The calendar Year 2022

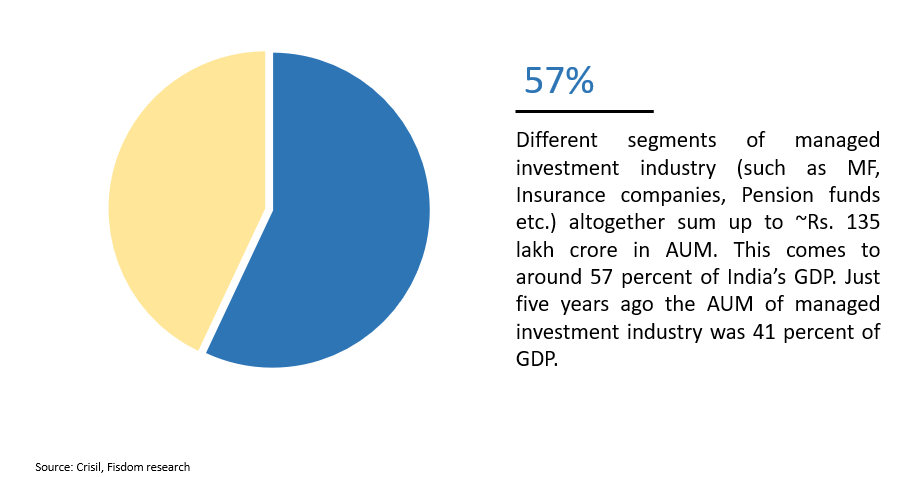

India’s asset management industry overview

Industry Level Trends

India’s asset management industry overview

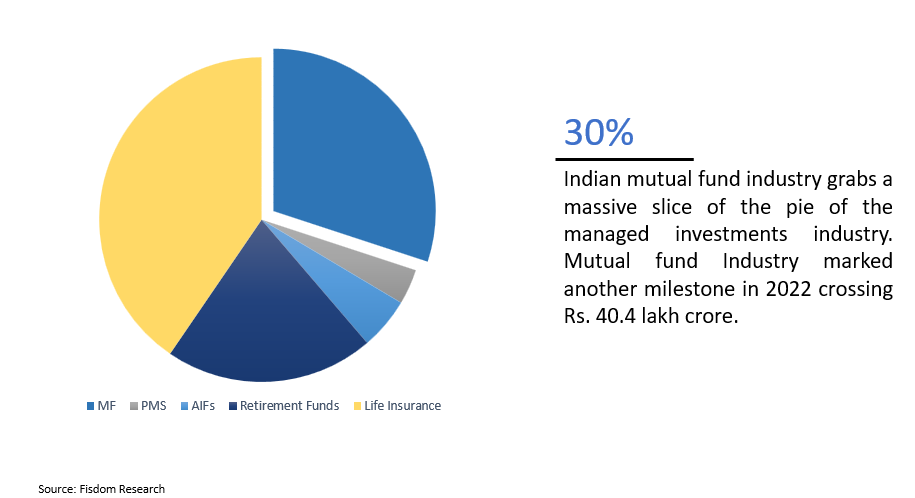

How significant is the mutual fund industry?

