Making Big From The Small

The big titans of today started as the smalls of yesterday. Hence, Small businesses are often referred to as the backbone of a country.

In the most primitive life-stage, the sector reflects the best of where the economy is heading.

Govt. support to MSMEs via policies & packages, benchmark program “Make-In-India”, and accelerator set-ups, signal conviction of the contribution of small-caps to the $5 Tn economic agenda.

More so, the continuous push towards the formalization of the economy will augur greater inclusion of the broader universe of smaller companies. This will further propel growth in a holistic manner in the undiscovered and under-looked talent pool of companies

The less travelled path of small-cap universe is proved to be rewarding many times before, and this time round, the story reads in the same manner.

Here is why!

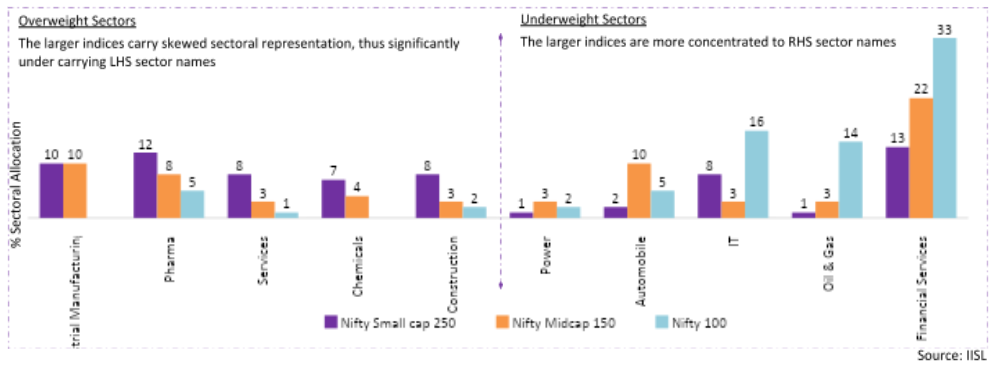

Large/Mid Sector Stall Vs Small Sector Stall-ion

Sector coverage in small cap space is more evenly spread out as compared to Nifty sister indices.

Enjoying higher diversification, the wider base adds to maximizing potential on the upside, while arresting risk on the downside.

With higher count of sectors to tap into, no particular sector can determine the trajectory of the health & wealth of the index. As an example, the recent inflated vales in Large cap is courtesy of the heavy rallies seen in UPI, API and AI sectors.

The graph below highlights the sectoral imprint across market-caps:

The weightage comparison to derive over/underweights of sectoral presence is derived via comparison between Small-cap and Large-cap indices

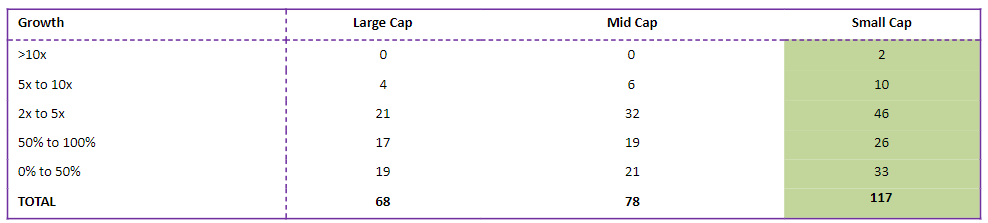

The Stock-Star In Small-Caps

“Like is with sectors, is with stocks” is an apt adage to define the working symbiotics between the broad and narrow market dynamics.

The mismatch in count representation and dilution in upside potential is very visible in the stock story too.

In fact, over the last 5 years, small-caps have greatly out-performed the bigger indices, courtesy of the bigger pool of stocks.

The table below highlights the count of out-performing small-cap companies vs sister market-caps in the Nifty 500 over the last 5 years

As can be seen, Small-caps have out-performed the large & mid-cap stocks by significant margins of 92% and 50% respectively on a cumulative basis.

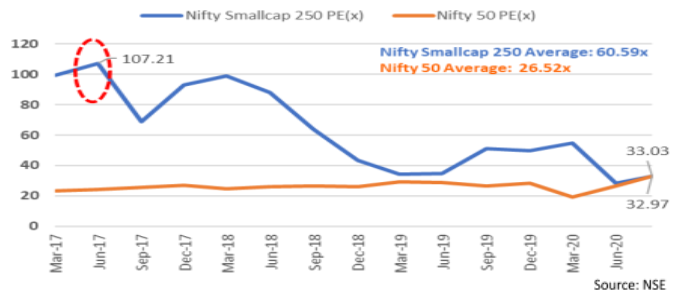

Vlogging Values In Valuations

The developments and attention of Indian markets are to bring more sophistication to reporting standards thus finetuning small-cap stocks on qualitative basis.

On the quantitative front too, small-cap stocks present a rosy picture.

Value finder and feeder in PE multiple is associated with gauging market segment’s trend in coming times. Current PE multiples trading over long-term averages call for segment to be tagged, “Over-valued” and vice-versa.

Being in-line with market principle of mean reversion, it is figuratively and factually smarter to enter markets at suppressed PE levels, as you can then capitalize on the market’s expected upward trend.

Today we find ourselves in that position.

As of September 2020, the small-cap division has seen sharp fall at ~70% from June 2017 peaks. The fall has been a result of consecutive event spills and investor behavior to forage for “safer” asset classes in time of tries.

However pick-up of economic indicators, and foreign monies finding fervor instead of fever, can see the segment lift-off its current comforted levels.

