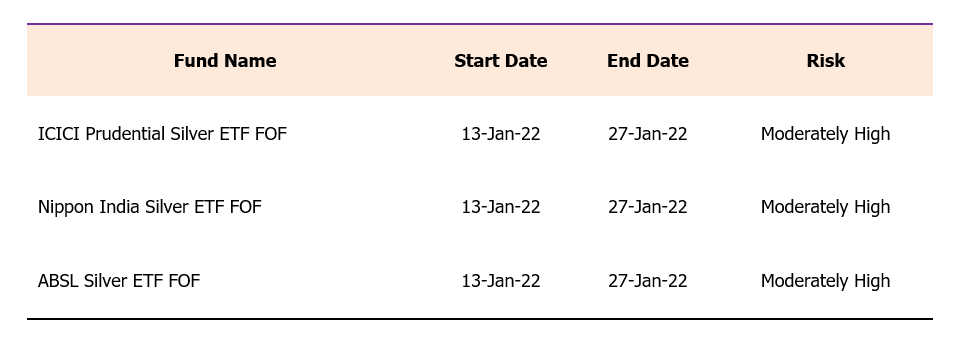

AMCs such as ICICI Prudential, Aditya Birla Sun Life, and Nippon have launched a silver-based fund of funds to cater to retail investors’ demand for the white metal. Before launching these ETFs, an investor could only buy silver in physical form or trade-in derivative contracts on the commodity exchange. On November 24th, 2021, SEBI laid out the operating procedures to invest in the metal. The schemes have to invest at least 95 percent of their assets in physical silver and silver-related instruments. Fund of Funds in commodity comes in handy as the critical concerns of storage and purity are mitigated and make them more liquid, which can be considered a cherry on the top.

Before jumping on to the conclusion of whether you can add silver to the portfolio, let us first try to understand the demand-supply dynamics and some background story around the white metal.

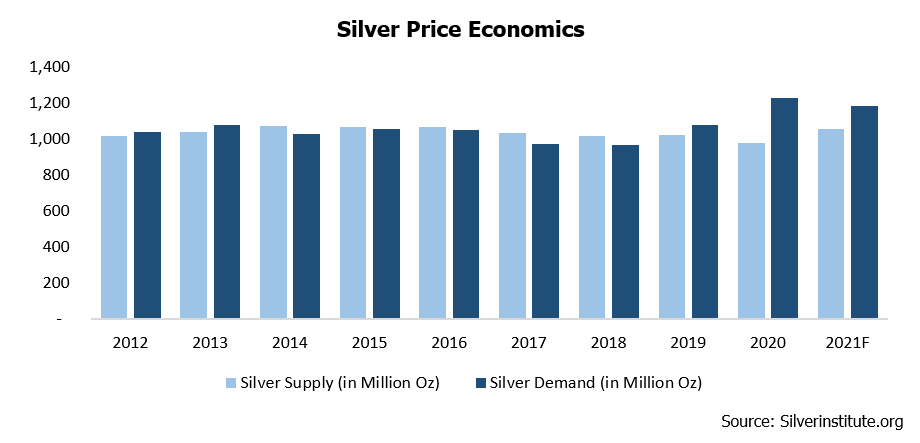

There has been a strong demand for silver in the past decade. The demand for silver may increase by 15% (YoY) compared to 8% expected supply growth. And it may push silver prices further.