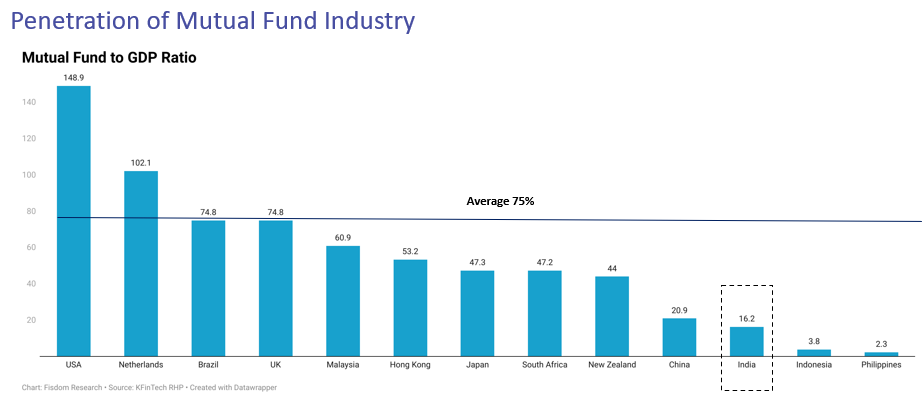

Penetration of Mutual Fund Industry

India’s MF to GDP ratio stands at 16.2 percent compared to 11.9 percent in 2017 indicating a robust growth in the industry assets. When compared to the world average of 75% India’s mutual fund penetration is significantly lower.

The Mutual Fund industry’s AUM hit a lifetime high at INR 40.4 Tn in CY’22. This amounts to a >5x growth in just a decade. Such AUM growth is accompanied by robust growth in number of folios, the bifurcation of which, reflects increasing retail participation. Total number of folios stood at 13.98 Crore for the period ended Nov’22.

Inflow/Outflow

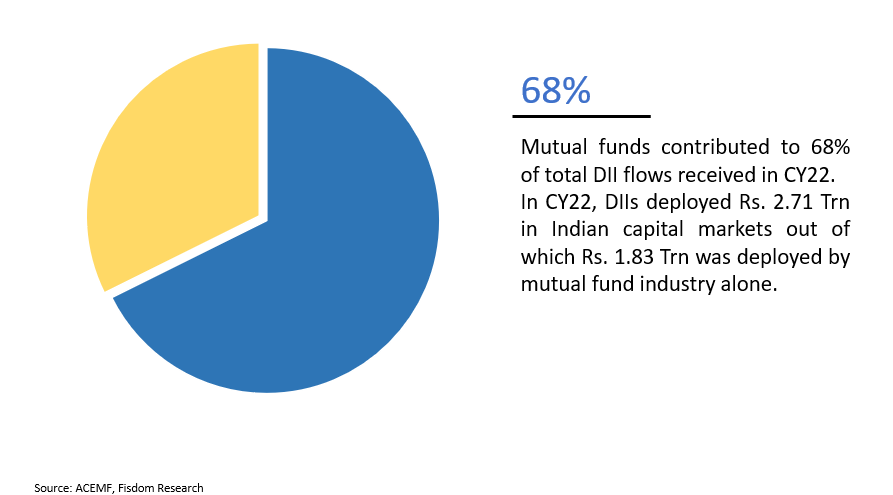

Mutual funds remained major deployers in CY 2022

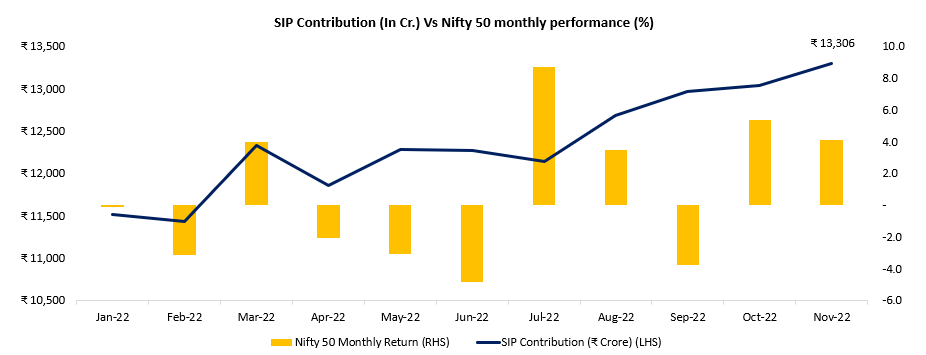

SIP contribution remained at all time high despite market volatility

Market continued to react to global factors and domestic rate hikes. However, mutual fund investors showed resilience and continued to invest in SIPs with consistent contribution month on month. SIP inflows trajectory remained upwards; during the year. SIP contributions clocked a lifetime high in Nov’22 with inflows of over INR 13,300 Cr. after increasing for five straight months. Total no. of SIP accounts stood at 6.04 Crore in Nov’22 with 1.6 crore fresh registered SIPs.

