The Reserve Bank of India has put out a press release on its new Financial Inclusion Index. To measure the extent of financial exclusion in the country the RBI will periodically publish a “Financial Inclusion Index”. It will be published annually in July every year. It has been constructed without any ‘base year’ and as such it reflects cumulative efforts of all stakeholders over the years towards financial inclusion.

What is the objective?

The objective of this index is to capture the extent of financial inclusion across the country.

What is the latest reading?

As per RBI’s assessment, the Financial Inclusion index for the period ended March 2021 was at 53.9 as against 43.4 in March 2017. The reading of 53.9 shows that a large proportion of India’s population is still outside the organized channels of finance or is unable to achieve quality services.

Components of Index:

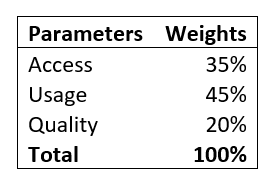

The index will have three broad parameters with below-mentioned weights:

How should you interpret?

The index will be single value between 0 and 100 wherein lowest number 0 indicates no financial inclusion and 100 reflects full financial inclusion. The unique feature of this index will be quality parameters, which will capture the financial literacy, consumer protection, and inequalities and deficiencies in services. In fact, the RBI should share more such data as it will help improve the general understanding of strengths and weaknesses of the economy.

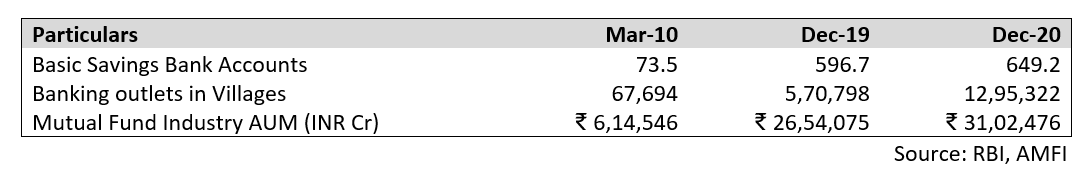

There was a long term need for such an index from the government as well as from a households’ perspective to track the overall quality of financial services available. Here is some data from the report published by RBI & also MF industry AUM published by AMFI to get an insight into the actual financial inclusion happened in last decade.

Progress Report:

Capital markets has created greater financial inclusion by introducing new products and services tailored to suit investors’ preference for risk and return as well as borrowers’ enterprise needs and risk appetite. It can be clearly reflected by the mutual fund penetration in the last 10 years.

So start your investment journey early to participate in the financial inclusion story.