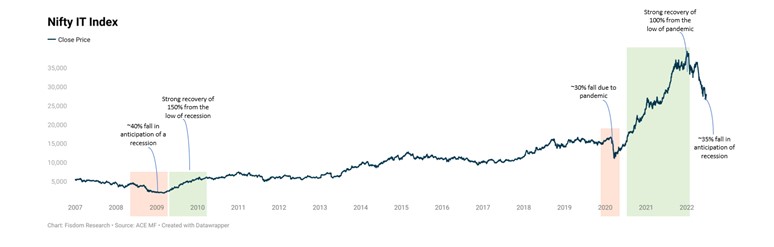

The earnings season began, and a few leading IT companies reported their results. The sector caught the attention of the investor for the following key reasons:

- BSE IT index corrected by 25 per cent YTD (as of 14 Oct 22)

- The valuation of almost all the companies is near their pre-pandemic level. IT companies which have reported their results are few exceptions.

- Hawkish commentary & aggressive rate hikes by the US Fed.

- The expectation of recession in the US & Europe

- The global growth forecast was trimmed down to 2.7 per cent in 2023 from 6 per cent in 2021. It will impact the demand for the sector.

Amid all these challenges, big four IT companies have posted decent earnings & shown remarkable resilience. It was primarily because of new noteworthy deal wins & ramp-up of deals won in the previous quarter. Even the demand for cloud & digital transformation was robust in North America & Europe, which has helped IT companies deliver strong results.

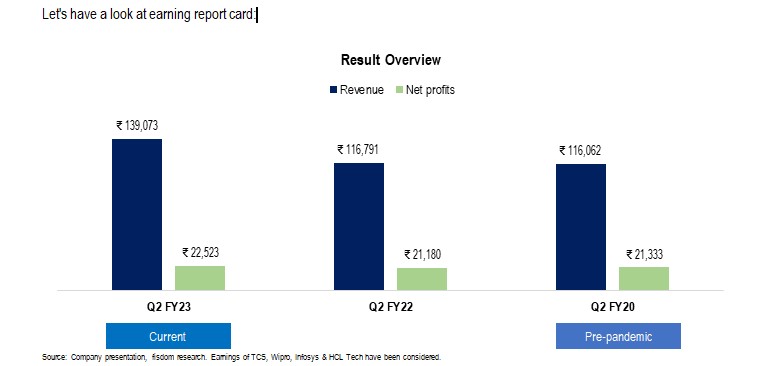

So far, only TCS, Infosys, Wipro & HCL Technologies have reported their results from the Nifty 50 bucket. It is evident from the above table that even though the total revenue from these four companies rose by 20 per cent since pre-pandemic, the net profits are still below 6 per cent. If we compare the same with the same quarter year ago, then both revenue & net profit growth stands at 19 per cent & more than 6 per cent respectively.

Now that we have understood the overview of what has happened to date at the broader industry level cumulatively, it is important to look at the hits & misses from these companies individually.

Hits:

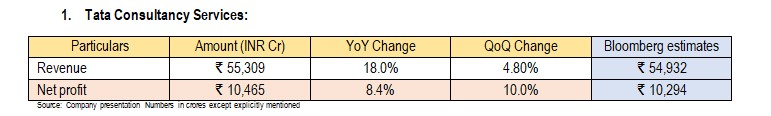

Key Highlights:

- Beaten profit & growth estimates as the company continued to witness strong demand for its services.

- Reported the highest ever revenue and net profits. It was the first time TCS reported a net profit of more than Rs. 10,000 crores.

- Attrition continued to rise at 21.5 per cent compared to 19.7 in Q1FY23.

Management Commentary:

The current quarter has been good in terms of profitability. Still, they remained concerned about the demand from the Euro region. But on an overall basis, the concerns in Europe are yet to be materialised on the order pipeline.

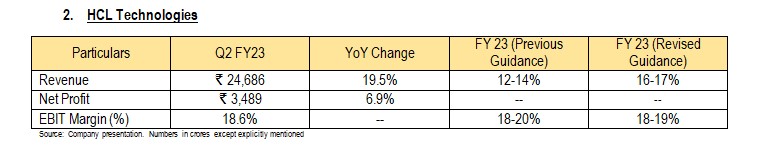

Key Highlights:

- HCL Technologies reported strong profit growth on new order wins.

- The company has increased its revenue guidance from 12% to 13.5%-14.5% along with the guidance of this service. It shows management confidence in the pipeline within the services segment

- The attrition rate for the company remained stagnant at 23.8% compared to the previous quarter.

