Hot Stuff This Week

Consumer Durables/FMCG companies look for festive cheer

The festive season have already begun in the southern and western parts of India initiating with Ganesh Chathurthi and Onam, and consumer centric companies are witnessing an uptick in sales when compared with pre pandemic levels.

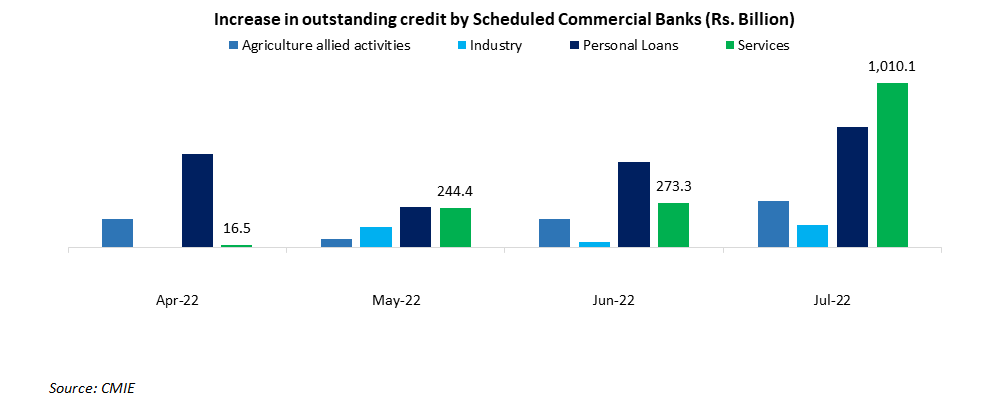

To understand more about the growth in consumer-oriented companies, let’s have a look at the overall service sector growth. The chart below reflects how the outstanding non-food credit by schedules commercial banks to different industries have been so far.

As observed from the above chart outstanding credit to services sector increased by Rs. 1 trillion in July 2022. Contact intensive sectors and services are rebounding at a much faster pace as restrictions imposed during pandemic come to an end. And talking about consumer-oriented sectors, outstanding credit for consumer durables increased by 5.6 percent in July 2022 which is at a six-month high.

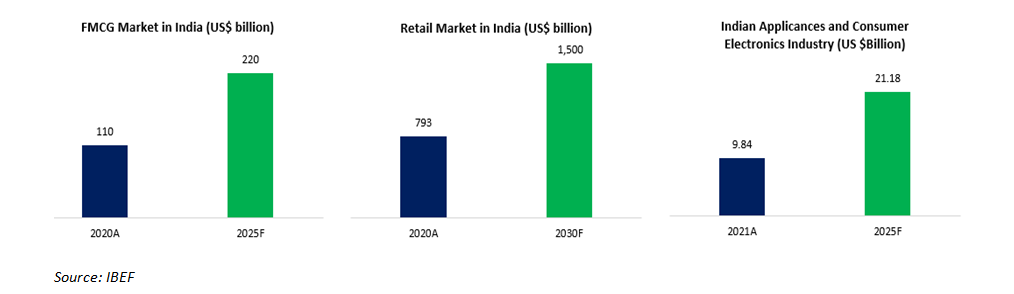

Almost every segment within consumer-oriented industry is expected double its size in next 3-7 years.

Consumer durables, retailers and FMCGs (fast moving consumer goods) expect their sales to grow in double digits this festive season as compared to pre pandemic times, on relaxation of mobility and other pandemic related restrictions. Consumer durables as an industry have surpassed the pre pandemic levels

