India’s real estate sector is seeing a sharp turnaround after two years of slump. Demand has been on the surge in the residential sector, with end-user demand driven by incentives offered by developers amid the festive season and government support.

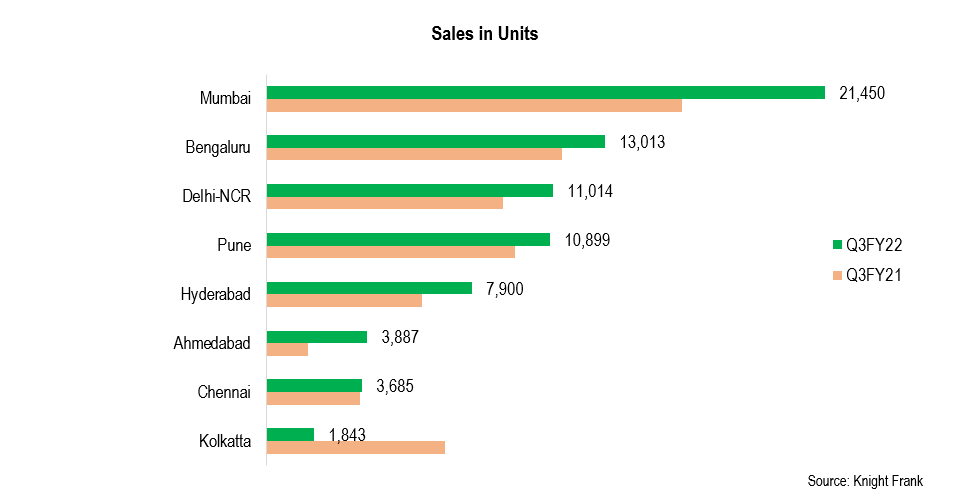

Below are the sales numbers published by the real estate research firm Knight Frank for July-September 2022:

With economic activity in full swing, housing sales jumped in almost all major cities.

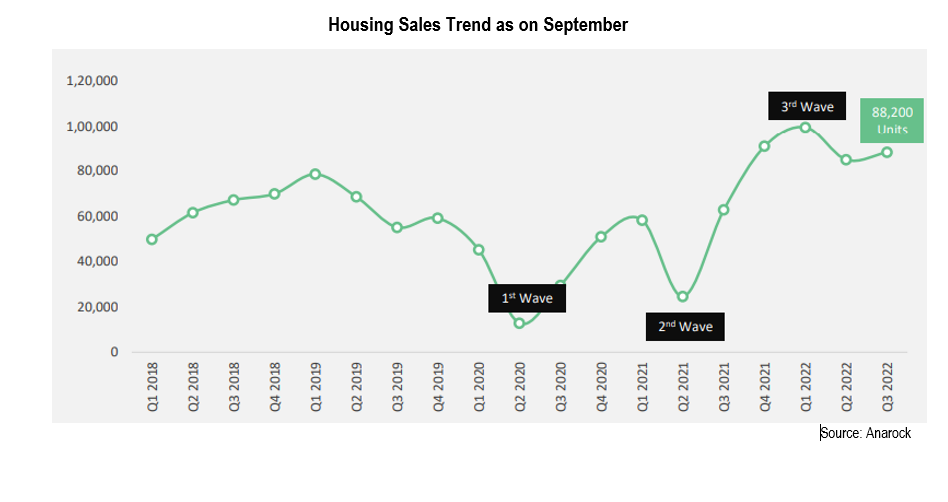

According to a JLL India study, housing sales in the top seven property markets have risen to 1.61 lakh units this year till September 2022. It has surpassed the annual sales performance registered in 2014. The housing sales peaked at 1,65,791 units in 2014, and the performance witnessed in the first three quarters of 2022 indicates that this year will scale a record number.

The real estate sector has rebounded despite various challenges faced during the pandemic. The demand for the real estate sector has exceeded the pre-pandemic level. The residential properties category primarily increased as buyers demanded larger houses with better amenities.

