Hot Stuff This Week

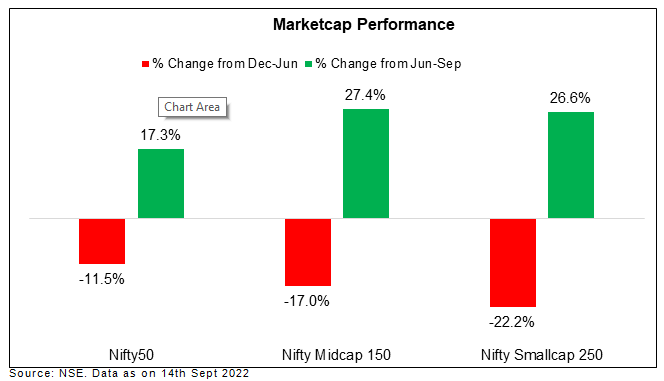

The Indian market performance showed resilience in CY2022 compared to other global markets, with nifty 50 recovering 17 per cent from the bottom of June’22. At the same time, the rally in broader indices was meteoric. Both midcap & smallcap indices too recovered by 27 per cent & 16 per cent, respectively. Some individual stocks have gone up by more than 100 per cent.

The above chart depicts that the midcap & smallcap indices recovered quickly compared to the nifty.

Let’s understand the factors impeding this rally and why street estimates favour mid and small caps.

- Attractive Valuations:

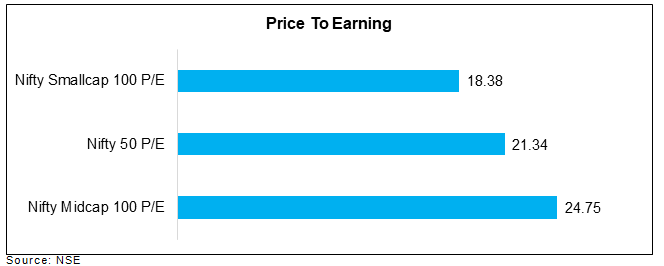

Even with the recent rally, Nifty Midcap 100 index now trades at a 16 per cent premium to Nifty 50 indices at 24.8x, whereas the Nifty Small cap 100 index trades at a discount of 14 per cent at 18.4x. And as per street estimates, valuations are at a premium compared to global peers; however, strong double-digit earnings growth for the segment justifies valuations to some extent. Valuations of several large-cap stocks looked stretched while most mid and small-caps are still attractive. It has triggered a rotation of money in mid and small caps, helping the broader market rally.

2. A shift towards cyclical:

- Favourable government policies focus on boosting investments through heavy CAPEX plans to expand the manufacturing sector. Government initiatives like GST compensation and multisector production linked incentives (PLI) schemes are likely to create a robust ecosystem for the manufacturing sector.

- Capacity utilization has risen for the last three quarters and has remained well above the long-term average of 73.2 per cent at 75.3 in June 2022.

- Real estate, the most significant contributor to the CAPEX cycle, has shown a strong revival. The housing market has shown considerable improvement amid a surge in demand for residential property, multi-year low inventory levels, and decadal high consumer spending.

- Overall multi-sectoral drivers and favourable domestic economic conditions will likely make the investment cycle broader and more prominent, directly impacting the earnings revival of niche segments of small and mid-cap players with solid balance sheets

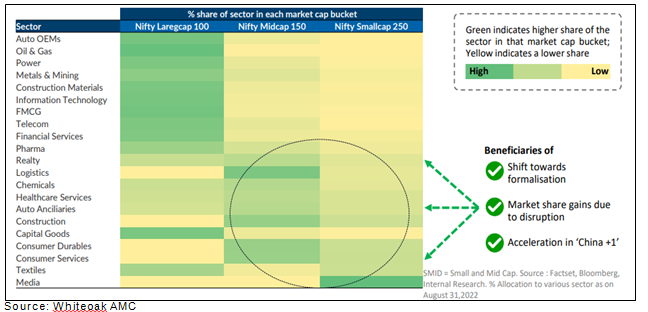

- Most midcap & smallcap indices are mostly cyclical oriented. Logistics, real estate, auto ancillaries, construction, and capital goods sector have a deeper presence in broader markets & investors get stock from these sectors in midcap & smallcap spaces. Given the optimism around the cyclical sector and government initiatives, as mentioned above, these stocks are grabbing the attention of investors.