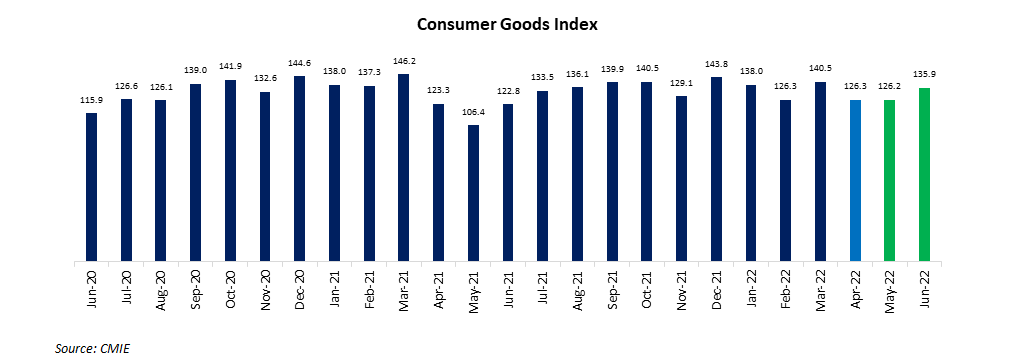

Here’s how consumer goods index which is a key component of IIP with a total weightage of 28.17 percent to the overall Index of Industrial Production index performed have remained well above pre pandemic levels of June 2017:

Below are a few positive developments that have happened in the months gone by which could benefit consumer companies this festive season:

- Easing supply chain issues: China’s zero Covid policy have impacted the supply chains, but companies have already procured components that are enough to help tide over the festive demand.

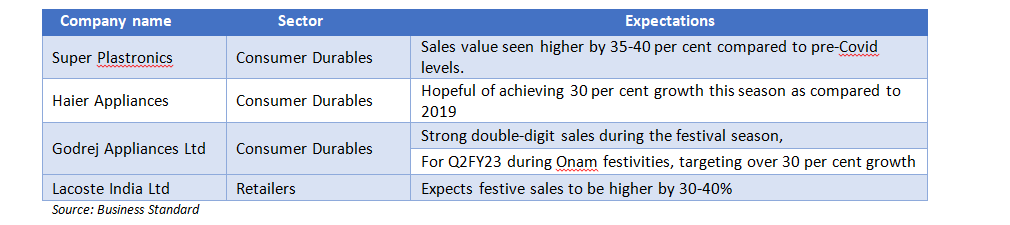

- Positive commentary from CEO and CFOs for consumer-oriented companies:

- Increase in number of online shoppers: As per a report by management consulting firm Redseer, E-commerce companies are expected to witness 28 percent year-on-year growth in sales at USD 11.8 bn during the festive season of 2022. And this growth might be driven by offering heavy discount in the form of cashbacks and direct discounts. Along with this increasing number of online shoppers in Tier2+ cities during festive season sales are expected to double as against 2018.

- Government support: Companies within the home appliances segments are heavy import dependant. For instance, import content for ACs in India is at 70-75% of total raw material costs. However, the government’s production linked scheme (PLI) is expected to bring down dependency to 20-25% in next five years. It is also expected that 80% of compressors which is an important part in AC, refrigerators etc are likely to be manufactured locally by 2026.

- Earnings revival: To offset the commodity inflation consumer durable companies have undergone 5-10 percent price hike. Earnings recovery in the first half of FY23 depends to the quantum of price hikes passed on to consumers. A strong festive season led pull back in demand and benefit of some moderation in input costs will benefit in improving margins going ahead.

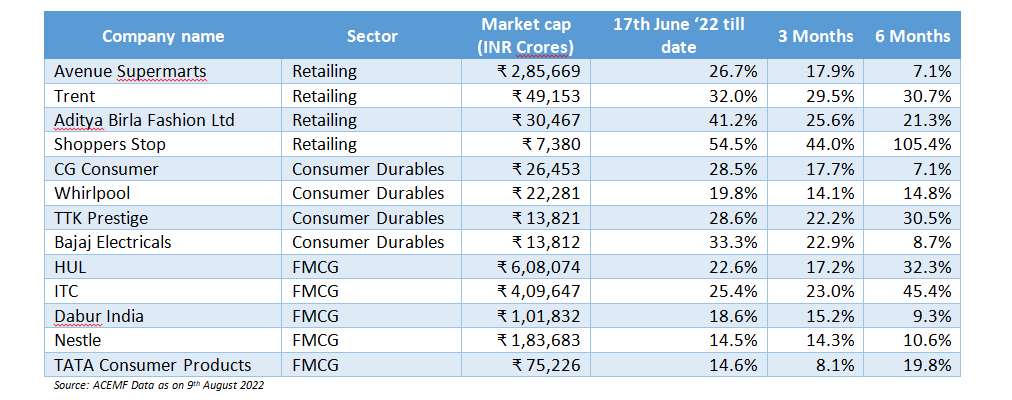

Below is a list of key players in Consumer Durables, Retail and FMCG industry:

Since FIIs have made a comeback June onwards FMCG sector witnessed 2nd most robust inflows after Financial services sector. Here’s a link of our coverage on FIIs coming back and which sectors are they preferring!