Management Commentary:

- The company won 11 deals during the quarter with a total contract value of $2.4 bn and a 16% sequential growth.

- The services business witnessed robust growth led by strong demand for engineering, cloud and digital services. Management also noted that bookings and pipelines continued to be very strong, which augurs well for future growth.

- Demand for IT services as a segment remained robust with a boost towards digital transformation.

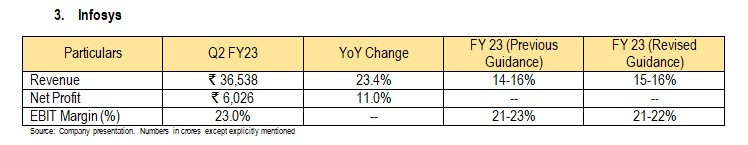

Key Highlights:

- Infosys posted numbers which were in line with analyst estimates. Remarkably the significant TCV total deal contract value was highest in the last seven quarters at $2.7 bn.

- Reported the highest revenue growth compared to TCS, HCL Tech and Wipro. The company has also approved a share buyback of Rs. 9,300 crores from the investor for Rs. 1,850.

- Infosys maintained its hiring pace as compared to its peers; also, it witnessed a sharp decline in attrition rate to 27.1% in Q2FY23 from 28.4% in Q1FY23.

Management Commentary:

- Strong deal wins and a steady second quarter reflects the company’s differentiation and profound relevance in digital and cloud solutions for clients as they navigate their business transformation.

- The demand pipeline remains robust despite some concerns about the economic outlook; customers remain confident in the company’s ability to create value in terms of growth and efficiency of their businesses.

Miss:

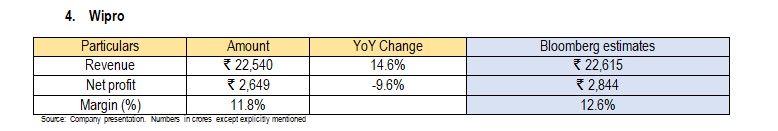

Key Highlights:

- Wipro was the only one among the big four IT companies which did not meet the street estimates. The company reported a 9.6 per cent decline in net profit for Q2FY23.

- The revenue growth of 14.6% came at the lowest among peers such as TCS, HCL Tech and Infosys. Rising employee expenses partially impacted earnings.

Management Commentary:

- The company has improved its market competitiveness and enhanced its value proposition amid solid booking growth and significant deal signings.

- Price realisations led to margin improvement on a sequential basis, and solid operational advances in automation led to productivity. The company has a robust operating cash flow.

- The company also noted that earnings from clients in non-US markets fell in Q2FY23 as earnings from Europe dropped as compared to the previous year.

Bottomline

Investors should not consider every correction an opportunity and instead adopt a staggered investment approach to build a position in these stocks. Even though tech spending may slow down for a few quarters & the budgets may get scaled down due to supply-side pressures, the long-term trend is intact.

Markets this week

|

10th October 2022 (Open) |

14th October 2022 (Close) |

%Change |

|

|

Nifty 50 |

17,094 |

17,186 |

0.5% |

| Sensex |

57,424 |

57,920 |

0.9% |

- Markets ended the week on a positive note.

- Markets witnessed revival of selling pressure during the week on mixed cues from US Fed minutes of policy meet. US inflation came in slightly above expectations.

- India’s CPI inflation reached 5 months high along with this IIP growth was at 18 months low in August 2022 which also dampened investor sentiments.

- Falling crude oil prices, decline in India’s WPI inflation and relief rally in global markets helped markets to close just above the week’s open on Monday.

- Foreign institutional investors (FIIs) sold equity shares worth Rs. 9,941.71 crore where-as DII’s bought Rs. 7,030.96 crores during the week as per provisional data

Stocks that made the news this week:

- IT stocks were at the top of the list this week amid back-to-back results. TCS, HCL Tech, Wipro and Infosys reported their quarterly numbers a detailed analysis of the same is mentioned above.

- Bajaj Auto reported quarterly results on Friday with a 30% increase in profits as compared to Q1FY23. On a sequential basis revenue grew by 27.45 percent from Q1 FY23. Revenue growth was strong on the back of recovery in volumes and improvement in supplies of semiconductors.

- Federal bank reported a 53 percent y-o-y growth in net profit at Rs. 704 crore which is the highest ever profit reported by the bank. The bank’s asset quality also improved sequentially at 2.46% vs 2.69% in the previous quarter.

- HDFC Life Insurance company has got final approval from IRDAI for merger with Exide Life Insurance.