Key factors driving the rally in the real estate sector are as follows:

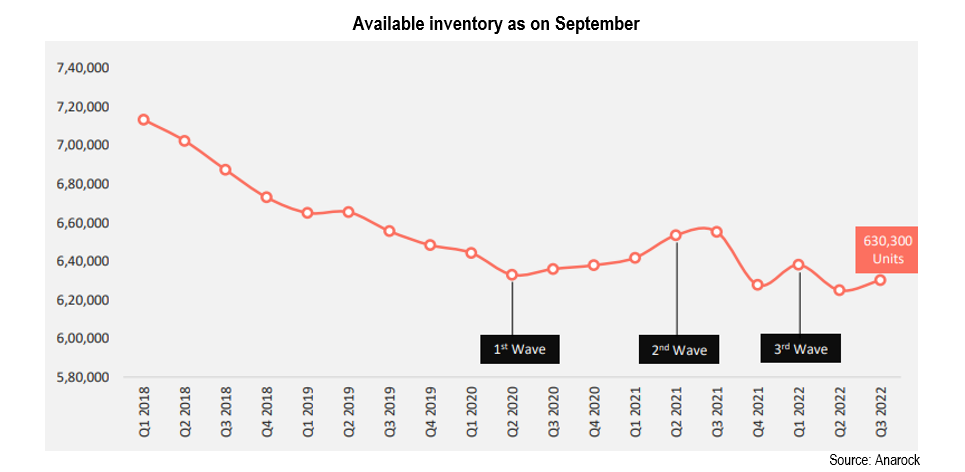

- Decline in available inventory levels:

On an annual basis, the overall available inventory declined by 4% in Q32022 across the top 7 cities, including Mumbai, which remains a top contender in inventory levels.

- Government support:

State and Central governments have contributed to the real estate sector’s growth momentum.

- Karnataka government has reduced guidance value by 10 per cent. Guidance value is the minimum amount at which one can register a property.

- The Central government constituted a special fund for stalled projects due to the Covid-19 pandemic. The fund will invest in over 250 projects aiming to offer debt financing to stalled projects of property developers.

- Reforms such as RERA and declassification of the status of a sponsor for InvT and REITs have revived buyers’ trust in the sector, boosting sales.

- West Bengal government had extended the 2% rebate and 10% waiver on circle rates till September 2022.

- Optimistic commentaries by real estate developers:

- Irrespective of the rate hike by RBI, the sentiments of homebuyers and investors in the residential sector are becoming more positive. There is a significant spike in demand for luxury properties.

- Developers offer massive discounts and freebies to capitalise on the overall positive sentiment during the festive season.

- While the continuous rate hikes by RBI have increased the cost of borrowing, the impact on home sales has been minimum. Current home loans hover around 7.4 per cent, whereas they were about 6.6 per cent for the last two years. Real estate developers remain optimistic as they believe the current growth cycle is led by solid fundamentals rather than speculation.

- Even though the cost of raw materials increased the overall property prices, homebuyers are still ready to grab the best deals developers offer during the festive season before further prices spikes.

- Increasing population of wealthy Indians

2016 | 2020 | 2021 | 2026 | |

HNWI Populations (US$1m+) | 486,619 | 765,929 | 796,961 | 1,407,287 |

UHNWI Populations (US$30m+) | 7,401 | 12,287 | 13,637 | 19,006 |

- Emerging Trends:

- The mid and premium segment-priced homes fall between Rs. 40 lakhs and Rs. 1.5 crore is comprised of the highest share in the residential property segment. These segments perform better than their pre-pandemic levels and are expected to do well in the upcoming quarters. Increasing affordability & demand for larger, more spacious homes may be the possible drivers.

- Most developers’ unsold inventory decreased as homebuyers showed interest in buying ready-to-move-in homes. Luxury and ultra-luxury segment demand is also buoyant as demand from NRIs remains robust.

