Stocks of tech companies were largely popular with investors and had a spectacular run between March 2020 and January 2022. Valuation of IT companies saw a consistent uptick, benefitting from a strong economy, low interest rate regime and a shift towards digital economy. From Jan’22, the Nifty IT index has fallen 25% (as on 9th December 2022). On the other hand, tech heavy Nasdaq 100 is down 30%. With such a deep correction in IT stocks globally the question arises is it time to start investing again?

What are the reasons for fall in US Tech stocks?

Markets are largely driven by forecasts and expectations. Companies that meet street estimates are cheered while those who fail to meet expectations are disowned. Same thing happens with businesses.

Slowdown in e-commerce in US

Meta Platforms earlier known as Facebook had predicted that soon after the pandemic receded there would be a surge in growth of e-commerce. The prediction came in line with the thought that digital adoption was the next big thing and it is better to migrate to digital as soon as possible. This was cheered by Wallstreet investors. However, in Feb 2022 situation took an unexpected turn. Even the best of the best analysts did not predict the Russia-Ukraine war. While inflation had started to hurt tech companies thanks to the loose monetary policy by Federal Reserve to come out of pandemic led downfall, the Russia Ukraine war added salt to the wounds.

As costs started to increase, businesses which were thinking of digital transformation took a backseat to preserve their reserves. When companies find it difficult to keep operations running, certain expenses like advertisements and promotions are trimmed down, as a result impacting ambitious goals of tech giants.

Meta had hired around ~87,000 employees in 12 months ending September. This accounts to an increase of 28 percent in overall headcount. This was in line with the company’s ambitious plans post pandemic.

Meanwhile another mega tech company Amazon became the first listed company to lose more than $1 trillion in value. One of the key reasons being Amazon reported a slower growth in its cloud business. To get some context one of the important pillars of internet is storage. One cannot function smoothly without having your data stored on a cloud server. This domain is ruled by Amazon Web Services with a 33% market share in US as on CYQ1’22. AWS was one of the fastest growing and most profitable segments of Amazon. A normalizing effect post pandemic has led the firm pause its hiring in the segment.

Strict competition

First mover advantage was considered to be a huge boon for e-commerce companies as advancements in technology would act as a entry to barrier for other local players. But another unexpected turn of events occurred thanks to the boom in cloud computing and smartphone adoption. Several local and small firms began to rise and posed a threat to dominance of big tech companies. For instance, Netflix faces strict competition from deep pocketed rivals such as Disney. Disney plans to spend $30 bn on content generation, and this has caused trouble to Netflix who was once a dominant player in OTT universe. In retaliation to Disney, Netflix has also announced a $17 bn spending this year. Since the race to who is spending more intensifies investors might face the brunt as Netflix’s cash flows are getting impacting due to rise in spending.

However, Netflix is adapting to evolving environment and the company is soon going to rollout ad based low cost plans along with targeting audience who often share their accounts with others.

Monopoly of distribution platforms

E-commerce businesses rely heavily on distribution platforms such as Apple app store and Google Play Store. This becomes a huge threat to companies who want to distribute their services. Few companies have also complained against the bigger tech companies. For instance, Meta had raised a concern that close to $10 bn revenue could get impacted due to new privacy feature introduced by Apple.

Key Takeaways:

- Since tech companies rely on advertisements as their main source of revenue, profits are now getting impacted and companies are forced to venture into new segments to gain market share.

- Another major reason why tech companies across the globe are getting impacted is persistent inflation many companies are hence looking to trim down marketing expenses to save costs.

- Rate hikes by Federal reserve on account of high inflation resulted in less spending by businesses on digital ads which in turn translated to slower revenue growth.

What should investors do now?

The US economy has started to show signs of revival. Consumer spending expanded in the July-September quarter; the US economy reported a 2.6% GDP growth in Q3 snapping 2 consecutive quarters of decline. Inflation for October rose 7.7% year on year smallest on-year gains this calendar year.

Tech companies are going to be at the centre of world’s economy in the decades to come and staying invested is them is and absolutely right thing to do. Winners might change over the time but the tech story is far from over.

Technology as a sector is much bigger than social media and OTT platforms. Not all tech companies have slowed down post pandemic. Companies are pushing digital technologies into other parts of their business verticals that they did not have during Covid-19. For instance, Microsoft, world’s largest software company in its most recent earnings call said that it expects its enterprise business to growth at 20 percent this year. At a time when macro environment is challenging Microsoft sees opportunity in cloud computing. Other companies such as ServiceNow, SAP, Oracle and IBM have proved to be highly resilient in the big tech meltdown.

Investors should avoid lump sum approach and allocate more through staggered way to enter into the US Tech sector. The most ideal way to enter in US Tech sector is through a NASDAQ 100 ETF FOF or a FANG+ ETF FOF. Existing investor should have a relook at their asset allocation and the allocation towards overall US tech sector in their portfolios. If the allocation has come off significantly investors can consider topping it off and maintains a allocation of 10-12% of the overall portfolio. Do consider your risk profile and goals before investing in international funds.

