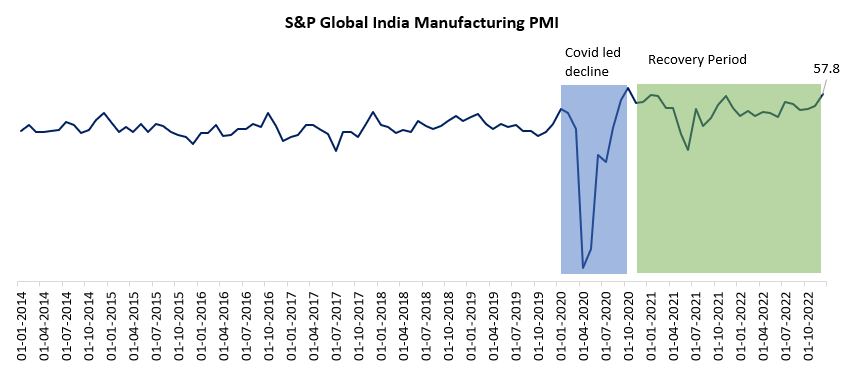

Hot Stuff This Week: Manufacturing PMI at 13 months high

India’s manufacturing activity finished 2022 on a strong note aided by improvement in business conditions. (at second fastest pace during post pandemic period). December 2022 Manufacturing PMI numbers were highest since October 2020.

Manufacturing PMI rose to 13 months high of 57.8 in December 2022 against a reading of 55.7 in November 2022. The number above 50 indicates expansion and lower than 50 indicates contraction.

Source: CMIE

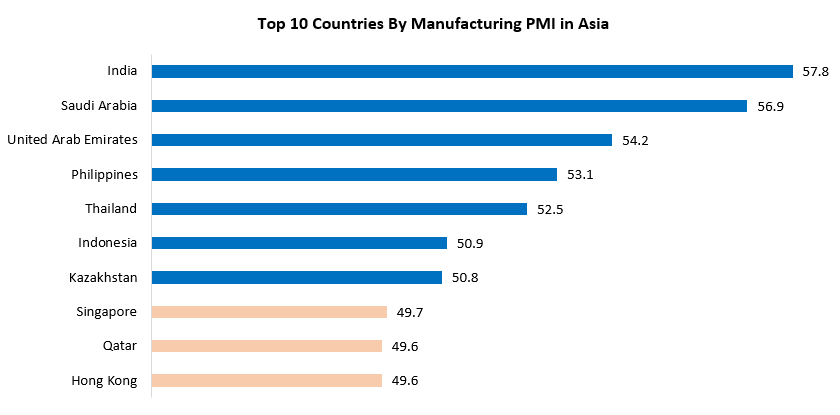

The manufacturing PMI data further gave confidence that Asia’s third largest economy is better placed than other emerging economies. The data also supports the fact: India is very well equipped to weather the impact of a likely recession in western parts of the world.

Source: Trading Economics. Data as on Dec 2022.

India has outpaced all major Asian countries in terms of manufacturing PMI in Dec 2022. The overall growth in December was not only led by increase in sales numbers but also by hiring activity within the sector. Outlook for production of companies were optimistic in S&P Global survey. Demand buoyancy and advertising were sighted as the key opportunities for growth.

What are the key prospects working in favour of manufacturing sector?

- Cyclical oriented sectors are growing at a much faster pace: During CY22, strong recovery was seen in passenger vehicle segment majorly led by improvement in supply chain scenario. As per industry estimates, passenger vehicles sales are expected to be around 38 lakh units for CY23.The calendar year 2023 is also set to see further penetration in EV segment with special focus on two wheeler EV segment. EV industry is at an inflection with the foundation laid by government policies and large investments favouring the sector to build entire supply chainsThe roads and logistics sector is expected to increase by 13 percent in 2023 by ICRA. Q2FY23 reported a growth of 6.1% against Q1FY23 majorly led by healthy and sustained demand by manufacturing sector.Capex outlay for Original Equipment Manufacturers (OEMs) is expected to remain higher with an estimated outlay of Rs. 650 billion over FY23-FY25.The China+1 strategy is looked upon by Global MNCs as India has plenty of low-cost labour, Research and Development and stringent Intellectual Property norms within especially in the chemical sector.