While additional SIP inflows during bullish market conditions is typical of retail investors, the persistent SIP flows reflect enhanced investor maturity and ability to stay committed through cycles.

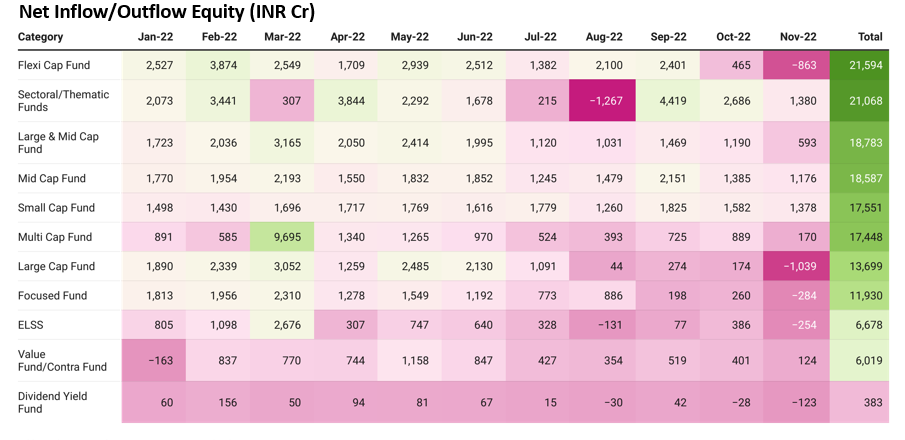

Flexi cap and Sectoral funds preferred by investors

Flexi cap category received highest inflows in CY22 so far. However, sectoral funds remain second preference by investors as they bet on broader market recovery. The rise in inflows in these categories can also be attributed to new funds launched in the segment.

Debt category witness outflow across the board

Debt category witnesses outflows across the board. Investors have been pulling out money from debt categories since interest rate hike cycle began due to persistent high inflation. Rising interest rate cycle resulted to lower bonds price and debt mutual funds saw mark-to-market impact on their NAVs spooking investors.

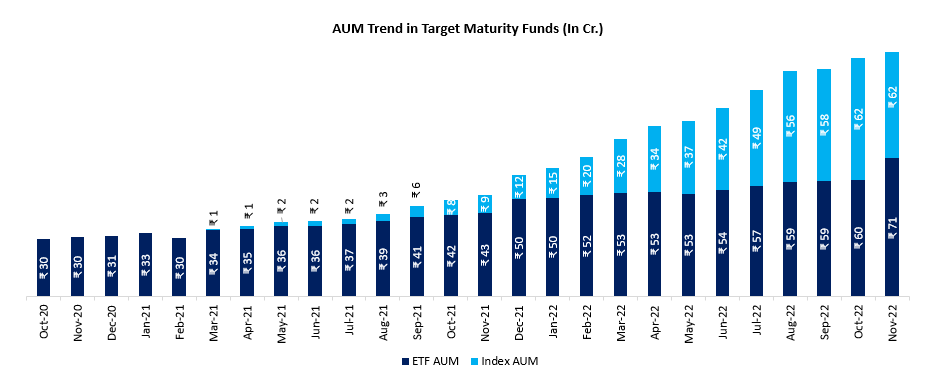

Target maturity funds gaining traction despite outflows in debt MF universe

Target Maturity Funds have grown significantly over the last few years after the government launched Bharat Bond ETF (managed by Edelweiss Mutual Fund) back in December 2019. In 2022, Target Maturity crossed Rs. 1.3 lakh crore AUM to become the largest debt mutual fund category, barring liquid and overnight funds. TMFs come with vide range of maturity which makes it easy for investors to invest in one that suits their investment horizon.

