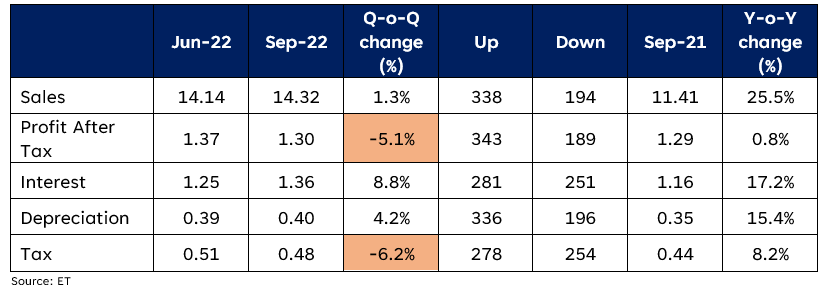

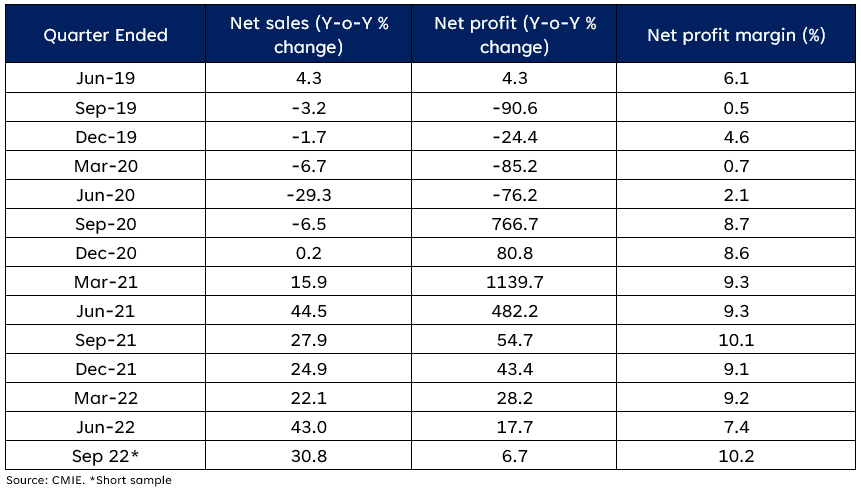

The Q2 earnings season has begun with some hits and misses. We have seen some moderation in profitability compared to Q1FY23. To gain more insights on the earnings front, let us first look at how corporate India has fared so far. Below is a summary of aggregate earnings:

Let’s dive deeper…

While the early bird results show moderation in quarterly profits, margins seem intact as there is no slowdown in the top-line growth.

Hits:

- Banking and Financial Services:

The sector has been the top-performing sector for Q2FY23. It has contributed significantly to the net profits. They have seen a profit growth of 61% YoY; similarly, the combined net profit of finance companies, including asset management, stock broking & insurance companies, went up 13.8% YoY to a record high of Rs.11,800 crores in Q2FY23.

The resumption of economic activity has led to improvement in the asset quality of banks. Quicker pass-through of lending rates compared to deposit rates boosted the banks’ overall profitability. Shrinking deposits will be the critical determinant for the profitability going ahead.

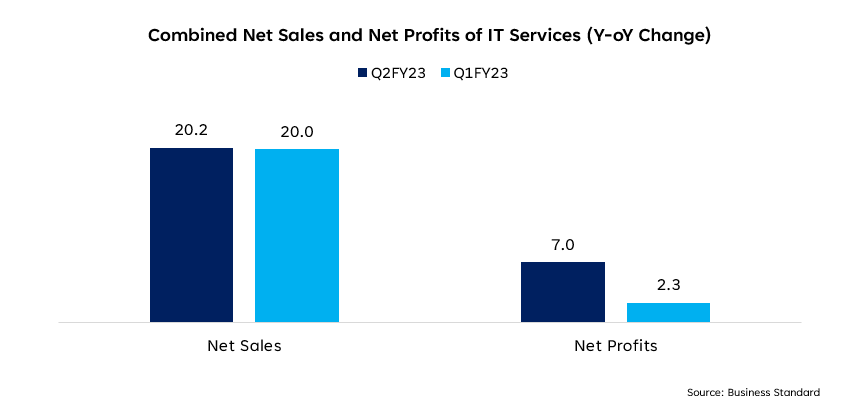

- IT & ITES:

Tata Consultancy Services, HCL Tech, and Infosys, primary IT services exporters, have surprised on the upside. They have seen a Q-o-Q rise in overall operating margins and faster growth in rupee revenues, led by gains from currency depreciation.