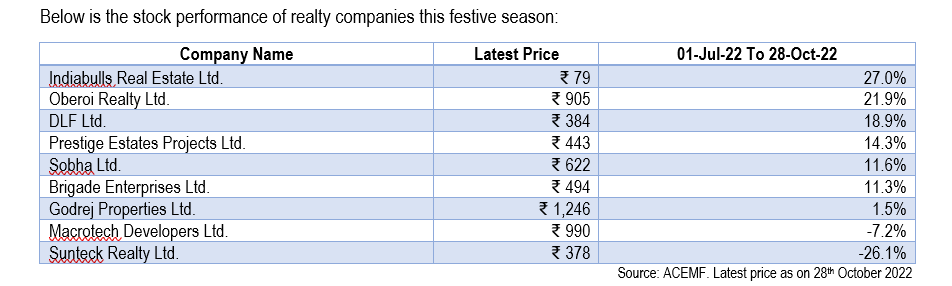

Investor takeaway:

Real estate is an essential element of economic growth as it is a large part of personal and business wealth. By 2030 India is expected to be the world’s third most prominent real estate market. Central government’s estimates suggest that the real estate market will reach a market size of $1 Trillion by 2030, which is estimated to contribute 18-20 per cent to the GDP. The story of the sector is exciting & encouraging.

Having said that, an investor should think twice before entering any stock without assessing the risk appetite and asset allocation plan. It is better to accumulate stocks/mutual funds in a staggered manner through the SIP or STP route rather than putting a significant amount through a one-time route.

Market This Week

24th October 2022 (Open) | 28th October 2022 (Close) | %Change | |

Nifty 50 | 17,736 | 17,787 | 0.28% |

Sensex | 59,804 | 59,960 | 0.26% |

- Markets ended the holiday-truncated week on a positive note.

- The Nifty50 witnessed more than 5% gains for the October series expiry on Thursday this week, negating all the losses from the September series.

- The November series has begun on a positive note. HNI and FIIs both rolled over their long positions to November.

- The BSE Sensex reclaimed the 60,000 mark on Friday, but profit booking at higher levels pulled the index down.

- After two consecutive quarters of decline, the US economy rebounded with a 2.6 percent increase in GDP. Resilient business and consumer sentiments help tide over inflationary pressures.

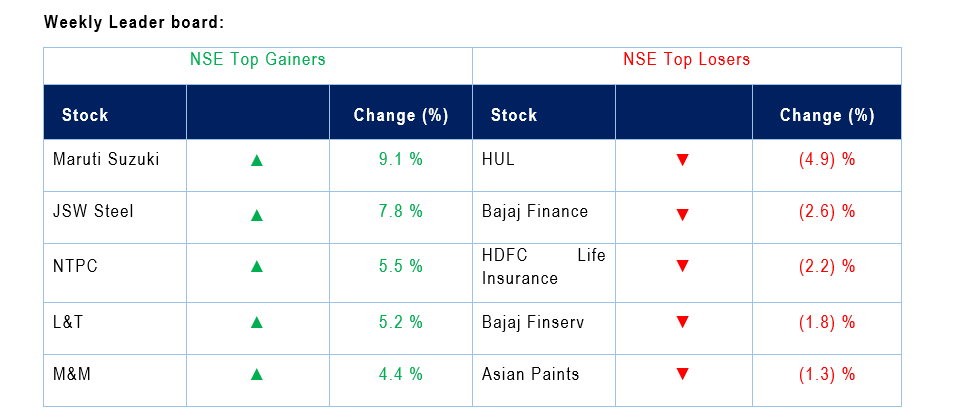

Stocks that made the news this week:

- Maruti Suzuki’s standalone net profit for the quarter ended surged fourfold beating analyst estimates. The company’s operational performance saw improvement. Better demand has impacted positively sales volume and improved capacity utilization and boosted profitability.

- Dabur India Ltd reported a 2.85% year-on-year decline in its net profit. The company delivered steady and organic growth in an environment where certain things remain challenging. The company has also signed a transaction agreement to acquire 51 percent shareholding of Badshah Masala. Badshah Masala is one of the key players in the Indian spice market space.

- SBI Cards and Payments reported average second-quarter numbers. The company’s revolve rate and margins are under pressure. However, analysts maintain their ‘buy’ recommendation on the stock.

- Nykaa or FSN E-Commerce Ventures Ltd has hit 52 week low during the week. The stock has been falling as the post-IPO lock-in period for anchor investors is about to end.