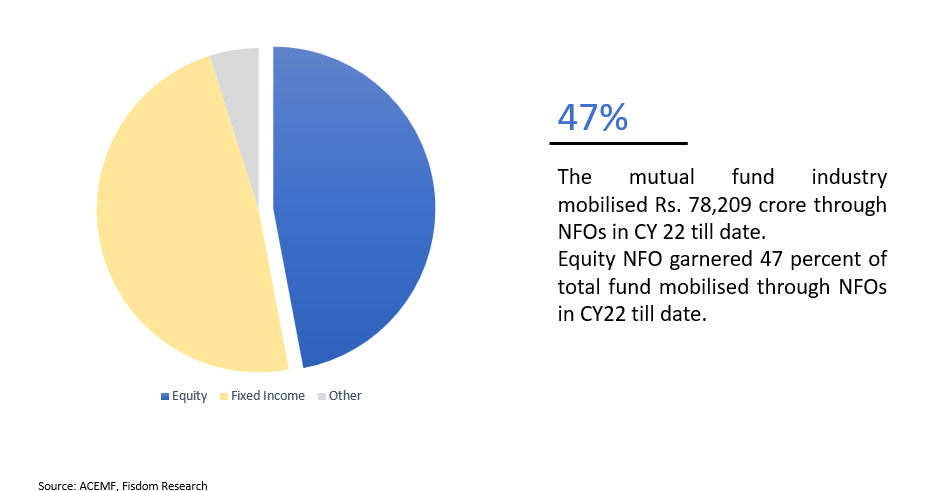

New Fund Offer Study

Funds mobilized through equity NFOs remain buoyant

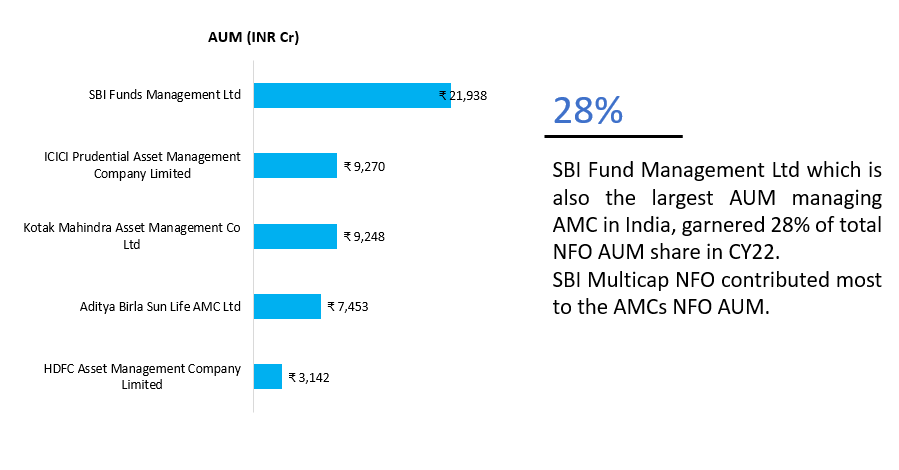

Highest AUM mobilized by SBI AMC through NFOs

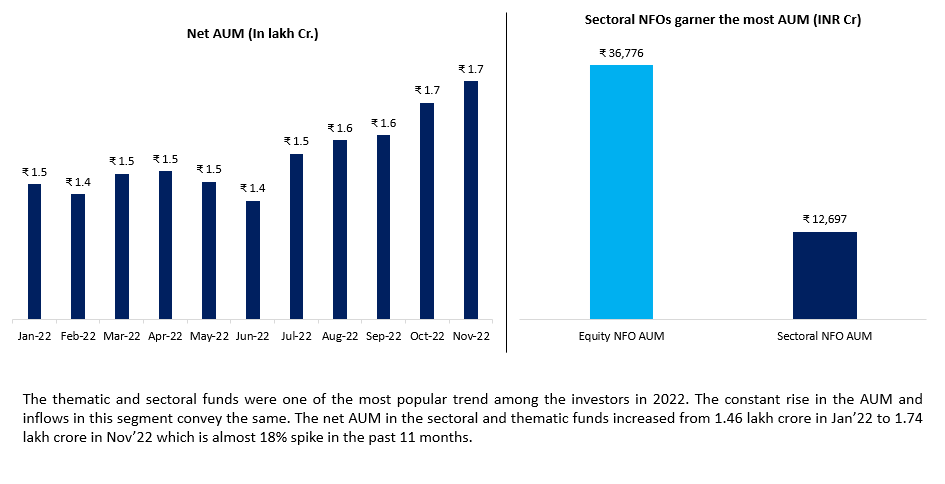

Sectoral/Thematic funds gained popularity

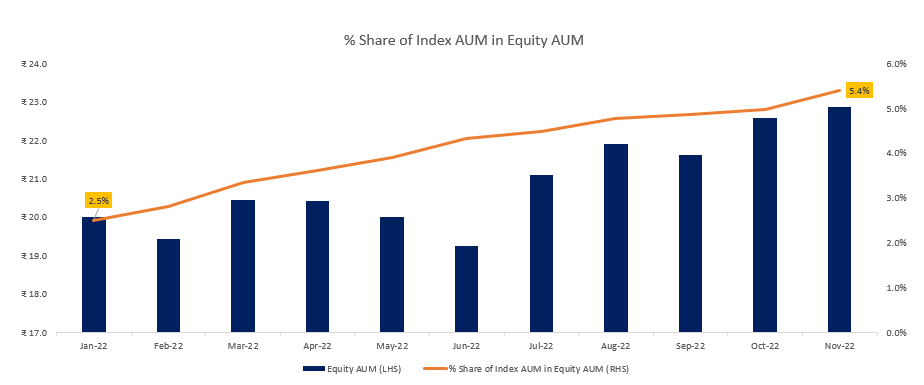

Passive funds gains market share

The current year saw 37 equity passive fund launches, In terms of AUM share of passive funds increased from 2.5% in Jan’22 to 5.4% of total AUM in Nov’22. The total AUM in the index funds is recorded at INR. 1.23 Lakh crore in the month of Nov’22.

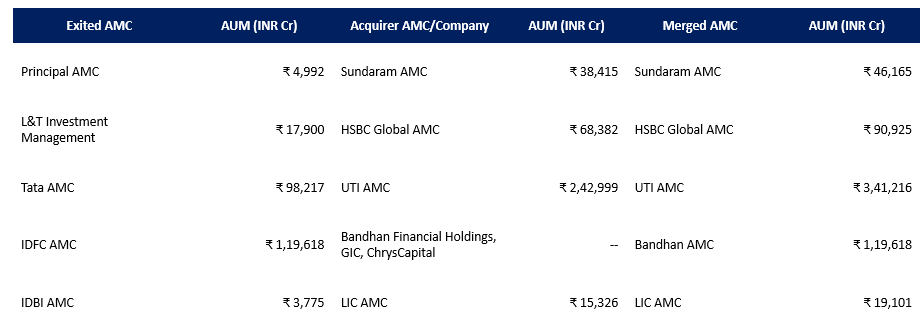

Mutual fund Industry – M&A Activity

- M&A is not a new thing in MF industry. Starting this year we saw acquisition of Principal Mutual Fund by Sundaram Mutual Fund. Sundaram AMC deal was announced in 2021 but actual execution happened in 2022.

- L&T Mutual Fund taken over by HSBC Mutual Fund, 45 schemes names were changed and 25 funds merged.

- The Tata Group is in final negotiations to buy a majority stake in India’s eighth-biggest mutual fund UTI AMC, if the merger is approved and Tata AMC and UTI AMC are united, combined company would rank as India’s fourth-largest AMC in India.

- Bandhan led consortium is set to acquire IDFC AMC. If this deal passes through all approvals it will be the largest deal in Indian Mutual fund industry.

- IDBI Bank a stake holder in IDBI Mutual Fund signed an agreement to transfer funds of IDBI Mutual Fund to LIC Mutual Fund.

Source: AMC investor notice, ACE MF, Fisdom Research