogen due to the tremendous strides, it has made in renewable energy over the past few years. It, combined with capital, land resources, extensive grid system, makes it an ideal candidate to make a quick transition to green hydrogen.

- Airports: India was the fifth largest aviation market based on airline passengers as of 2019. The country is poised to emerge as the third largest by 2025. It is already the third-largest domestic passenger market and is expected to be among the fastest-growing domestic air passenger markets over the next decade.

- Data Centers: India hosts approximately 164 data centres spread across nine cities. Total installed capacity as of Fiscal 2022 was 550–580 MW and 320-370 MW in Fiscal 2020. With the pandemic-induced challenges, digital transformation became necessary, and the demand for hybrid cloud and colocation models surged. Data usage also increased, creating more need for data storage and transforming the data centre industry to a large and strategically important segment.

- Roads: India has the second largest road network in the world, aggregating 6.4 million km. Roads are the most common mode of transportation and account for about 87% of passenger traffic and close to 63% of freight traffic.

- Water: In India, water use is broadly used for domestic (household purposes) and industrial usage. The water treatment industry comprises fresh and clean water and managing wastewater for commercial/residential customers and industries.

- Copper: Domestic copper demand logged a 1.9% CAGR between Fiscals 2017 and 2022. The share of secondary copper has been rising gradually since 2017 owing to better scrap availability and increasing primary copper prices. Renewable energy as a sub-segment in the overall power segment will significantly determine copper demand over the medium term. Copper is used to making solar modules and electric motors for wind and hydropower generation.

Key Takeaways:

Raising fresh money by issuing fresh equity would reduce the company’s high leverage and increase public shareholding. Except for the current valuation, the current state of business, growth prospects, and financial strength seems close to reasonable. High-risk investors with a long-term horizon seeking a play into infrastructure, industrials & utilities can use the FPO to invest in AEL.