Let us have a look at the below chart to see the percentage share of the sector in each market cap bucket:

Read our coverage on auto ancillary, consumer durables and banking segments if interested.

- Also, existing investors are holding on to their current positions and refusing to sell them in the market, expecting even higher prices. Low floating stocks mean that as new money pours into this space, stocks zoom higher in a short period.

The following is the list of the top five better-known midcaps & smallcap stocks that have gained more than 25 per cent since the start of CY22. The recent positive trigger in these stocks is due to the acceleration in the china+1 strategy, shift towards formalisation, and market share gains due to disruption.

Top performing five midcap stocks:

|

Stock Name |

Absolute YTD Change |

Mutual Fund Investment – Market Value (cr) |

|

Adani Total Gas |

105.0% |

₹ 151 |

| TATA Elxsi |

49.1% |

₹ 1,345 |

| Trent |

34.3% |

₹ 4,417 |

| Coromandel Intl |

34.1% |

₹ 4,632 |

| AU Small Finance Bank |

26.5% |

₹ 5,329 |

Data as on 14th Sept 2022. Mutual fund portfolio data as on August 2022

Top performing five smallcap stocks:

|

Stock Name |

Absolute YTD Change |

Mutual Fund Investment – Market Value (cr) |

|

Chennai Petroleum |

167.6% |

₹ 71 |

|

Raymond |

84.7% |

₹ 154 |

|

Ujjivan Financial Services |

64.3% |

– |

|

Swan Energy |

60.6% |

– |

|

VRL Logistics |

49.6% |

₹ 726 |

Data as on 14th Sept 2022. Mutual fund portfolio data as on August 2022

Investor Takeaways:

An investor should think twice before entering into any stocks without assessing the risk appetite and asset allocation plan. It is better to accumulate stocks/mutual funds in a staggered manner through the SIP or STP route rather than putting a significant amount through a one-time route. Based on the sector’s buzz/tips or momentum, abstain from buying small and midcap stocks.

Markets this week

|

|

12th September 2022 (Open) | 16th September 2022 (Close) | %Change |

|

Nifty 50 |

17,891 |

17,531 |

-2.0% |

|

Sensex |

59,912 | 58,841 |

-1.8% |

Source: BSE & NSE

- Markets ended the week on a negative note.

- India’s leading technology companies have shed a combined market cap of Rs.1.6 trillion in the last four trading sessions amid the volatility in global markets post-release of US inflation numbers.

- Several rating agencies have revised their forecasts for India’s economic growth post-June quarter GDP numbers.

- Post Higher than expected US inflation data for August, market participants are now expecting aggressive rate hikes by the US Fed. Street estimates also predict a 20% chance of a 100 basis points hike in the policy announcement next week.

- India’s consumer inflation inched on the upside in August at 7.0% y-o-year from 6.7% in July.

Weekly Leaderboard:

|

BSE Top Gainers |

BSE Top Losers |

||||

|

Stock |

Change (%) |

Stock |

Change (%) |

||

| Ambuja Cements Ltd |

▲ |

13.7 % |

Infosys Ltd | ▼ |

(8.8) % |

| ACC Ltd |

▲ |

10.6 % |

Tech Mahindra Ltd | ▼ |

(8.2) % |

| Vedanta Ltd |

▲ |

9.0 % |

Hindustan Petroleum Corp | ▼ |

(6.9) % |

| IndusInd Bank Ltd |

▲ |

8.0 % |

Tata Consultancy Services |

▼ |

(6.5) % |

| Adani Enterprises Ltd |

▲ |

7.3 % |

Larsen & Toubro Infotech | ▼ |

(6.3) % |

Source: BSE

Stocks that made the news this week:

- CEAT, a tyre manufacturer, the stock hit the upper circuit after the company’s management laid out a strategic road map in its annual general meeting. CEAT has increased its market share in the high-end premium PCR (Passenger Car Radial) tyres. And is the new and preferred supplier for Mahindra & Mahindra’s XUV700 model, which received record bookings at the launch.

- Eicher Motors, parent of Royal Enfield, has become India’s fifth auto firm to join the elite club of Rs 1 trillion market capitalisation (MCap) this week after its shares surged this year.

- PVR share price declined after a huge block deal in which around 4.7 million shares changed hands. Plenty Private Equity FII I sold 762,499 equity shares, Plenty Private Equity Fund I sold 1,076,259, and Gray Birch Investment offloaded 2,206,743 equity shares in the company.