Till then Happy investing.

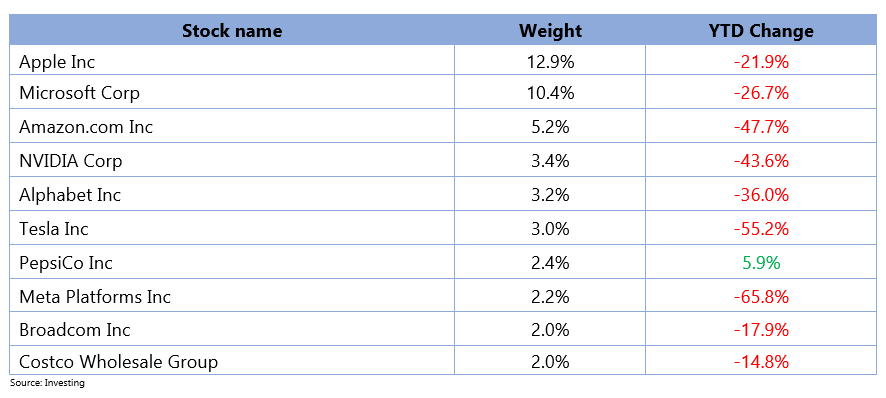

Below is the performance of top 10 Nasdaq 100 Index stocks by weightage:

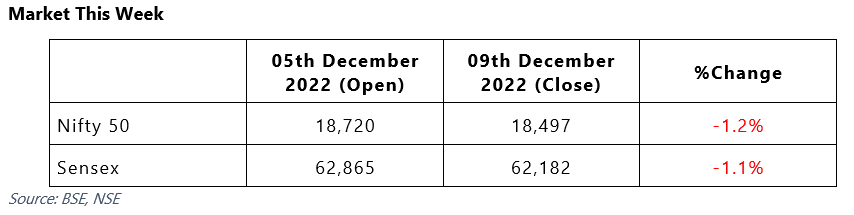

- Markets ended on a negative note.

- The Reserve Bank of India raised repo rate by 35 basis points in line with expectations. The RBI lowered FY23 GDP growth forecast to 6.8 percent from 7 percent. Strengthening rural economy and government CAPEX remain key positives.

- Indian rupee lowered during the week. The rupee depreciated by 96 paise to close at INR 82.27 against the USD.

- Foreign investors sold shares worth Rs. 4306crores while DII’s bought shares worth Rs. 3,712 crores.

- US Services PMI data surprised with an increase in growth rate due to acceleration in business activities and employment for the month of November 2022. The price element also saw decline in November, indicating easing pricing pressure that would reflect in November CPI data to be released on 13th December 2022.

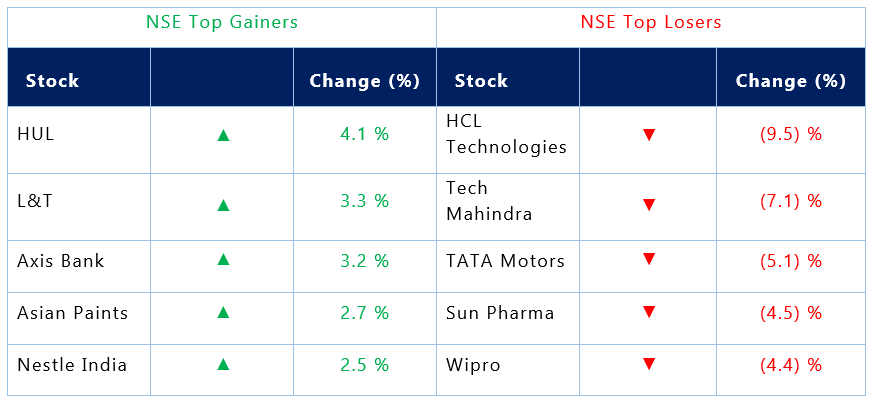

Weekly Leaderboard:

Stocks that made the news this week:

- Paytm board will meet on 13th Dec to consider proposal to buyback shares. Fund managers and analysts are raising questions over the decision. The company in a very unusual way will be using proceeds from previous rounds of fundraising to buyback share. The company says that this will be beneficial for shareholders. While tech companies such as Infosys, TCS buyback share out of their profits earned Paytm is a loss-making entity hence analysts are making

- HCL Technologies remained top loser for the week as the company’s management indicated that FY23 revenue growth will be lower. The company further said that December quarter will be challenging amid challenged in BFSI and hi-tech segments.

- Bajaj Consumer Care board has approved a proposal to buyback shares worth Rs. 81 crore. Currently promoter group holds 38 percent stake and foreign investors hold 11.51 percent in the company.