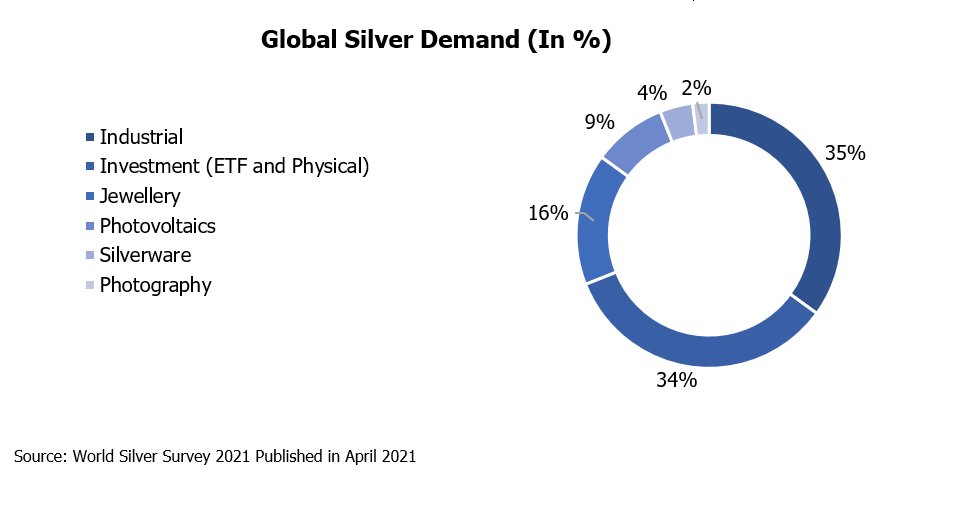

Now let’s understand the drivers behind this expected rise in demand:

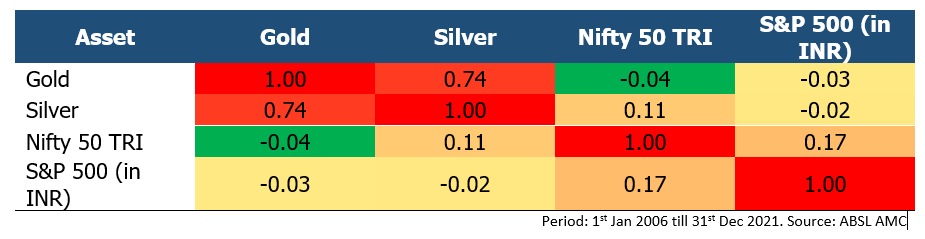

Industrial demand has been a significant driver for silver as a commodity. Industrial and investment demand account for more than half of the total demand for silver. Because industrial demand is a massive driver for silver, prices rise during the stock market boom. Silver is more correlated to equity than gold. Refer to below mentioned table for more details:

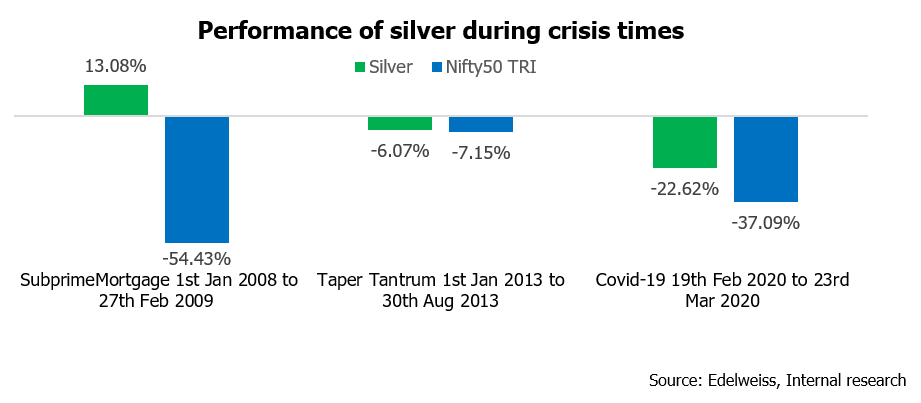

Silver has a high correlation to Nifty50 as compared to gold. Like gold, silver is considered a store of value and is safe haven and hedge against inflation.

We can conclude that silver has acted against equity-linked volatility; its demand and prices are likely to pick up during economic recovery and expansion. Given the demand and supply dynamics and high industrial market, the metal performs well in an economic expansion phase where companies tend to do well.

Gold adds portfolio diversification for those investors who get nervous due to high volatility in the equity market. As far as long-term wealth creation is concerned, investors can add a small proportion of silver and equities.

One should always take into consideration their risk profile, horizon before taking any investment decision.