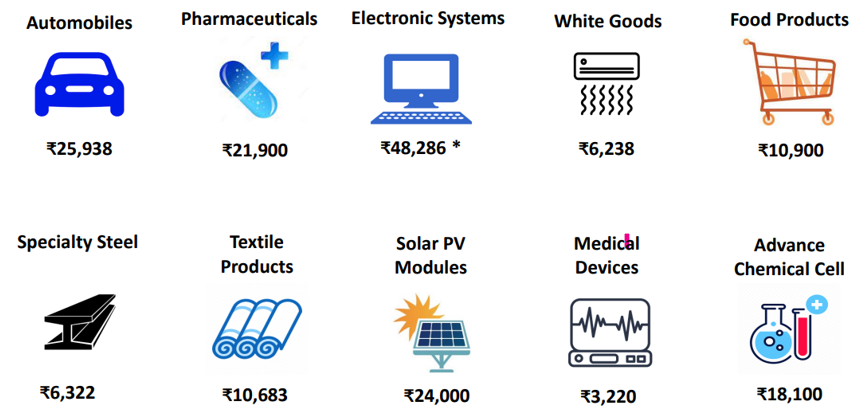

- PLI Scheme: The Great Manufacturing Push by Government: The PLI scheme will bring in a meaningful change in manufacturing sector. Below is the sector wise outlay of PLI scheme till September 2022.

Source: EY India Tax Insights FY 22, Fisdom Research, Mirae AMC, Data as on Sep 30, 2022 * ₹40,951 for Large Scale Electronics ₹7,325 for IT Hardware

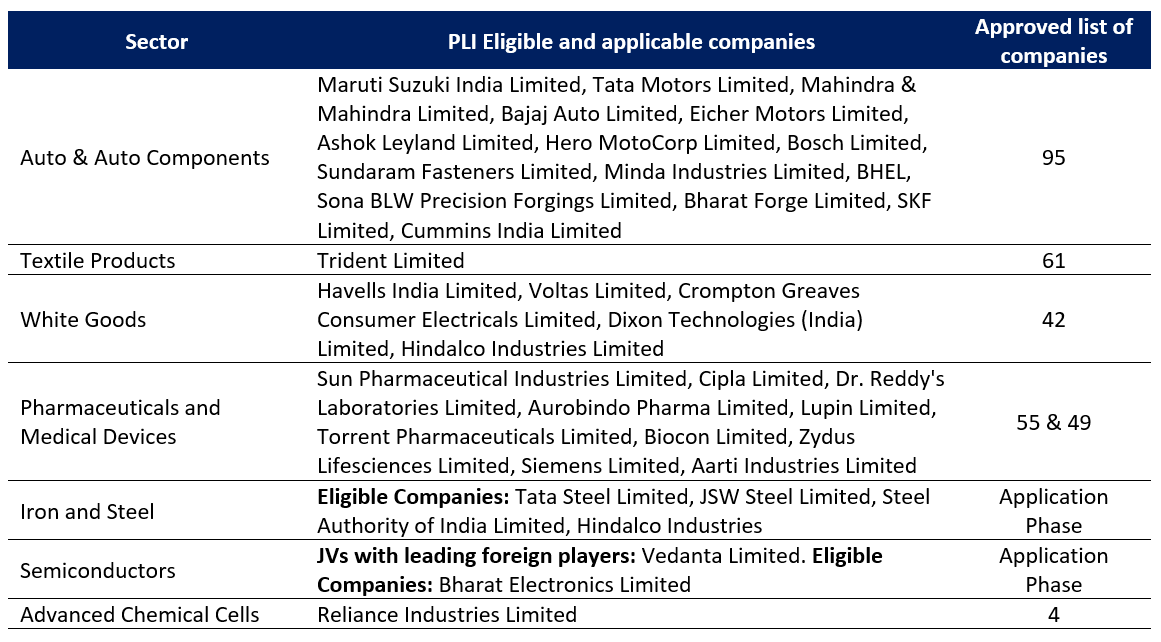

Below are the sectors and companies that have benefitted from the PLI scheme push:

Source: HDFC Securities: PLI Manufacturing Report 2022 Fisdom Research Mirae Asset AMC

Way Forward:

Currently India is considered to be the second most favourable player for manufacturing. Key developments within industrial clusters accessibility to credit, and government initiatives are set to drive India’s manufacturing sector. Amid Russia Ukraine conflict and US-China trade war India stands out to be the most favourable looked upon destination by global giants.

