The Russia-Ukraine conflict has been highly volatile, and investors in the past few days have panicked because of the ongoing geopolitical tension. But before arriving at the investor’s actionable for the future, let’s first understand some significant developments that led to the current situation between Russia and Ukraine.

The year 2008: Ukraine 2008 had initiated talks with North Atlantic Treaty Organization (NATO). NATO was founded in 1949 and is a group of 30 countries from Europe and North America to protect the people and territory of its members. The Alliance is based on collective defence, meaning that if one NATO ally is attacked, then all NATO Allies are attacked. Russia had immediately expressed disregard and considered this as unacceptable.

The year 2010: President Viktor Yanukovych came to power and signed a gas pricing deal with Russia to lease a naval base in the Black Sea Port of Ukraine.

In the year 2013: President Viktor Yanukovych suspended all talks from European Union and once again reaffirmed ties with Russia. It triggered several violent protests within the country.

The year 2014: In Feb 2014, President Viktor Yanukovych’s government was overthrown amid violent protests. In March 2014, Russia took control of Crimea after a referendum. Ukraine military reports the significant movement of the Russian army in Eastern Ukraine.

The year 2017: European and Ukraine sign an agreement for free trade of goods and services, along with free travel for Ukrainians across EU nations.

The year 2018: Russia completed the construction of a bridge over Kerch Strait. Kerch Strait is a sea pass between Russia and Ukraine to the sea of Azov. It obstructs the water route to Ukraine. Ukraine reports that three of its ships were intercepted by the Russian coast guard.

November 2021: Satellite images show a growing build-up of Russian troops on Ukrainian borders and 100,000 soldiers with tanks and other military hardware.

7th December 2021: US President Joe Biden warns Russia of Western economic sanctions if Ukraine invades.

17th December 2021: Russia demands that no membership to admitted to Ukraine by NATO.

January 2022: US President Joe Biden assures Ukraine President that they will respond decisively if Russia attempts to invade. US and Russian officials meet in Geneva for diplomatic talks, but the conflict remains unresolved.

NATO puts forces on standby and reinforces its military presence in Eastern Europe with more ships and fighter jets. Some Western nations have started evacuating non-essential embassy staff from Kyiv. The US puts 8,500 troops on alert.

President Joe Biden warns of a likely invasion in February. China supports Russia and tells the US that Russia’s security concerns should be taken seriously.

1st February 2022: Russia President Vladimir Putin denies planning an invasion on Ukraine and accuses the US of ignoring Russia’s security demands.

12th February 2022: Jake Sullivan, Joe Biden’s national security adviser, says US intelligence shows a Russian invasion could begin very soon.

What could be the possible impact if Russia invades Ukraine on global markets?

_____________________________________________________________________________________

- Crude oil prices: Crude oil prices are expected to jump in the event of invasion, likely sending the crude prices above $100 per barrel for the first time since 2014.

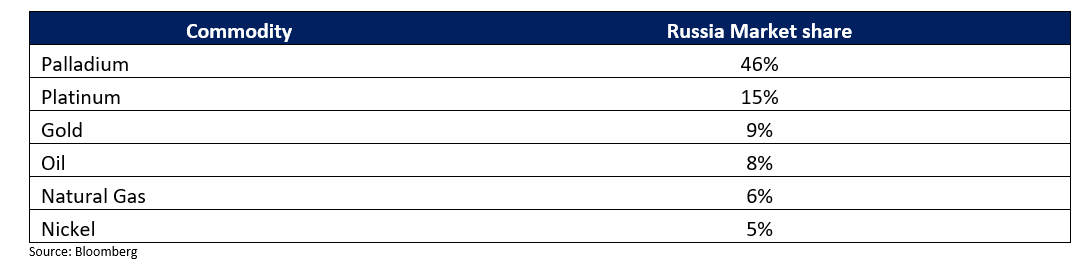

- Supply-side disruptions: Russia plays a vital role in global economics. Hence, any disruption in exports due to the conflict or sanctions imposed can drive up commodity prices and put the already disrupted global supply chain in turmoil. Below are some of the critical products where Russia has a stronghold

Russia has the highest share in the global market for Palladium. This is an essential element used in emission control devices for automobiles. Hence this could have a significant impact on the auto supply chain and result in soaring prices. Both Russia and Ukraine are substantial producers of wheat. Therefore, any unprecedented situation between them could result in lower production and a shortage in supply, and a subsequent increase in prices.

An invasion by Russia on Ukraine would likely drive up the already high cost of living, even slowdown the economic recovery and perhaps rattle portfolios of investors. Supply is already on the fall to keep up with demand and investors are on high alert for any further supply shortages that could emerge through in a variety of ways, including damaged goods from infrastructure in war, sanctions on Russia trying to make energy exports their weapon.

What should Indian investors do?

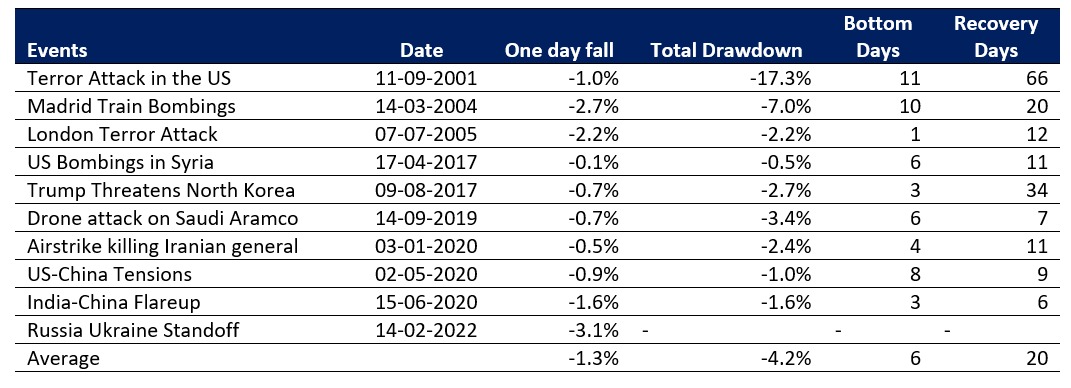

The ongoing conflict undoubtedly impacts the stock market. Post the reports from US intelligence on 12th Feb 2022 that Russia could invade Ukraine global market tumbled. Indian benchmark indices dropped by 3% each. But from an investment standpoint, we need to remember that major political events historically haven’t moved the markets much. Below is a list of a few such events:

In the last two decades, stock markets have mostly ignored geopolitical conflicts beyond a point. Markets have recovered losses and have delivered positive returns post such events within a month. Will this conflict further escalate and bring markets down further for a longer term? Not necessarily.