Hot Stuff This Week: Metal stocks rally

Metal companies have been on the radar since the start of market rally post June lows. The Nifty Metal index has surged sharply largely because of news flow coming out of China. In second week of November there were news around China ending its zero Covid policy and that is where the real rally started. Now before jumping on to reasons and factors that might impact metal companies stock prices let us first understand how did the sector perform this year.

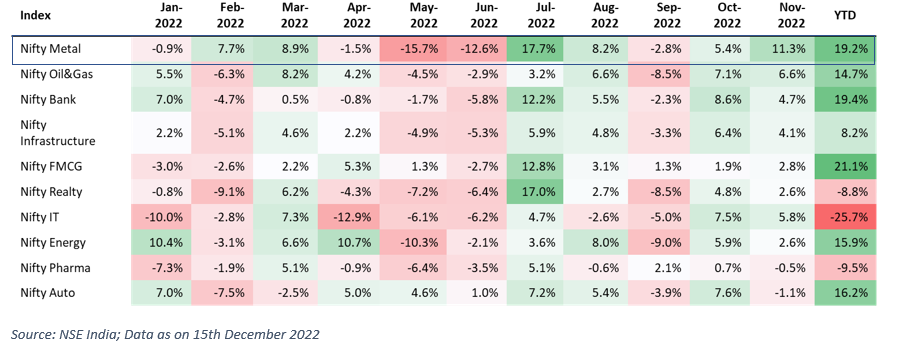

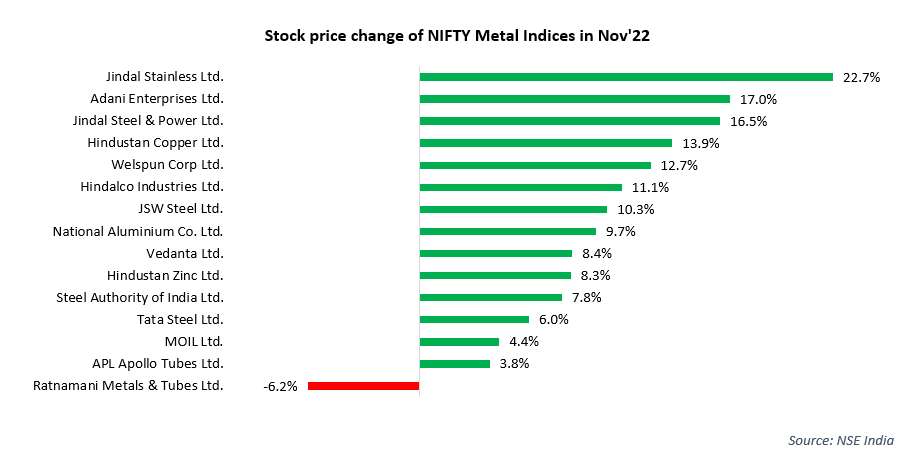

Nifty Metal remained the top performer for Nov’22. On a year-to-date basis the indices has rallied by 19.2 percent. Companies like Jindal Stainless Steel Adani Enterprises have rallied more than 17 percent respectively.

Here are few reasons for the optimism in Metal Indices:

- Export Duty Rollback: Indian government decided to cut back export duty on steel and raw materials required for steel making on Nov 18th. Government had imposed taxation on exporting steel and other products in May 2022 in order to preserve higher domestic supplies and control rising prices. Now with the rollback of export duties it is expected that prices of iron ore and steel to increases and consequently stock prices of companies can also rise.

As a result of imposing these export duties there was a sharp decline in domestic metal prices and steel exports declined by 53% to 5 million tones in first half of FY23 as compared to 11 million tons for the same period in last year.

Domestic steel prices have corrected by 25% in the last 6 months as against global price correction of 25%-30%, on the back of weak demand in China, macro headwinds in the western world.

- China’s Zero Covid Policy Ending: China is the biggest commodity consumer. And if China is easing its Covid restriction that means companies can produce more and in return they will require resources and metals to produce more. Another factor playing out here is that Chinese government has recently announced 16 measure to help property markets. Some of the measure include credit extensions to the industry and easing deposit restriction for homebuyers. This move can boost the demand for metals including steel and copper once the huge property market in China comes back to its new normal.

