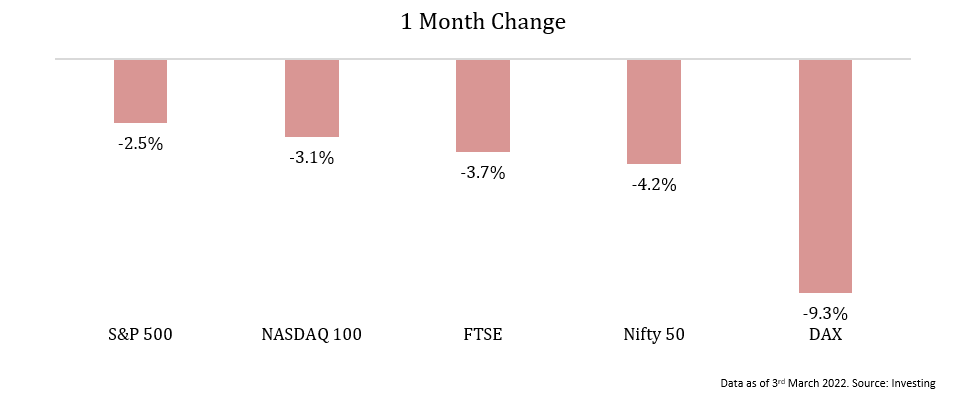

Globally majority of indices have fallen in the last month amid rising concerns over the Russia Ukraine conflict. Below is the chart reflecting the impact of ongoing conflict on key global markets.

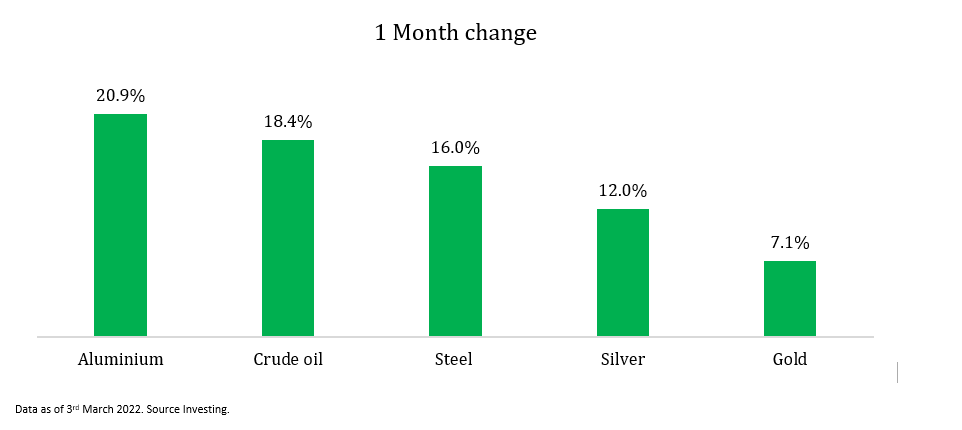

The only basket which has defied all the stock market negativity is the commodity basket. Russia Ukraine conflict has pushed commodity prices to levels not seen since the financial crisis.

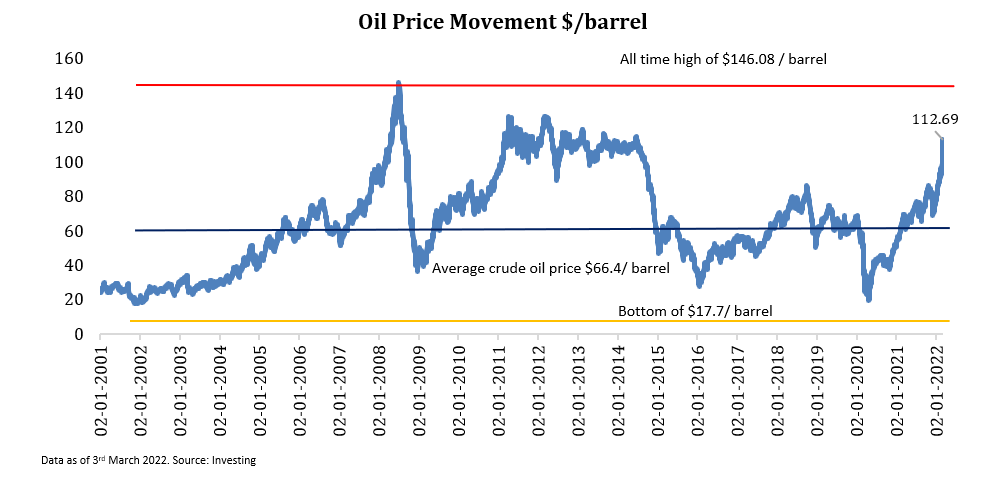

The major rise has seen in crude oil prices. Oil has a major impact in our day to day activities. Right from the car we drive, the food we eat, the cream you apply, and the paint that goes on your wall and the list goes. Companies dealing in tires, plastics, chemicals, fertilizers, wax industries, refining, airline, paints, footwear, lubricants, cement, logistics, and construction material for whom crude or its derivatives are major inputs/costs will take a hit on their margins.

Why is the oil price rising?

Oil prices have been on the surge as the markets are bracing for disruptions to crude oil supplies from Russia as Moscow’s invasion of Ukraine grinds on. Even if the US and its Western allies have intentionally tried to avoid targeting Russia’s energy supplies, they are trying to put financial restrictions.

Russia is the world’s third-biggest oil producer and second-biggest producer of natural gas ranking among one of the major exporters to the US and China, the world’s top two economies. In 2020, Russia accounted for 7 percent of US petroleum and crude oil imports, making it the country’s third-largest supplier along with Saudi Arabia.

Hence, these restrictions/sanctions have made oil purchasers, like refineries, wary of the risks posed by future sanctions if they enter new contracts. Other logistic concerns being the prices of things like tankers are soaring as most companies refuse to do business in Russia.

How is the rise in crude oil prices affect the economy?

- Higher Inflation: India which imports 80 percent of oil demand, and is on the verge of retail inflation staying above the central bank’s tolerance limit of 6 percent as companies pass on a nearly 40 percent rise in crude prices since November, as well as rises in prices for other imported raw materials.

- Current Account Deficit: The rise in crude oil prices has a big impact on the Current account deficit (CAD). CAD is a measure of India’s trade where the value of goods and services exceeds the value of goods and services exported. CAD indicates how much India owes the world in foreign currency.

- Fiscal Deficit: Fiscal deficit indicates the amount of money the government has to borrow to meet its expenses. A rise in crude oil prices could hurt the economy as well as markets. The fall in crude oil prices was a major contributing factor in the reduction of India’s fiscal deficit in the year 2014-2016.

How is the price going to impact investors and their investments?

Elevated oil prices have caused depreciation in the value of the rupee and tandem appreciation in the value of dollars. This also causes an increase in the prices of the bond, which results in a lesser yield for the bond. Apart from bonds, the stock prices of the company will also get impacted as the increase in price will result in higher expenses and lesser profits and hence lesser return on investments.

Conclusion:

Oil prices do fluctuate and it has happened in the past as seen in the chart above. Oil prices have fluctuated in every direction as the game is all about bringing equilibrium. The prices are high today. But expect them to fall in near future. It is just a momentary situation caused due to short term uncertainties. Stay invested. Stay safe.