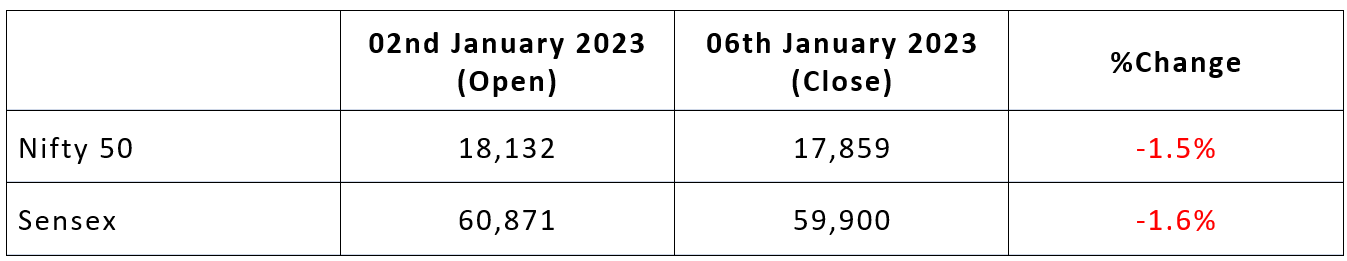

Market This Week

Source: BSE, NSE

- Markets ended on a negative note.

- Investors were concerned as US Fed December’22 monetary policy reignited expectations that the apex central bank is expected to continue increase interest rates going ahead.

- S&P Global India Composite PMI Output Index rose to 59.4 in December from 56.7 in November, indicating quickest pace of growth since January 2012. India’s corporate sector signaled a strong performance at the end of 2022.

- Investors around the world also cheered as recently released inflation data from France and Germany indicates consumer price rises are slowing across euro zone.

- GST collection for December stood at Rs 1.5 lakh crore, a surge of 15% yoy, mainly driven by price rise in consumption items, elevated inflation, and compliance actions.

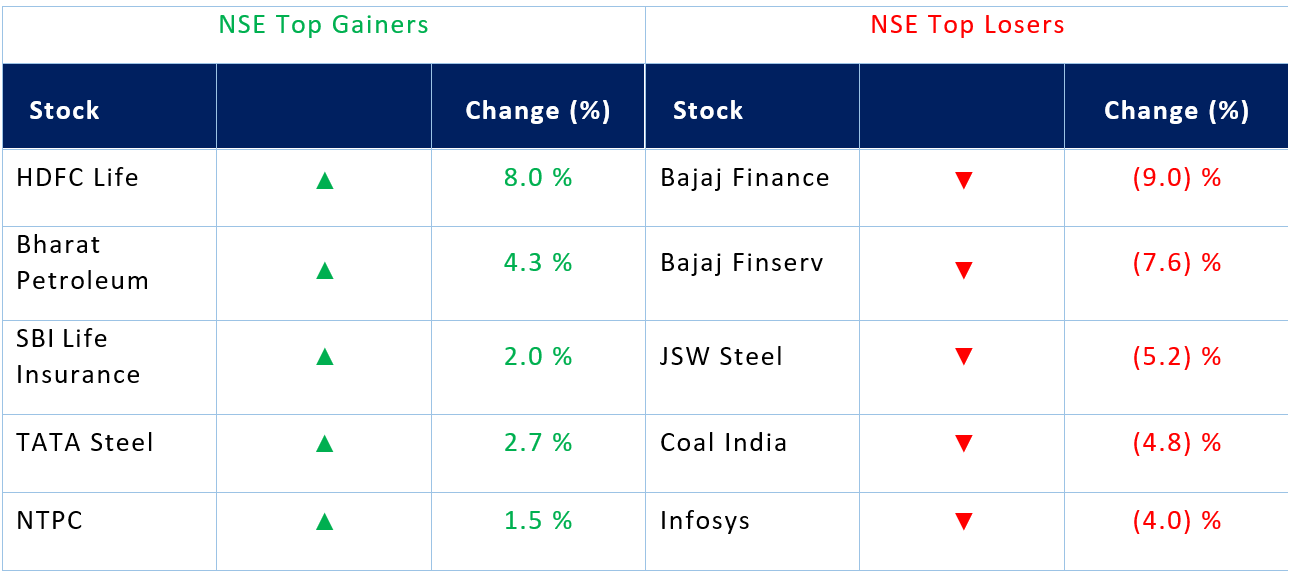

Weekly Leaderboard:

Stocks that made the news this week:

- Bajaj Finance and Bajaj Finserv remained top losers for the week amid lower than estimated growth of AUM in FY23. The company’s AUM increased by Rs. 12,500 crore which is up by 5.7 percent q-o-q. MOSL brokerage highlighted weaker growth and lower utilization of capital.

- Ambuja Cements incorporated a wholly owned shipping services company called Ambuja Shipping Services Ltd. The subsidiary will be into business of operating ships. Gautam Adani earlier had pledged his entire stake in Ambuja Cements and ACC Ltd to foreign banks to fund the entire $6.5 billion acquisition deal.

- SEBI has approved the Indian government’s stake reclassification in IDBI Bank. The government and LIC cumulative sale 60.72 percent stake in IDBI Bank. Post this transaction the governments share in bank will reduce to 15 percent.