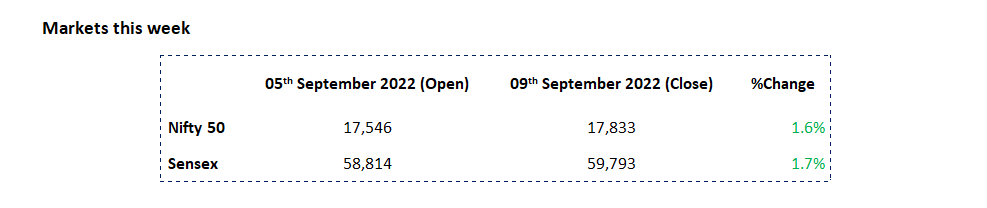

- Markets ended the week on a positive note.

- Global cues were positive as investors digested a record rate hike by the European Central Bank and further comments from Federal Reserve Chair Jerome Powell.

- Asian markets were positive as oil prices steadied at lower levels not seen since before Russia’s invasion of Ukraine.

- China’s exports and imports lost momentum in August as surging inflation crippled overseas demand and new Covid curbs and heatwaves disrupted output, reviving downside risks for the shaky economy.

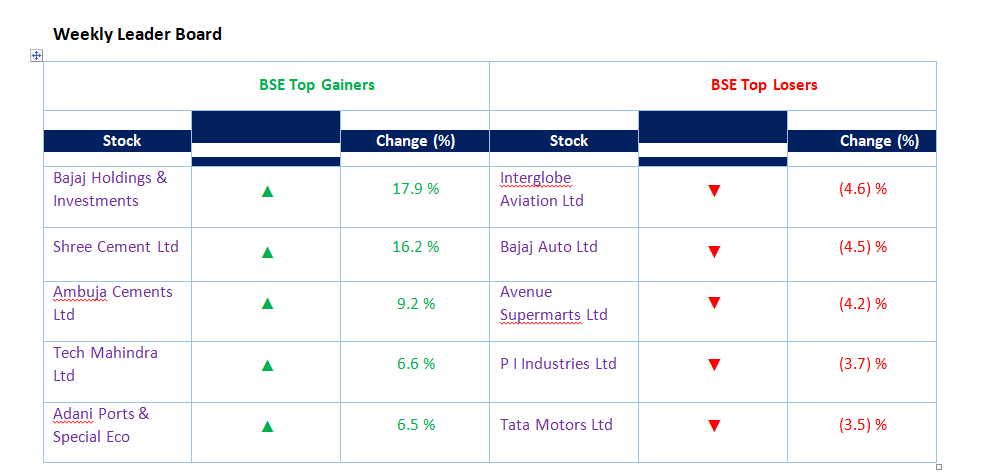

Stocks that made the news this week:

- Mahindra & Mahindra Ltd has overtaken Tata Motors Ltd in terms of market capitalization to become second most valued auto firm of India. Maruti Suzuki India Ltd remained India’s most valued auto firm with an Market cap of Rs 2.66 trillion.

- Cement companies like Shree Cements, UltraTech Cements saw a surge during the week amid price hikes, petcoke prices cooling off, margins likely to bottom out in the second quarter of FY23 and anticipation of volumes as well as demand rise in the second half of the current fiscal.

- Adani Ports rallied as the Supreme Court has given relief to the largest private multi-port operator by allowing it to withdraw its petition challenging the high court’s order that cited the company’s disqualification from a Visakhapatnam Port Trust project.