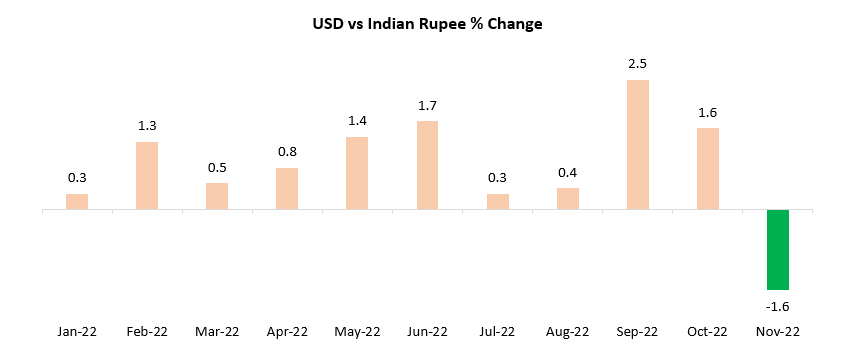

- Dollar weakens in Nov’22: There is an important linkage between US dollar movement and commodity prices. As dollar weakens commodity prices start to increase and vice a versa. Weakening dollar is always positive for import dependant countries like India.

- Capex Boom in India: However, dollar weakening is not the only factor that is driving metal prices also there should be enough demand to the metals. In India for instance banking stocks are rally because investors are counting on the era returning for private investments and capex. If there is capex recovery there will be demand for steel, cement, copper. And the demand is expected to be better from emerging markets even if developed market see come moderation, especially in Europe. But if China’s demand does comeback, they would bring global demand back to earlier levels and metal prices will start to rise.

Way Forward

With Covid restrictions easing out in China and reforms like ‘Make in India’ and increase in infrastructure spending, rural electrification, Smart cities projects themes, the metal sector is anticipated to undergo several change in the years to come. The robust growth engine in India is driven by cost advantages for manufacturing of steel and aluminium and other products. Besides this the sector is expected to grow on the back of rise in infrastructure and logistics sector revival along with favourable government policies. Meanwhile below is the performance of Nifty Metal components.

Market This Week

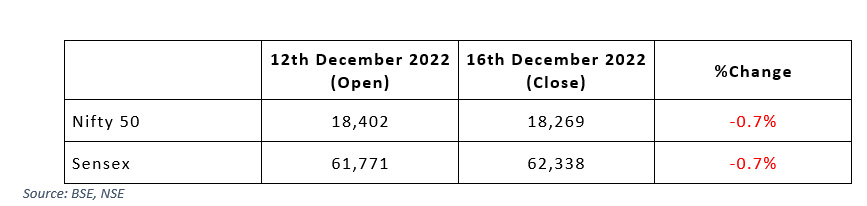

- Markets ended on a negative note.

- India’s CPI inflation growth eases in November 2022 to a 11 month low of 5.88%.

- On a separate note factory activity as measures by Index of industrial production declined by 4% in October.

- US Fed during the week raised policy rates by 50 basis point at a 15 month high.

- Global markets extended their losing streak on last day of week as Bank of England and European Central Banks raised rates.

- Global indices were also under pressure as PMI data from eurozone showed contraction for the sixth consecutive month

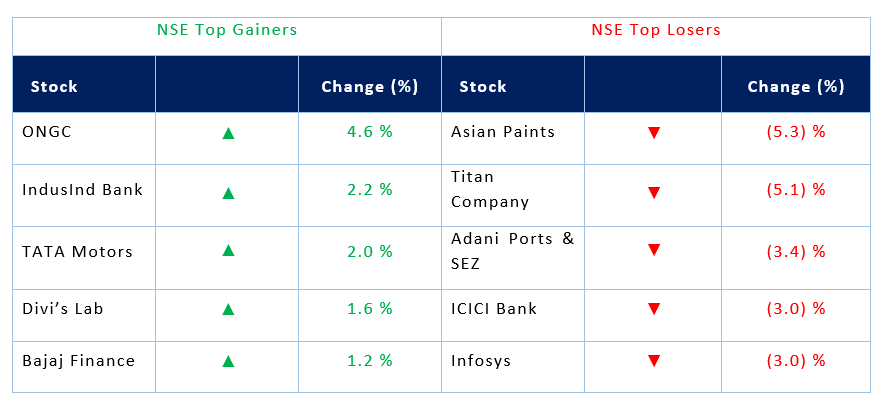

Weekly Leaderboard:

Stocks that made the news this week:

- Life Insurance Corporation has increased its stake in HDFC Asset Management through open market transactions. The life insurance major has increased its stake from 7.0 percent to 9.0 percent respectively.

- Sapphire Foods promoter group and private equity players offloaded part of their stake. Sapphire reported highest ever revenue and net profit for Q2FY23. On the key revenue contributor KFC delivered 36 percent upsurge in revenues.

- Deepak Fertilizers is set to demerge its mining chemical and fertilizers business. Over the years DFPCL have enhanced its operational metrics, generated healthy cash flows and made their balance sheet even stronger.