The FY22 Union Budget is set to take centerstage on February 01, 2021. Coming in the midst of a global pandemic, the budget will look to address the socio-economic stress witnessed across state borders.

Amongst the many keynote events that transpired last year, no cause-action pair sums up all of 2020 than ones mentioned below:

Cause: virus pushed India into its 1st recession (read as: GDP decline) since our habit of publishing quarterly data, beginning 1996.

Action: In response India designed 1 of the largest relief packages, at the expense of it stretching Budget FY21 estimates.

The write-up above highlights why the annual budget merits the quantity and quality of discussions in the weeks nearing its announcement. It Is recognized as the financial charter in shaping the India of tomorrow. The tomorrow where India looks to become the new global growth engine.

The timing of the budget, in ritual-like fashion, brings with it, a mix of fortunately-unfortunate happenings. Why? Here’s Why:

Unfortunate: Market participants are flushed with worry about what impact budget can have on markets as many lend their voice (read as: noise) in stating hypotheticals.

Fortunate: This week’s Signal edition is designed to help you stay tone-deaf to those hypotheticals while assessing impact of Budget on markets.

Budget & Markets – Finance’s Asymptomatic Relationship

Right off the bat, let us state that the relationship between markets and budget is more an impression than an image. In studying figures, it is clear that markets treat Budget as just another event. Appearing dismissive on 1st look, do realize that markets are built to scale up/down on current occurrences till a new event comes its way.

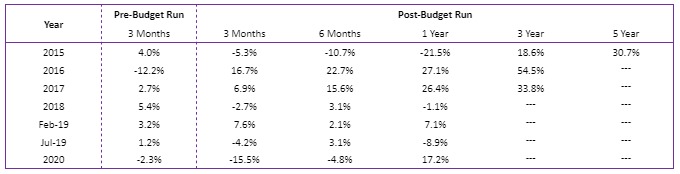

The table below looks at how markets reaction over the last 5 years in pre-&-post budget scenarios to fully assess “apparent” impact of budget on markets:

As is observed, the effect of budget on market movements dilutes the longer one stretches the time-line from its announcement date.

Besides, all budgets are designed to propel the country across all its growth parameters. Hence, as the country grows, so do the markets.

As an example, the run-up to 2016 budget saw market participants tense up with many opting for exits as markets contracted by 10%+ in 3 months leading up to the budget. Today, 3 years later, all those who chose to stay invested at the time have enjoyed staggering returns of ~55% on their investments!

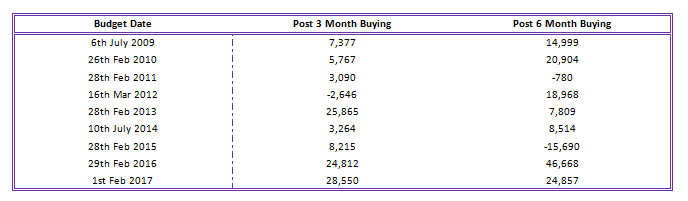

This link, rather de-link, between markets and budget has been capitalized upon by FIIs as well. In observing the budget’s nature of welcoming health-&-wealth into the country, FIIs have not shyed away from buying into Indian markets. The table below highlights the same:

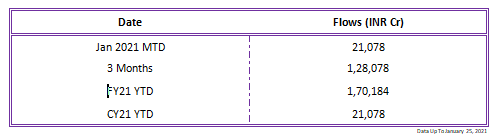

Like in the past, FIIs have maintained their buying spree this time round too. FIIs buying activity in the run-up to this budget is highlighted below:

India ended CY 2020 being the only emerging country to witness positive FII flows. The trend seems to carry in 2021 as well as FIIs remain bullish on the country irrespective of keynote events in ongoing pandemic and upcoming budget.

Budget & Time – A short-lived Love Story

The beauty of budget lies in it having visible short-term illness but long-term wellness on markets and its participants. This time round, the short-term effect of budget is paired with “apparent” stretched market valuations, hence adding to notion of market tumbles.

To address this near-term worry as well, we reviewed the daily returns markets have given since its inception on April 30, 1996. Here’s our discovery:

- Over 6,160 trading days, markets delivered positive 1-day returns for 3,436 times, 56% of total bucket size

- Of the positive returns, markets delivered >2.5% returns on 241 trading days

- Since inception, markets have given 1177% absolute returns or ~12% CAGR returns!

As is observed, markets in the long-run have maintained their return slope to be upward sloping. This curve is inclusive of the budget since and more. Hence, as we walk into Budget FY22, we continue to uphold our golden advice of staying invested and not act out of hesitation.

Investor Takeaway

The annual budget is arguably the most important financial event to kick off the money cycle for the next fiscal year. It bears direct and indirect investments on all soil within country borders. It is the degree of impact that is important to assess when talking of facts & figures making mentions in the finance minister’s words and woes.

In line with aforementioned, we observe that, more than markets it is its participants who nail-bitingly await the implications of the budget on their portfolio investments. But as we learnt from this note, this notion is manufactured motion as markets tend to inculcate the learnings from the budget into earnings for those stay sans-sense to market rumors.

In re-iterating, we recommend investors to not give in to temptations and take advise from investment professionals before taking any qualifying portfolio actions.

Have any thoughts about the budget you wish to share with us? Do right away, for we excitedly await the same.

Till then, Happy Weekend