Here’s our brief coverage of earnings of the big four IT services companies (https://bit.ly/3WsmXxf)

Misses:

- Nonfinance Companies:

This has been a challenging quarter for nonfinance companies. Most large manufacturing companies have reported a decline in profits. Metals, mining, cement, and oil and gas were the biggest laggards during the quarter. These sectors reported a sharp decrease in net earnings due to higher operating costs and lower sales realizations. Moderation in commodity prices also slowed down the growth in sales of a few industries.

It is reflected in depressed growth in net sales of mining and metal companies and, to a lesser extent, chemical companies. JSW Steel, the country’s second-largest Steel manufacturer, has reported a net loss for September 2022. Amid all the clutter around commodity-centric companies, consumer goods industries such as cosmetics, food, toiletries, and transport equipment continue to report robust sales and profit numbers. High inflation does not impact the sales of consumer goods companies.

However, the net profit margins of nonfinance companies are holding up better than expected. The overall growth has still been better than pre-pandemic levels. We expect margins to stabilize in the upcoming quarters and remain higher than the pre-pandemic levels, and robust top-line growth will keep profits elevated.

Investor Takeaway:

The overall profits of listed companies are thus anticipated to stay substantially elevated compared to pre-Covid times but may fall compared to the current outstanding profit levels. Slowing global growth, high-interest rates and volatility in commodity prices are key risks to growth & earnings from now on.

On a sectoral front, sectors dependent upon domestic demand & that can pass the input cost pressure to the end consumer are a better place.

Market This Week

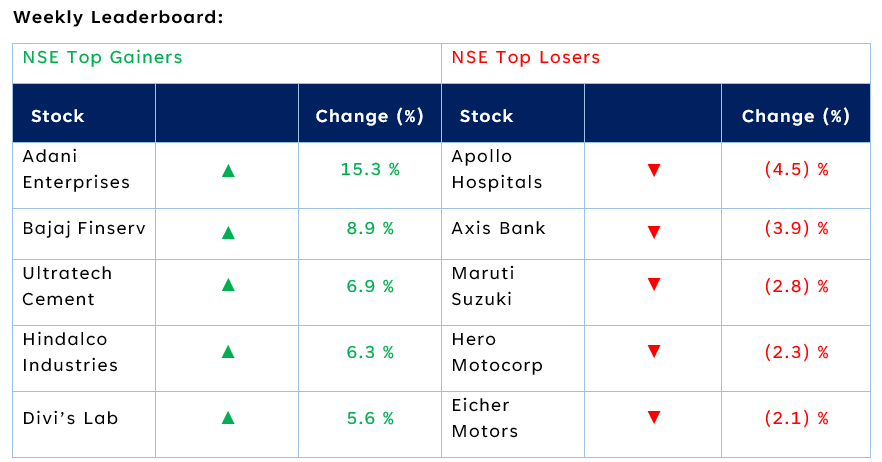

- Markets ended on a positive note.

- FIIs have invested $3bn into Indian equities over the past 10 trading sessions even though the US fed raised their rates to fight out inflation.

- Better than expected earnings and economic data during the week have kept the sentiment upbeat.

- Investors were also cheerful as the US reported robust Q3 GDP numbers which improved by 2.6 percent versus a decline in the previous two quarters.

- The Sensex touched the 61,000 mark while the Nifty50 hit 18,000 mark which was just one percent away from its all-time high.

- Auto sales recorded strong growth in October. Consumers made record purchases this festive season during the month, car and two wheeler makers reported highest ever monthly sales along with peak dispatches.

Stocks that made the news this week:

- Titan Company reported a y-o-y growth of 33 percent in standalone profits. The festive season starts from the end of September to October 2022. The company reported a retail growth of 17-19 percent in the larger business divisions, watches and wearables, jewelry, and eyecare against the previous year’s festive season.

- Adani Enterprises reported a healthy year-on-year growth of 122 percent for the quarter that ended September FY23, driven by strong operating as well as top-line performance. Adani Enterprises is accelerating the pace of business incubation and its remarkably consistent success demonstrates the robustness of the Adani Group’s fundamental approach to value creation.

- Karnataka Bank hit an upper circuit as the bank posted an all-time high net profit of Rs. 411 crores for the latest quarter. Net profit growth saw 228 percent on a year-on-year basis. The bank also reported a better asset quality with the bad loan’s ratio declining to 3.36 percent from 4.03 percent in the previous quarter.