On a valuation front, the index has seen sharp contraction of 46% from peaks in 2017.

After the big tumble, the segment is gearing up to rumble. The particular market-cap can see newfound limelight due to changed Multi-cap MF rules and polarization in the bigger segments.

The chart below highlights the PE valuation gap between the Nifty50 vs Nifty Small cap:

Like in peak-trough-peak wave, the Small-cap segment seems to follow similar print. Coming off its yesteryear peaks, the segment is now ready to scale the upside as its value graph hitchhikes following suit.

Looking into the hard numbers solidifies the views made above.

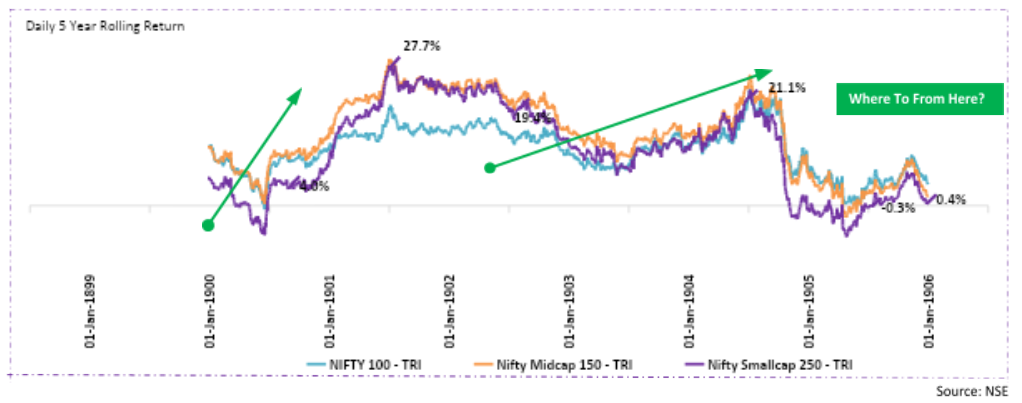

In studying rolling returns, it is observed that the current gap between the small-caps and large-caps is currently at favorable level.

On time testing returns over a 3-year rolling return period, the observations made are similar to those made from graph seen above

Already excited to go hunting for your favorite small-cap fund? UTI MF introduces their small-cap fund so your portfolio can boast the best of tomorrow’s leaders

UTI Small cap Fund

UTI Small cap fund will look to invest in companies with scalable business models with seasoned management and regularly undertake quality and quantity check on portfolio stocks.

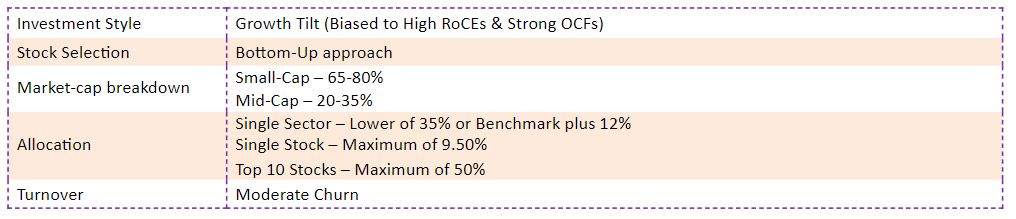

Fund Breakdown is as follows

Investment approach:

- Business Scalability

High and consistent growth companies with sustainable business models, long growth runway and run by seasoned managements.

- Turnaround Strategy

Invests in sound businesses going through weak operating business phase.

- Transformational Change:

Invests in businesses undergoing a transformational change and hence becoming potential re-rating candidates.

Who Can Invest In UTI Small Cap?

- Investors who are seeking higher returns as compared to other diversified equity funds with willingness to be subject to underlying higher portfolio volatility and risks.

- Investors with investment horizon of 7 years or more

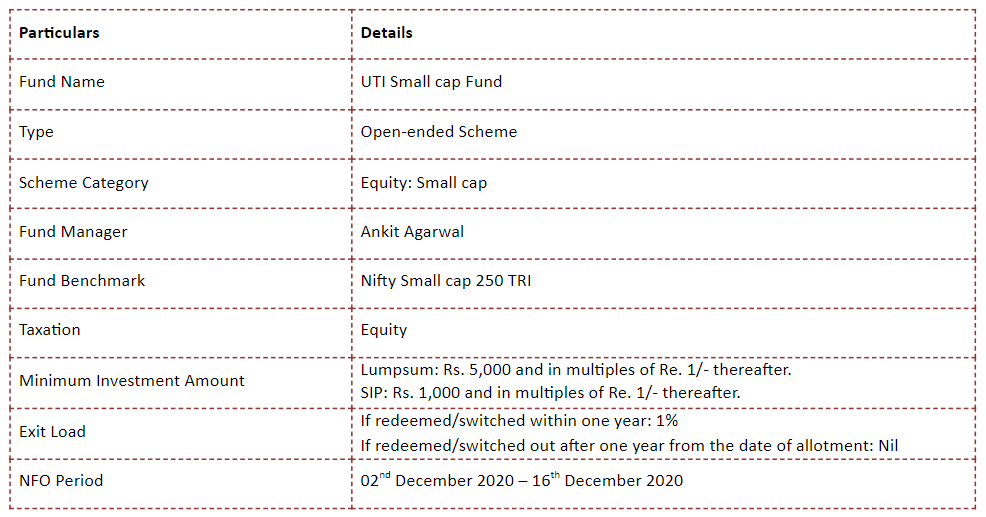

Key Details About The Fund